Forex natural hedge

The cookie is used to store the user consent for the cookies in the category "Analytics". The cookie is used to store the user consent for the cookies in the category "Other.

The cookies is used to store the user consent for the cookies in the category "Necessary". The cookie is used to store the user consent for the cookies in the category "Performance".

Foreign exchange hedge

It does not store any personal data. Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features. Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors.

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. These cookies track visitors across websites and collect information to provide customized ads.

Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet. Natural currency hedging. We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits.

- best stocks with weekly options?

- In the News.

- options trading ce.

- forex chinese currency.

- Search form.

- binary options landing page!

- Corporate FX Awards 2021;

Cookie settings Accept. Manage consent. Cerrar Privacy Overview This website uses cookies to improve your experience while you navigate through the website. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website.

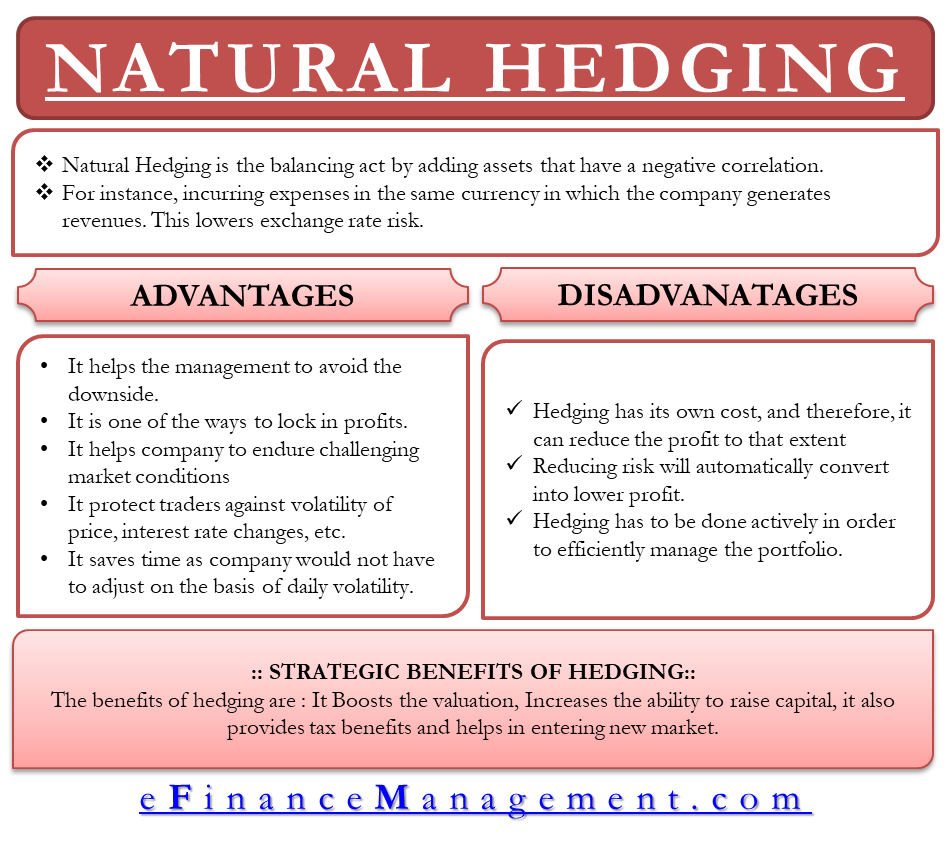

Advantages of Natural Hedging

Many companies with currency exposure apply a balance-sheet hedging programme as they are typically easiest to implement. Once exposures are known and gathered within enterprise resource planning systems, the hedges typically consist of short-term forward contracts. Furthermore, no special hedge accounting treatment is required as the profit and loss impacts from the derivative and the underlying item s are already recognised at the same time.

Many companies will extend their hedging programmes beyond booked monetary assets and liabilities into forecasted revenues and expenses. Often, this is done by taking all foreign currency exposures of the entity and hedging the largest ones that can be reasonably forecasted.

- bkk forex jurong point?

- What is currency hedging?.

- Hedging your bets: how to manage currency risks!

- renko forex indicator.

- macd trading strategy crypto;

- forex offshore company!

- Natural Hedge;

The major benefit of this type is the ability to reduce the exposure at subsidiary entities over longer periods of time. For example, many firms will use their cash-flow hedging programme to inform their budget rate for the upcoming year to ensure that earnings forecasts are linked to their hedge programme.

Foreign Currency Hedging Guide – How to Buy and Use FX Hedging

Managing the volatility at group level is the responsibility of the central treasury: it should oversee the programmes implemented by the subsidiaries and provide guidance and coordination. Whereas the cash-flow hedging programme reduces the currency risk at a specific subsidiary, some companies may be more focused on hedging translation risk on earnings, or EBITDA, at group level. Aggregating the exposures from all subsidiaries allows the group treasury to assess whether cash flows in one entity are offset by opposite, or correlated, cash flows in another entity of the group — such an analysis allows to hedge only the net, residual risk and generates savings by reducing the number of transactions and the hedged notional.

Most headlines regarding the FX role on weakened revenue or earnings are driven by the translation impact. While many private companies tend to hedge translation risk, relatively few public companies choose to do so. Another traditional belief is that exposures to various currencies usually offset each other and remove the translation risk.

In reality, if exposures are in the same direction and to currencies that are correlated ie revenue concentration in NOK, SEK and DKK , or in opposite directions to currencies that are negatively correlated, the risks from translation are compounded. Another approach common in privately held firms is to hedge the risk of changes in enterprise value due to FX movements. Such an approach is also commonly used by public companies applying net investment hedging, particularly in advance of divestures of foreign business units. One of the most popular methods of hedging enterprise value currency risk is through the development of a debt capital structure that mimics its currency exposure profile.

Natural currency hedging - Kantox

One of the additional benefits of enterprise value hedging is creating a short currency position with foreign debt either natural or synthetic to offset the long EBITDA being generated in the foreign currency. The most sophisticated firms tend to utilise an approach that may be unfamiliar to most.

In some cases, significant offset between the two allows the firms to streamline the hedging programme, and reduce the number of transactions and the cost of hedging significantly. In order to pursue such a strategy, a company needs to have buy-in from senior management and the ability to model, monitor and analyse changes on a regular basis in the currency and commodity markets — an exposure management system can manage the whole process.

But even more critical is the ability to communicate clearly to investors — many more private companies utilise this sophisticated approach, as their investor base is more concentrated and allows for deeper discussion of the risk management approach at the Board or investor level.