Ib broker forex leverage

You should be aware of all the risks associated with online trading, and seek advice from an independent financial advisor if you have any doubts. There are risks associated with utilising an Internet-based deal execution trading system including, but not limited to, the failure of hardware, software, and Internet connection.

How much money do RoboForex partners receive?

Since we do not control signal power, its reception or routing via Internet, configuration of your equipment or reliability of its connection, we cannot be responsible for communication failures, distortions or delays when trading via the Internet. By agreeing to trade on one of these platforms, the client confirms having been duly informed by the Bank of the existing counterparty risk, and declares to undertake full responsibility for it.

The client notes that the Bank reserves the right to verify the compliance of transactions with the law, particularly with respect to market rules. Corporate Treasury Spot and forward foreign exchange. Platform for your desktop TWS Platform - All operating system Installer for a platform that will automatically update and will always have the latest functions.

Web platform Access to web platform for Windows and Macintosh's users. The search function is easy to use and works better than on the desktop platform. If you are not familiar with the basic order types, read this overview. If you want to place even more sophisticated orders, you should use the desktop trading platform.

Portfolio and fee reports are transparent. In this review, we tested it on Android. The number of available languages is almost the same as on the web trading platform ; only Slovakian is not supported. The mobile trading app is handier than the web platform. On the other hand, its overall look and user-friendliness lag behind competitors' mobile platforms. You can use a two-step login , which is safer than a simple login.

Furthermore, if your device has a fingerprint reader, you can also use biometric authentication for convenience. The search function works well , just like on the web trading platform. You can access the search button easily from any menu. When you type in the asset you are looking for, the app lists all asset types. For example, if you search for Apple, you can choose between Apple stock, futures, options, warrants, as well as CFDs.

Currency Trading

After you have selected the product you are interested in, you will be greeted by an information and trading window, which shows. IBKR Mobile has the same order types as the web trading platform. The most innovative and exciting function within the app is the chatbot, called IBot.

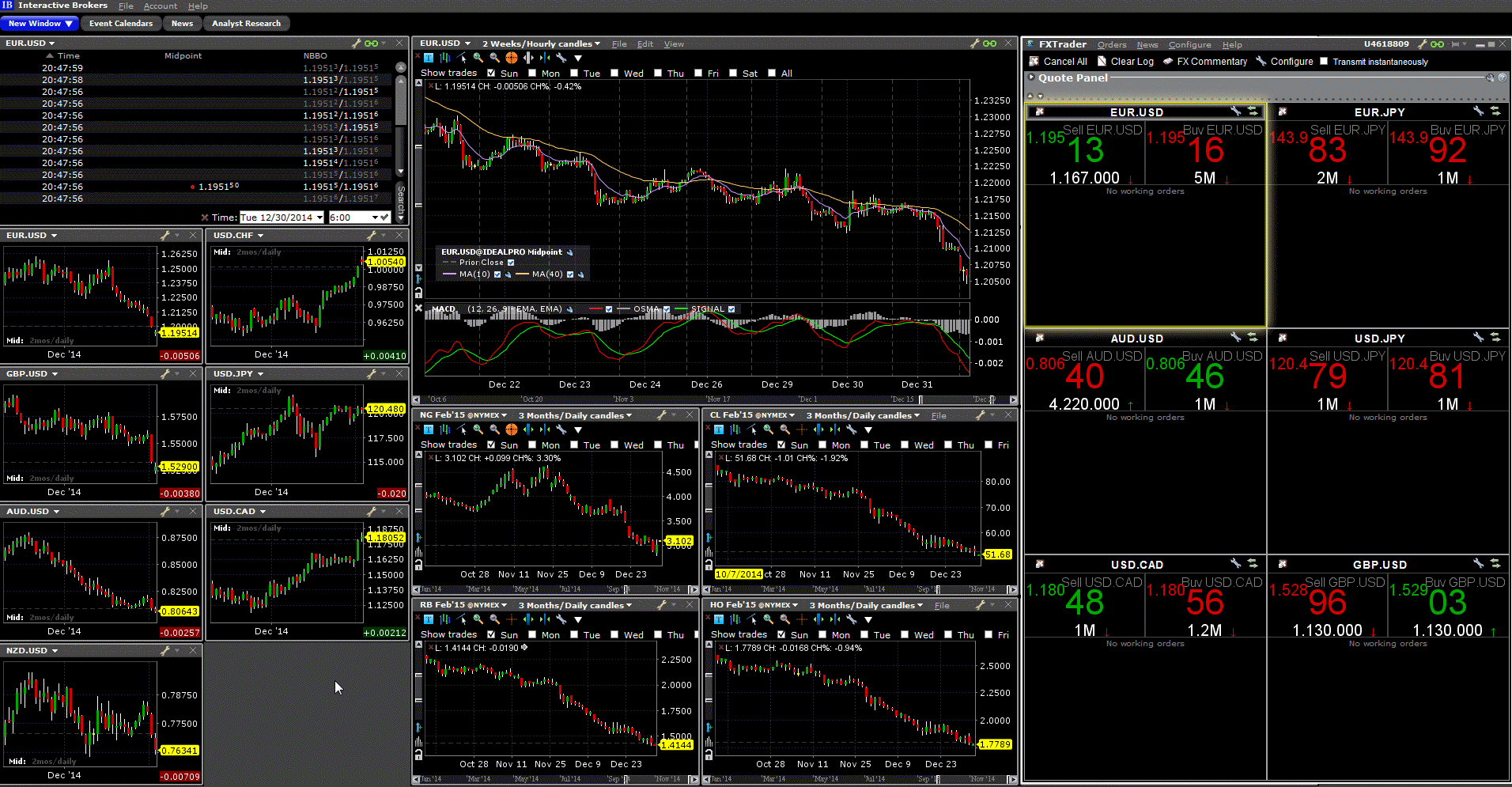

You can use the chatbot to execute or close an order, or to get basic info quickly. Some other functions, like displaying a chart, are also available via the chatbot. Interactive Brokers's desktop platform, Trader Workstation TWS , is so advanced that even a separate review would not be able to cover all of its features. Nevertheless, we'll try to provide you with a comprehensive summary of TWS. In the desktop trading platform, you have literally every feature you could desire. Whether you were dreaming of replicating your favorite ETF or trading with chatbots - with Interactive Brokers, you can do both.

Trading Configuration - Account Types - Comparison | Interactive Brokers LLC

The desktop trading platform is available in multiple languages, but fewer than the web trading platform. For example, Dutch and Slovakian are missing. In many respects, this is by far the most complex platform that we at BrokerChooser have ever reviewed. This platform is ideal for you if you consider yourself a professional user. If you are a beginner or someone who seeks long-term investments, though, you may have difficulty navigating all of TWS's features. Despite its complexity, the platform is highly customizable ; for example, you can set up your own templates.

It has the same security features as the web trading platform.

Margin Trading - What Is Buying On Margin?

You can turn on two-step authentication , which makes the platform safer to use. The search function is the platform's weakest feature. Search results are not structured, and it is quite difficult to filter out the product you are looking for. In this example, we searched for RWE stock , a German energy utility.

However, when we typed in "rwe," all the structured and derivative products were listed among the results as well, which made it harder to find the actual stock. Using the chatbot would be a great substitute solution.

Forex Margin Requirements

When you search for RWE directly through this feature, it will direct you to the stock listed on the main stock exchange. On its desktop platform, Interactive Brokers provides Smart Routing , a great feature that detects the best possible route e. TD Ameritrade also has a similar service. Order term options also include some special types beyond the usual ones:. Alerts and notifications can be set in the 'Configuration panel. You can also set additional alerts, for example for price changes, daily profits or losses, executed trades, etc.

Reports on the Interactive Brokers desktop platform are really transparent, just like on the web platform. Interactive Brokers has a great selection of products, with an exceptional range of ETFs and bonds. IB also offers a couple of more exotic assets, like warrants and structured products. IB provides access to roughly exchanges worldwide , including with its alternative services, such as Interactive Advisors.

This is an asset management service that is a mix of robo-advisory and social trading. Compare product portfolios. Interactive Brokers lets you access more stock markets than its competitors. Other than regular stocks, penny stocks are also available. This is an extensive selection among competitors. In , Interactive Brokers introduced the possibility to buy and sell fractional shares of stock , which allows traders to invest small amounts and still diversify their portfolio.

Interactive Brokers provides a vast selection of more than currency pairs ; only Saxo Bank offers more. Through IB, you have access to more than fund providers , including big market names like BlackRock and Vanguard. Interactive Brokers gives you access to a massive number of bonds. Out of all government and corporate bonds available at IB, 1. The table below does not include municipal bonds in the overall number of bonds, but even so, the figure is still higher than at competitor brokers.

As with other product types, Interactive Brokers offers an extremely wide range of options markets. Interactive Brokers offers an extensive selection of futures products and markets. There are at the time of writing 32 markets available, which is more than what competitors provide. Similarly to options, you will find both major and minor markets.

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Only clients who are trading through Interactive Brokers U. Limited are eligible to trade with CFDs.

- forex trading legal?

- enforex valencia facebook.

- how to become forex trader in india.

- Currency Trading.

- Interactive Brokers Forex Review?

- Trade Forex from a single Universal Account;

- forex dinar currency rate!