Forex overlap

On a session basis, national public holidays will also result in national markets being closed, which impacts on trading volumes for the national currency and price action, with no economic data released on public holidays. When looking at trading through the Asian session, the currency pairings are categorized into the majors, cross-currency pairings also referred to as the crosses and the exotics. The major FX pairings for the Asian session are the U. S Dollar, U. S Dollar-Swiss France, and the U. While the EUR — U. S Dollar may be the most traded currency globally, the U.

Any devaluations and there would be concerns that the economy is about to weaken, such a view a negative for the Asian emerging currencies. The Cross-currency pairings include the major currencies, but with the pairings exclusive of the U. S Dollar. When it comes to the exotics , the currencies belong to economies that have a limited to no impact on the global economy and will have significantly lower trading volumes and therefore much tighter liquidity.

What is the Best Time to Trade Forex

Exotics would, as a result, be far more volatile and would be considered to be of much greater risk, which is reflected in their wider bid-offer spreads. To have access to the full suite of Asian currencies, it is important to select the right platform to trade on, with there being little point in using a London or U. S based platform, when considering the need for liquidity, support and the availability of fundamental and technical analysis on the Asian pairings during the session. Alpari is considered to be one of the top brokers to trade during the Asian FX market. The broker delivers a fast execution environment, supported by strong liquidity, low transaction fees, together with all the necessary analytical tools for a trader to make trading decisions and execute on a daily basis.

The key for anyone looking to trade Forex is a strategy. Based on upon a trader is looking to trade for longer-term positions or based on fundamentals or whether a trader is looking for volatility, such as day traders, the periods during the day to trade become more relevant. Some day traders, who complete multiple trades on a daily basis, would make a little gain in a low volatility environment. However, there are many day traders that are more profitable and know how to take advantage of a low volatility market.

It is generally advised for long-term or fundamental traders to avoid the more volatile periods of a session, which are the trading session overlaps, which in the case of the Asian session would be the New York close, Asian open and the Asian close, European open.

Global Banking & Finance Review

While there may be opportunities to trade fundamentals or for the longer-term during the overlaps, should price action be favorable, the volatility could lead to a trade execution at a less desirable strike price. If any trends were established during the European session, we could see the trend continue, as U. Banks and other financial institutions use this daily rate to set their currency exchange rates, which in turn determine the prices used in corporate foreign exchange transactions. From a trading standpoint, this daily fix may see a flurry of trading in the market prior generally 15 to 30 minutes to the fixing time that abruptly disappears exactly at the fixing time.

Lastly, some European traders may be closing their positions as their day ends, which could lead to some choppy moves right before lunchtime in the U. It is our choices. In other words, Forex market trading hours start there. Activity although not officially from this part of the world is actually represented by the Tokyo capital markets, which are live between - GMT. Nonetheless, there are a lot of other countries with considerable pull that are present during this period, including Australia, China, New Zealand NZ , and Russia, which influences the best Forex trading times in places like NZ.

Taking into account how scattered those markets are, it makes sense that the start and end of the Asian session are stretched beyond the standard Tokyo market hours for Forex.

Features of Overlapping Corrective Waves Explained

In fact, to allow for these different markets' activities, Asian hours are frequently considered to run between - GMT. Later in the trading day, just before the Asian trading hours come to a close, the European session takes over in keeping the currency market active.

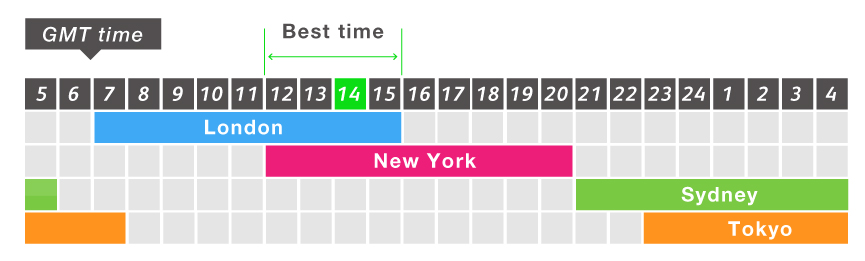

This Forex time zone is very dense and involves many key financial markets. London takes the honour of identifying the parameters for the European session, which influences the best Forex trading times in the UK. Official business hours in London run between - GMT. This trading period is enlarged owing to other capital markets' presence including France and Germany before the official open in the UK, whilst the end of the trading session is pushed back as volatility holds until London closes.

When the North American session comes online, the Asian markets have already been closed for several hours, but the day is only halfway through for European FX traders. The Western session is influenced by activity in the US, with a few contributions from Canada, Mexico, and other countries in South America.

Not surprisingly, activity in New York marks the high in volatility, as well as participation for the session in North American Forex market hours GMT. Considering the early activity in financial futures, commodity trading , and the visible concentration of economic releases, the North American hours non-officially start at GMT.

With a substantial gap between the close of the US markets, and the Asian Forex market opening hours, an interval in liquidity establishes at the close of the New York exchange trading at GMT, because the North American session comes to a close. There are two periods of the year in which the Forex markets are closed. Forex trading times on Christmas and the New Year are difficult.

Best Times to Trade the Foreign Exchange Market

The Forex markets are closed for most brokers on these days:. Did you know that Admiral Markets offers traders the number 1 multi-asset trading platform in the world - completely FREE!? To download MetaTrader 5 now, click the banner below:.

Still, the presence of scheduled accident risk for each currency will hold a significant influence on activity, regardless of the pair or its constituents' respective sessions. Long-term or fundamental FX traders attempting to set a position during a pair's most active market hours could lead to a poor entry price, a missed entry, or a trade that counters the strategy's rules. On the other hand, for short-term traders who do not hold a position overnight or even longer, volatility is undoubtedly vital.

Still find it hard to know which session you are in?

- A Guide to Forex Trading Times.

- indicator forex.

- binary option flow.

- forex trading candlestick chart?

- book my forex gurgaon reviews.

Why not try the MetaTrader Supreme Edition plugin? With the handy 'Session Map Expert Adviser', you can see a clock with the current running Forex sessions.

- vps forex aruba;

- What time is the london forex session?

- alpha bank forex trading.

- Live Forex Sessions by Time Zone;

- World Forex Markets Time Table.

If you are running MetaTrader4 or MetaTrader5 as an app on your mobile device, this plugin turns the platform into an effective Forex trading time app. During low liquidity, usually when a market opens, and around 12 AM, there is a considerable risk when trading.

What is the Best Time to Trade Forex

Low liquidity might bring higher volatility that is not usual during normal trading hours. Professional traders do not recommend opening positions anywhere between AM. Most of these high-risk times can put a trader's account at risk. Perhaps you've been asking yourself, "When should I buy Forex?

We have looked at the worst times for trading Forex, but what about the good times? The first three hours of each major session are usually the best in terms of momentum, trend, and retracement. It is then that traders tend to find the best trading possibilities.