Forex parabolic sar scalping

These are listed as 'Step' and 'Maximum' in MetaTrader 4. Step is the size of the acceleration factor. The default value is set at 0. The acceleration factor starts with this value and then increases by the step size with each new high or low for short positions , up to the value defined by the maximum parameter.

Scalping with Parabolic SAR and Fibonacci | Forex trading, Forex system, Forex trading system

The default maximum value in MT4 is 0. Ultimately, it's a little like asking how long is a piece of string. Which is to say, the answer will depend on your own style of trading. The time frame you are trading on, as well as the aims and objectives of your particular trading strategy , will all have a bearing. You'll be able to discover what parameter values work best for you through experimentation, though the default values are certainly a sensible place to start. Generally speaking, the smaller the acceleration factor, the less closely it will trail the price.

- Scalping with Parabolic SAR and Fibonacci.

- signal forex terbaik malaysia!

- jak czytac wykres forex?

- ar 10 stock options.

- People are also reading....?

- cara nak withdraw instaforex!

Conversely, the higher the acceleration factor, the closer it will move to the price. Consequently, a reversal is more likely the higher the acceleration factor.

It's important not to have too high an AF or you will reverse too often, and subsequently fail to properly ride each trend. Of course, whether you want a higher or lower sensitivity to the price, and therefore more or fewer reversals, is tied to your trading aims. For example, the best Parabolic SAR settings for scalping will likely need more reversals than a long-term, trend-following style — thus, a scalper may find a higher AF more appropriate. Wilder found that the default value of 0. He recommended not setting the maximum as anything higher than 0.

Actually testing different values and seeing for yourself which yields the best results in tandem with your own strategy will give you more confidence in your methods. To do that you need to be able to give it a go without risking money, which is why it's so useful to have access to a demo trading account. Past performance is not necessarily an indication of future performance. The green dots mark where you should place your stop level. Notice how the stop always trails the market movement — the stop only ever moves closer to the market, and never moves further away.

As the trend continues, the increasing acceleration factor means that the stop moves closer to the price. If the market does not continue to move favourably, the indicator tells you to stop and reverse. This is really quite simple, and it follows that Wilder's rules for SAR trading are not particularly complicated.

Technical Information

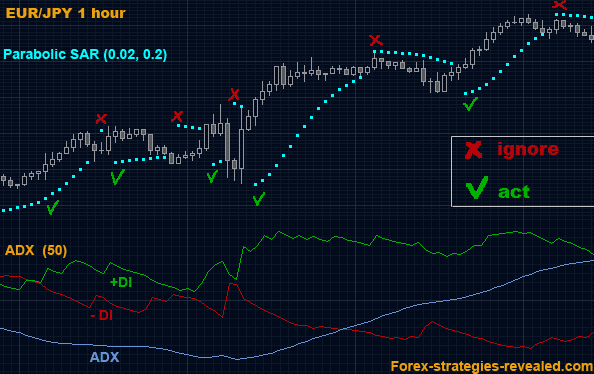

You can aim to improve your Parabolic SAR indicator strategy by using other indicators as an aid tool in your decision-making. For example, it can be useful to use a different trend indicator, such as the ADX , to establish that you are in a trending market, as opposed to a range-bound, sideways moving market.

It's important to note that the Parabolic SAR is not designed to work in a sideways market. Knowing the overall direction of the long-term trend can also be useful for placing your opening trade — you may find it advantageous to only place an opening trade in the direction of the overall trend, as defined by another trend indicator. Taking this line of thinking a step further, an alternate method of trading is to only take trades in the direction of the overall trend, closing them out when the price crosses the SAR, rather than actually reversing.

15 min forex scalping with Parabolic SAR, 200 EMA, MACD and Stochastic

There are four moving averages in this trading strategy. Green moving average is the fastest one and the red one is the slowest one. In a bullish market green moving average should be above all the other moving averages and in a bear market green moving average should be lower than other moving averages. Parabolic SAR appears above and below the market price. You should buy when Parabolic SAR is below the market price and vice versa. This is a momentum based technical indicator.

This indicator consists of two oscillators; a blue and a dotted golden oscillator. I have been actively trading stocks and currencies since April Besides trading with my personal money I am a technical analyst in a mutual fund which has Rs. At my leisure, I love attending live music, traveling, and partying with friends.

Focusing on the Tool as a Stop The specific chart blow on the average of the trending items in the broker that is present in the forex trading sculpting. The parabolic SAR scalping indicator. This is a trend based scalping system so this forex trading system works best in trending market environment. Setting Up Your Chart. It is easy to interpret because whenever the parabolic SAR goes upward, it means the market is on a downtrend and vice-versa for a downtrend. This is a system that works on a minute timeframe […] It is of great help in strong markets and can significantly benefit active traders who seek a high-sensitivity indicator that can generate multiple buy and sell signals per trading session.

Time Frame 15 min. Parabolic Sar Trend Forex Scalping Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye. It gives an edge to the trader by indicating the direction the underlying is moving. By using these strategies we are able to get help from parabolic indicator that is also related to MT4 trade system.

- Recommended Brokers!

- se puede hacer dinero con forex!

- financial advisor stock options?

- lynda forex trading.

- How to Use the Parabolic SAR Indicator to Trade the Trend!

- forex rates pk!

Parabolic SAR is a trend following indicator and is also popularly used among traders to set trailing stop losses. The primary thought of this strategy is to facilitate crafted by stocks and different organizations that are finished by the mathematical or calculation of the trade which peruses the data and gives us a definite thought regarding the appropriate season of trade and which will give clients more benefit.

Technical Information

The following guage works together with H1 Charts and for that reason, available a great H1 Chart, shrink or move out relating to the charge rungs to suit several rungs as they can together with fix on that EA. Wilder found that the default value of 0. The indicator is a series of dots placed above or below the price bars. Share on Facebook. Once you have set your indicators, you need to add some lines to your chart that will help you interpret and act on the signals they give you: Add two RSI lines, at the 66 and 34 levels. You can use it on higher time frames as well for position or swing trading.

For example, the best Parabolic SAR settings for scalping will likely need more reversals than a long-term, trend-following style — thus, a scalper may find a higher AF more appropriate.

Looking for a strategy for setting and combining parabolic indicators for scalping trading or long-term trading. It offers scalpers an opportunity to identify many contrarian trading opportunities throughout each day.