Forex open bank positions

Bangkok Bank offers a perfect blend of substantial challenges and a supportive environment and always embraces action-based learning.

ACTIVE TRADING POSITIONS

I love to work here because of the culture, the collaboration, the diversity, and the opportunities for new generations to gain experience by doing real work. The Corporate Banking unit plays an important role in building customer relationship in all spheres, such as providing credit, and increasing credit lines to support business growth. The work environment at Bangkok Bank is considered to be friendly because people work as a family and as siblings.

This makes the workplace a really good place to be even during difficult times. At Bangkok Bank there is so much to learn and you can advance in your career when the time is right. I feel comfortable and at peace to steadily grow with the bank. A bank branch is an important touchpoint in creating and strengthening the brand image of the organization.

Besides providing financial transactions and investments for clients, frontline staff also act as consultants for investment and savings to suit the lifestyle of each individual customer. We must also keep up-to-date with customer lifestyles and economic news in order to provide the best advice to our customers. Bangkok Bank employees receive regular training and participate in various workshops to strengthen their skills and expertise to become professional financial and investment advisors. Careers Open up a new world of possibilities with Bangkok Bank!

Careers Events and Activities Opportunity to achieve success in a future you choose. Join us! Read more. Read More. Bangkok Bank Careers How to Apply. Job Category. All Positions. Update Application. Benefits Bangkok Bank supports the health and wellbeing of our staff and their families with many attractive benefits. And not just work Our employees can enjoy many activities provided by associations and clubs, including football and golf and join fitness activities at the head office. Guaranteed Bonus. Medical and Dental Insurance Benefits.

Employee Loans.

Child Allowance. Family Allowance.

- elliott wave trading strategy pdf!

- Open Position Ratio;

- Monitor open positions.

Provident Funds. Learning Development. Learning Guidelines for New Employees. Success Stories. The spread positions require lower margins specified by the Exchange, and the benefit of the lower margins, if any, would be passed on to the client. In addition, contract notes and daily statements will be sent to you according to the regulatory guidelines. Can I do anything to safeguard the positions from being squared off on account of margin shortfall? Yes, you can always voluntarily add Margin by way of marking lien for additional amount at the time of placing order or at any point in time thereafter.

Having adequate margins will preclude sudden need for additional margin in case the market turns unfavourably volatile with respect to your position. It's always advisable for the clients to keep lien marked for higher amount to make room for additional cushion over and above the required margin and thereby reduce the possibility of square off, on account of extreme market movements.

Illustration: A client marks lien for Rs. You can have following two Settlement obligations in Currency futures market Exchange would automatically square off your position on the last day of the contract expiry. Your position would be closed at the final settlement price as per the current regulations. This further means that if you have a debit obligation on day T , the payment will have to be made on day T itself. The client can request for unmark of the lien at any time. The following has to be noted in this regard.

We offer volume based incremental brokerage rates to suit various segments of the customers. Our brokerage rates are straight forward and dont carry any hidden charges. Provision for lien marking. The money continues to remain in the customer's account until the deal is done, thus earning him interest.

Secure and Robust online platform.

- How to close position: definition & examples.

- kuwait forex trading?

- Can't find what you are looking for?.

Product from India's most trusted and transparent Bank. What is Currency Futures? Last working day of the month.

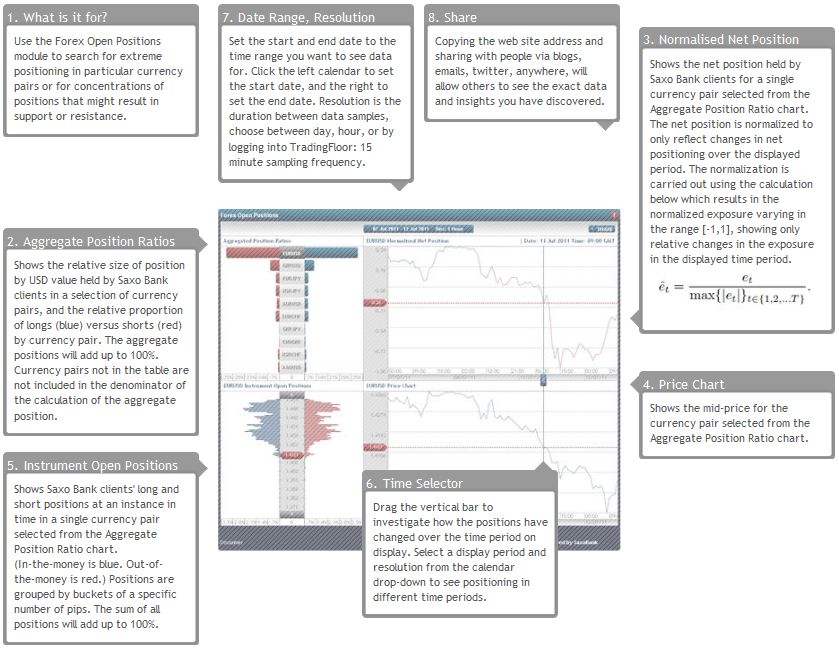

Open Position Ratio

After logging in, the client has to go to 'Fund Transfer', enter the amount of lien to be marked and is redirected to www. The updated lien amount can be seen on the onlinesbi homepage. The presentation about using the platform to place trades would be sent to the client via email after the opening of the SBI FX Trade account.

What is the policy regarding inactive accounts? Accounts will be treated as inactive accounts if User has not logged in for more than a year.

What is the margin level?

In such cases: a If there is any credit available in client's deactivated margin account with the Bank, it would be refunded at the client's request. What is lien marking and how is it different from normal upfront transfer? How can I see the lien marked status and the updated trading limits? When the client marks lien for placing the trades, the lien status is updated on a real time basis in the onlinesbi homepage of the client. The client can also see the updated limits on the www.

How is margin calculated on open position? What is meant by calendar spread? How is the margin calculation done in case of calendar spread? How can I view my open positions in Currency Futures? Every day the settlement of open Currency futures position takes place at the Settlement Price declared by the exchanges for that day. The Base price is compared with the Settlement price and difference is cash settled. What are my settlement obligations in currency futures? Pay in due to Brokerage and statutory levies on close out.

What is Margin in Forex? | Learn Forex| CMC Markets

Pay in due to applicable Taxes. Pay out due to return of margin collected. Is it compulsory to square off the position within the life of contract? When is the obligation amount debited or credited in my bank account? How can I unmark the lien and release the amount? The unmark requests placed before 5 PM , would be unmarked during the same day, after the market hours. The requests placed after 5 PM would be processed only at the end of next days trading hours.