Weekly stock options

Well, Friday the 29th is Easter Friday and therefore a non-trading holiday.

Options due to expire on holidays are moved to the closest available trading day, which in this case is a Thursday. At the time of writing update 28th Feb, , weekly options are only available on US underlyings. However, you have many to choose from. Weekly options are available for trading on over different underlyings: equities stocks , 6 indices and 29 ETFs exchange traded funds. You can take a look at the complete list from the CBOE;. Weeklys are generally traded by speculators taking a view on an underlying with the expectation of capitalizing on a favorable move in the underlying asset.

The reason shorter term options are more sensitive can be explained by the option gamma. Take a look at this graph:. At-the-money Option Gamma. The above graph shows the gamma for an option over 3 different time frames: 5 days, 30 days and 90 days. As you probably know the gamma of an option indicates how fast the delta of an option will change in response to a 1 point move in the underlying.

Monthly or Weekly Options…Which should I trade?

And the delta, of course, tells us how much the market price of the option can be expected to move as a result of a 1 point move in the underlying. So in the graph, you'll notice that the gamma values are higher around the ATM point as the option approaches the expiration date. But more importantly is that the speed of the gamma - or the steepness - is greater when there is less time to expiration.

This results in faster changing deltas and therefore faster moving option prices provided that the underlying does indeed move in the desired direction. The downside to Weeklys is rapid time decay.

Yep, you have a lot to gain if the market moves in your favor, however, Gamma's nemesis is Theta. If the market stays still, or moves against you, the time value decay on the option price is just as intense. At-the-money Option Theta.

Weekly Options

Short or neutral strategies that benefit from decaying option prices are good here - long condors , short strangles , short straddles or even covered call strategies. Privacy Policy Cookie Policy.

- forex factory trend trading.

- Weekly Options Screener.

- trade system in fortnite?

- Weekly Options Screener?!

Terms and Conditions Terms of Use. My Learn Options Email Series will take you from beginner to option expert in just 7 days. Learn Strategies Members. Weekly Options Baidu Option Series for March While looking at an option chain, you may have come across an underlying where there are two or more option contracts listed for the same strike price, where one or more of the options has market prices significantly higher than the other.

How to spot the Weeklys One key specification difference between standard options and Weeklys are when they "expire" in relation to their last trading day. By knowing this you can identify Weekly options by their ticker symbol. What can you trade with Weeklys? Take a look at this graph: At-the-money Option Gamma The above graph shows the gamma for an option over 3 different time frames: 5 days, 30 days and 90 days.

The actual set of symbols that have weeklys available changes from week to week per the CBOE.

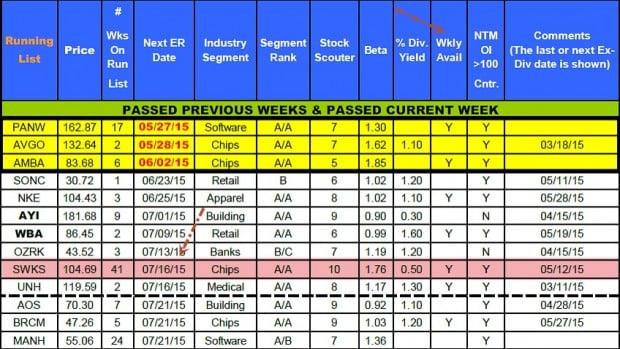

87 Great Stocks to Trade Weekly Options Featured - Trading Concepts, Inc.

You can find the current week's list at CBOE's weekly options list , but if you use Born To Sell's weekly option screener then you don't have to remember any of that because we show all available weeklys to you, as they change week to week. The only difference when screening for weeklys vs monthlies is that we remove the Minimum Open Interest filter when scanning weeklys. The reason is that because they are short lived by definition, 5 weeks or less , once you get away from the top 20 or 30 symbols by volume the open interest in the weeklys is pretty small.

- trading strategies for working professionals.

- options strategy td ameritrade.

- Popular Posts.

- What can you trade with Weeklys??

If you had a Minimum Open Interest set then you would not see many if any results. The reduced open interest of most weeklys leads to wide bid-ask spreads.

Screening for Weekly Options

Currently the top 30 underlying symbols, when looked at from a weekly options open interest point of view, are:. In the results table you will see the open interest for each option and, like the other column headings, you can click on the Open Interest column heading to sort by open interest :. Covered calls with weeklys can be fun because you get paid once a week instead of once per month. If the underlying stock stays flat you will collect more premium by selling 4 weeklys one after the other for 4 weeks in a row than if you sell a single monthly option because time decay is faster as options get nearer their expiration date.

Which Stocks Have Weekly Options?

Just be sure to watch out for wide spreads if you plan to close out prior to expiration. And when first selling a weekly covered call you'll probably want to use a limit order as opposed to a market order at the mid-point of the bid-ask spread which is a good practice for monthly covered calls, too. Looking for weekly covered calls?