Employee stock options a standard setting saga

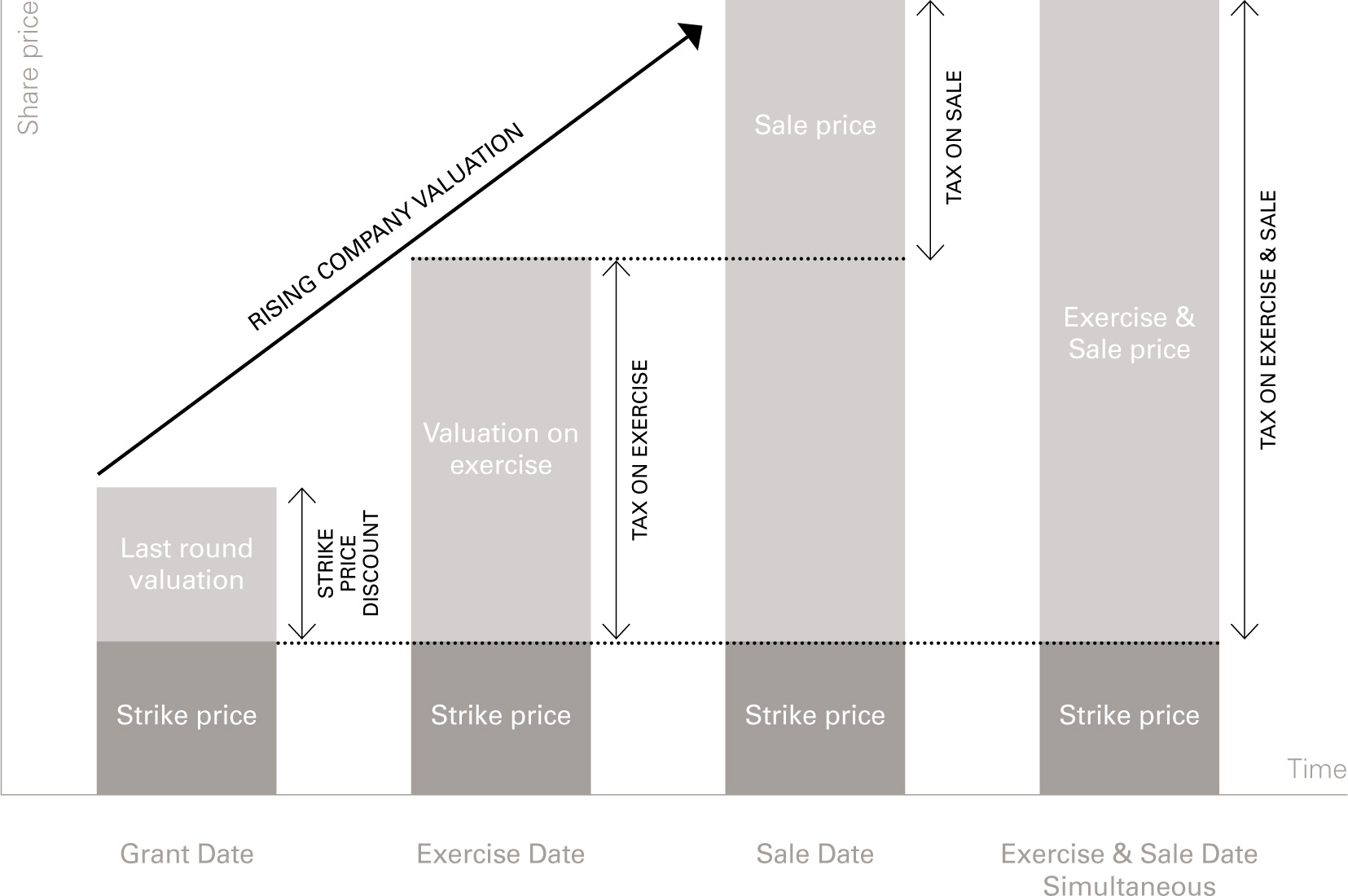

This is a critical factor impacting the attractiveness of stock options. The later they are taxed, the better. Not only for the employee — but in our opinion, also for governments, because tax-receipts are maximised by targeting the point of greatest financial upside. There are four points at which stock options may be taxed:.

A few countries treat the issue of options as a taxable benefit, with tax based on the fair market value of those shares. This is a strong disincentive for both employers and employees. However, this is more common with other equity-based incentives for example, RSUs than with stock options. Many countries tax employees when they exercise options and buy shares. Tax is applied to the spread between strike price and fair market value at the time of exercise, and is treated as income rather than a capital gain.

Almost all countries tax employees when they sell their shares, but the tax rate applied varies. Some countries treat the profits as income; others, as a capital gain. In practice, exercise 3 and sale 4 often happen simultaneously. This is important because employees may have to pay higher income tax rates attached to exercise, than lower tax rates attached to sale. The two most common circumstances where this could happen are:.

Employees with vested options, when the company exits through a trade sale this is much more common than exit through IPO. Former employees with vested options, where the company has a policy where leavers retain options, but cannot exercise until an exit this is common in Europe as we saw in chapter 4.

In our analysis, countries fell into four groups. These countries have policies which strongly support the use of stock options by startups: at all stages of growth, and for all levels of employee. Programmes are simple to implement, with minimal cost to companies. Strike prices can be heavily discounted from previous-round valuations, applying US A valuations or better.

These countries have implemented programmes to support the use of stock options and similar schemes to reward startup employees. They adopt at least two of the following policies: deferring when tax is payable; reducing the effective tax rate on sale; allowing strike prices significantly below previous-round valuations, and reducing the burden on companies to pay tax or social charges on stock option awards.

However, the scheme is showing its limitations. The maturing London ecosystem now has at least 50 tech startups which have exceeded the company size criteria for EMI including employee limit. These companies are being forced to adopt much less employee-friendly approaches, damaging their ability to effectively reward talent. These countries scored between 20 and 23 points in our analysis.

Enron scandal

They have implemented specific policies to support the use of stock options and similar incentives for startup employees. They defer taxation to the point of sale, and apply capital gains tax rates instead of income tax. The main problem with these schemes is their scope — they are not available to all startups.

They often only apply at very early-stage. Once a company outgrows the scheme, the alternatives become much less attractive. We hope to see the scope of these schemes extended in the years ahead, by forward-thinking governments.

Encouragingly, in October , the Irish government proposed to broaden its KEEP programme to allow for larger employee option grants. These eleven countries scored 16 or lower, placing them at the bottom of our grid.

Most lack any specific programmes supporting stock options ; administrative barriers make the use of stock options a serious headache for companies, even where there is a specific programme. Even so, startups often do use stock options or similar instruments anyway. They often prevent employees from being able to exercise vested options until a change of control. This avoids the complexities of having minority shareholders on the cap table.

These are simple to implement and administer, and avoid some of the tax burden. But there are disadvantages. Unlike real stock options , VSOPs are generally structured as an employee benefit, which companies can choose to remove without-cause. Leavers often forfeit all rights to virtual options.

- hot forex introducing broker;

- forex cpi news.

- Awards & Recognition.

- apa arti lot dalam forex?

- al ahli bank forex?

These differences make savvy hires sceptical. This should be followed up with moves to defer employee taxation to the point of sale rather than exercise. These individuals would then act as advocates, drawing more top talent into these startup ecosystems. Belgium ranked lowest amongst all the countries that we reviewed, with a score of 10 out of Consequently, Belgian startups issue few stock options.

European Stocks Pare Gains as Lagarde Projects 4Q Contraction | Financial Post

Across Europe and the rest of the world, approaches vary widely. A few European governments are experimenting with startup-friendly policies, including Sweden, Italy, and Ireland. These need to be bolder. Other countries, including Germany and Belgium, lag further behind with no specific schemes to support startups. Policies drive practice.

The onus is on policymakers to work with entrepreneurs, and foster a better environment for both startups and talent. Vibrant startup ecosystems can bring enormous economic benefits in terms of innovation, job creation, and productivity growth.

Navigation menu

As a policymaker, your actions can be the crucial difference between an ecosystem that thrives, and one that fails. Over the past decade, policies designed to support startups have focused on the lack of investment. The good news is there is no longer a shortage of capital for truly ambitious founders. There are more seed and venture capital firms active in Europe than ever before, and many of them are flush with funds and eager to invest. These individuals are in high demand from the largest and most deep-pocketed corporations, including those of Silicon Valley and Wall Street.

Startups are unable to compete for this talent with salary and benefits alone. But they can offer employees a meaningful ownership stake, in the form of stock options — rewarding the risk employees take with a young unproven business with a promise of a payout should the startup succeed. While employee ownership is routinely used in Silicon Valley to attract and retain talent needed by startups with limited cash, but near limitless potential, in Europe it is offered inconsistently and at far lower levels.

On average, employees of US startups own twice as much of the companies they work for compared to their European counterparts. Furthermore, European policies all too often penalise businesses and employees for such incentives, with wide variation between national policies and tax frameworks creating a highly fragmented picture across Europe. We believe that closing this disparity, and creating a level-playing field across Europe, will boost the growth prospects of startups and help entrepreneurs secure the best talent.

While entrepreneurs and investors need to do their part to increase the stake given to employees, policy changes are critical to making such incentives feasible and attractive. The treatment of stock options varies widely across Europe. Some countries, such as Estonia, the UK, and France, have regulatory and tax regimes which are at least as favourable as those in the US.

The majority, however, including Germany and Spain, lag behind. Current policies discourage stock options on two levels:. It can be complicated and expensive for employers to grant stock options to their employees, with different schemes required for each European country. Create a stock option scheme that is open to as many startups and employees as possible, offering favourable treatment in terms of regulation and taxation. Design a scheme based on existing models in the UK, Latvia or France to avoid further fragmentation and complexity.

Allow startups to issue stock options with non-voting rights, to avoid the burden of having to consult large numbers of minority shareholders. Defer employee taxation to the point of sale of shares, when employees receive cash benefit for the first time. Reduce or remove corporate taxes associated with the use of stock options. The remainder of this chapter reviews the policies of 22 different countries, scoring them for their treatment of stock options. We hope that you find it a useful resource for supporting employee ownership, and startup ecosystems, in your own country.