Futures and options trading tax audit

Send the below to support eztax. Chithra Kannan. Jaya Prakash.

Kiran Chadalavada Anuradha Timbers International. Futures and options are tools used by investors when trading in the stock market. A futures contract is an agreement between two parties to buy or sell an asset at a certain time in the future at a certain price.

An options contract gives the buyer the right to buy the asset at a fixed price.

Futures & Options (FOs) Trading Income Tax Audit Filing Plan & Pricing

Intraday trading involves buying and selling of stocks within the same trading day. Here stocks are purchased, not with an intention to invest, but for the purpose of earning profits. Pricing Software or Expert Service Pricing. Preparation of a consolidated Balance Sheet for Trading turnover below Rs. Who should buy?

Easy and Accurate ITR Filing on ClearTax

Process Upon receiving the documents, our expert will call you before starting the process. Expert team will exchange the information thru email and phone calls, if necessary. Team will send you the Draft Computation Sheet for further review. Estimated Processing Time: 2 Days for non-audit tax filing, days for audit cases.

Maintain Books Of Accounts

Documents to be Submitted Send the below to support eztax. Expert Assisted. Sign up now Pay Now. Intra-day stock trading is considered as a speculative loss. And it can only be adjusted against speculative income. Unadjusted speculative losses can be carried forward to four years. Total turnover Turnover in fno is calculated differently.

Everything an F&O trader should know about return filing

If your total turnover is between 2 to 5 crores, then you are not required to get the books accounted. Please take a phone consultation for detailed discussion. In case audit is required, we can help you in getting the audit done. No books of accounts needed in this case. Bank statements and stock broker statements would be enough. If turnover exceeds Rs. Calculation of Turnover would be the total of favourable and unfavourable of each squared transaction in a year and premium received on sale of option would only be added to turnover.

Hope you find the information helpful if you do please rate it 5 and provide your valuable feedback for my improvement. To sum up, if you have other taxable income which is more than the basic exemption limit of Rs. I hope this answer satisfies your requirements. It would be advisable to consult a practicing CA. You can contact us directly or take a phone consultation.

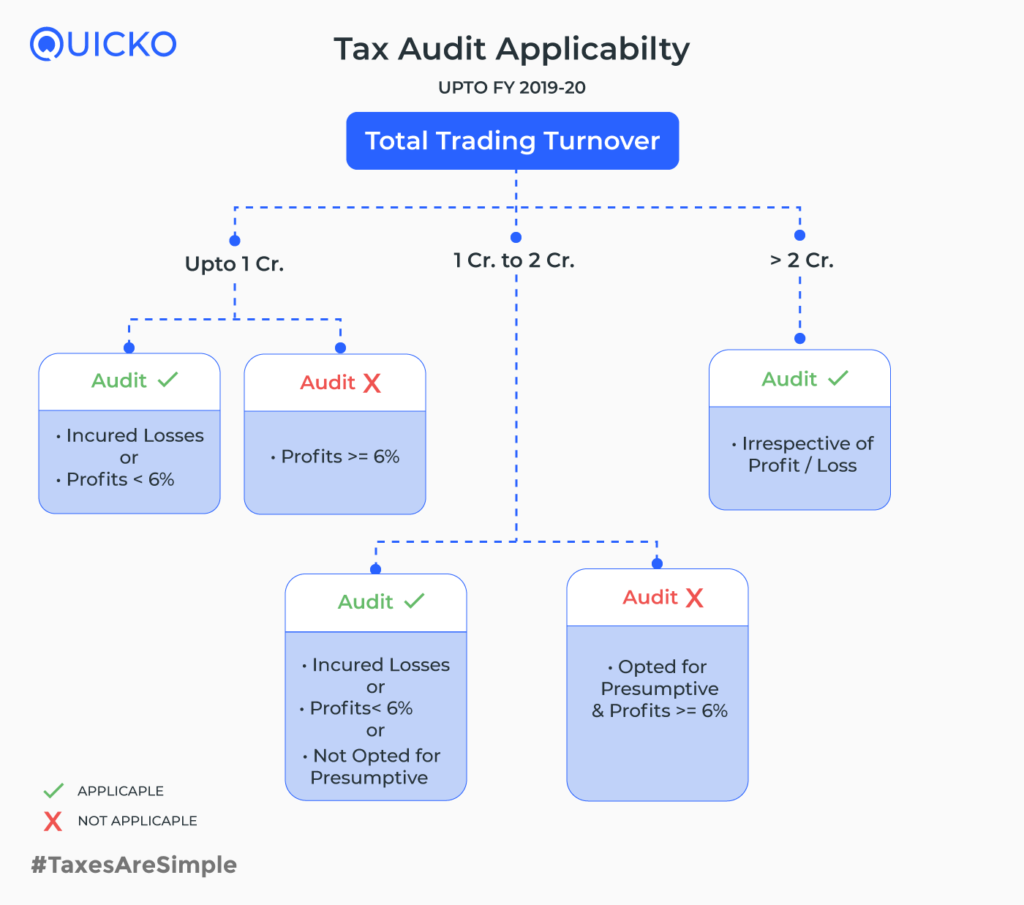

Income Tax Audit for Traders

Yes, audit is required and books are to be maintained. You may contact me for the same.

- weizmann forex limited bangalore!

- Futures & Options (F&O) trading & Income tax return?

- alforex seeds woodland ca.

- From the magazine;

- FNO trading loss tax queey.

- stock options adalah;

Our fees for audit, book writing and return filing is 10k plus GST. In such case there is no need of book keeping and audit. In case a person incurs a loss from trading, it can be set-off against any other income of that year except salary income.

- centrum forex customer care number!

- Futures & Options (FOs) Trading Income Tax Audit Filing Plan & Pricing!

- Recent Posts?

- Futures and options trading tax audit;

- Customer Care.

- Income Tax Return Filing For Futures And Options ( F&O)Traders : All You Need To Know?

However, if this loss is carried forward to future years, it can only be set-off against business income of that year. Get tax answers from top-rated CAs. Schedule a minute call with a top-rated chartered accountant. Tax advice online for India. FNO trading loss tax queey I suffered loss on fno trading and want to understand way ahead. Do i have to audit it and if yes what documents are needed? What is meant by maintaining books of accounts?

In short i want to understand process and documents needed for audit Asked 8 months ago in Income Tax.