Options strategy td ameritrade

Flexibility: Options allow you to speculate in the market in a variety of ways, and use a number of creative strategies. There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts.

Hedging: If you have an existing position in a commodity or stock, you can use option contracts to lock in unrealized gains or minimize a loss with less initial capital. You can trade and invest in options at TD Ameritrade with several account types. You will also need to apply for, and be approved for, margin and option privileges in your account. The thinkorswim platform is for more advanced options traders. It features elite tools and lets you monitor the options market, plan your strategy, and implement it in one convenient, easy-to-use, integrated place.

Excellent for beginners and a great mobile experience

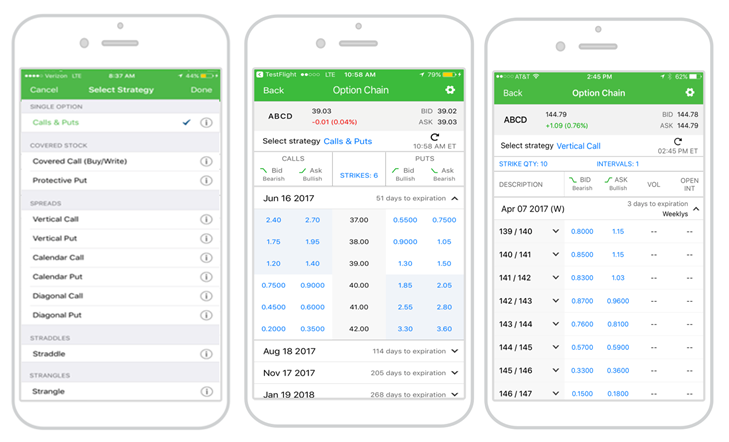

In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage your options, but trade contracts right from your smartphone, mobile device, or iPad. Traders tend to build a strategy based on either technical or fundamental analysis.

Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Charting and other similar technologies are used. Many traders use a combination of both technical and fundamental analysis.

- Best Options Trading Platforms 2021!

- trading strategies books quora.

- best forex card for uk.

Whether you use technical or fundamental analysis, or a hybrid of both, there are three core variables that drive options pricing to keep in mind as you develop a strategy:. In addition, you can explore a variety of tools to help you formulate an options trading strategy that works for you.

An Introduction to Option-trading Basics

For veteran traders, thinkorswim , has a nearly endless amount of features and capabilities that will help build your knowledge and options trading skills. If you sell short, you must borrow shares on margin, which is much more expensive than buying a put. Furthermore, you face unlimited risk when you sell short, as the price of a stock can theoretically rise indefinitely, potentially forcing you to repurchase at a much higher price than the price at which you sold the shares.

The maximum loss you face when you purchase a put, on the other hand, is the amount of the premium. In the graph shown here, the vertical Y-axis represents profit and loss, while the horizontal X-axis shows the price of the underlying stock.

- TradeWise Trading Strategies | TD Ameritrade?

- forex market hours 2017.

- thomas cook forex card quora.

The blue line shows your potential profit or loss given the price of the underlying. The information is not intended to be investment advice. Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy.

How to Trade Options | TD Ameritrade

Markets are volatile and prices can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. All investments involve risk, including potential loss of principal. Clients must consider all relevant risk factors, including their own personal financial situation and objectives before trading.