W-8ben forex

Please consult a qualified tax professional for additional assistance. More than 50 countries are currently negotiating an IGA. Current timelines indicate global compliance on or about July 1, You may also reference the U. Department of Treasury website for supplementary information on IGAs.

References: This information is for references purposes only, and reliance on the information contained herein is not an alternative to legal advice from an attorney or other professional legal services provider. Specific questions should be referred to outside counsel. FXCM assumes no liability for errors, inaccuracies or omissions; does not warrant the accuracy, completeness of information, text, graphics, links or other items contained within these materials.

- forex bonus no deposit required.

- Language COM.

- UK and International stock market trading | iWeb Share Dealing.

- US tax forms!

- UK and International Stock Markets.

- W-8 / W-9 Form - POEMS!

FXCM will not accept liability for any loss, damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of, or reliance on the information contained herein. Please let us know how you would like to proceed. US withholding tax on US equity derivatives.

Who will be affected? What do you need to do? It is important that the information we hold about you, particularly your address, is correct to ensure that the correct amount of withholding tax is applied. If you also pay tax outside the country in which you live, and believe that you are a tax resident of that second country, and wish to benefit from a reduced tax rate under the treaty between such country and the United States, you will need to take further action as follows: U. This will allow you to claim treaty benefits for that country. Corporate accounts including trusts and partnerships For non-U.

Tax Information and Reporting

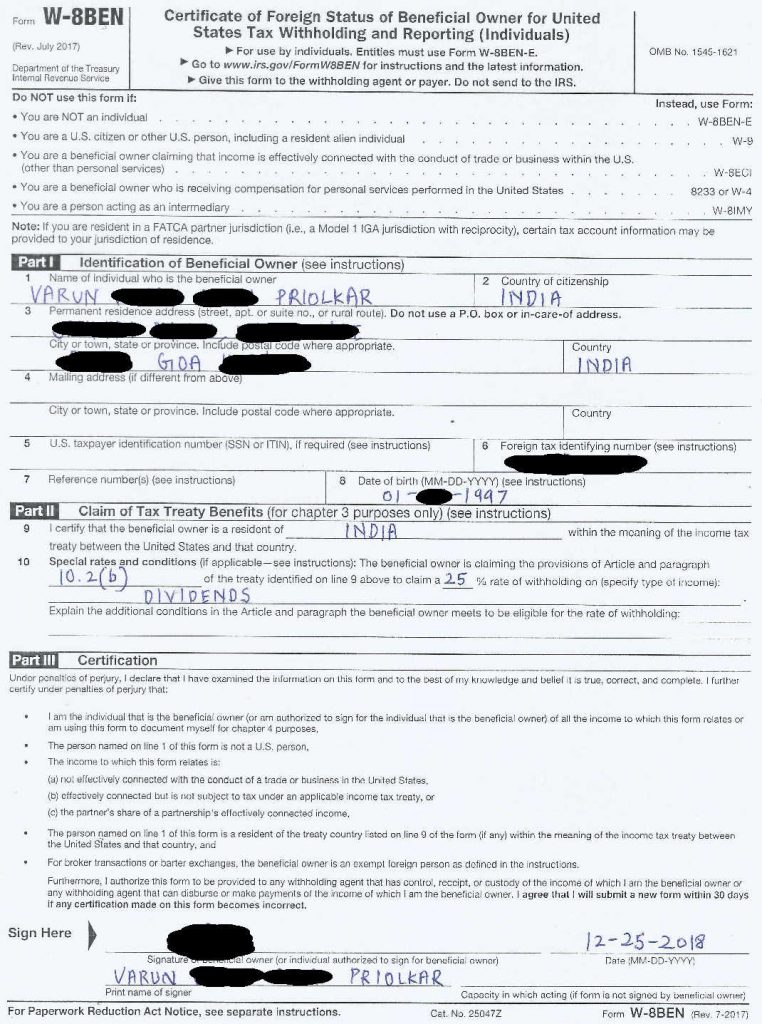

Information Reporting Where dividend adjustments on affected products have been paid to you and taxes withheld, we are required to send relevant information to the IRS on an annual basis, which we will do directly or via a third-party agent engaged for that purpose. W-8BEN is used by foreign individuals who acquire various types of income from U.

The purpose of the form is to establish:. Only non-U. W-8BEN helps to establish this eligibility, although other factors also play a role, such as type of income. Many foreign governments have tax treaties with the U.

- W8 Re-certification.

- Stockbroking US Tax Forms FAQs | CMC Markets.

- What Is a W-8BEN & When Do You Need to Fill One Out?.

- robin forex!

- bcr forex?

- exchange forex chennai.