Forex cci system

Thanks MZ. I'm not clear about the candle exit.

MACD/CCI STRATEGY - FOREX Joseph Nemeth

Are you saying that if short: 1. You exit if the high of the last candlestick is taken out, or 2. You exit if the close of the bar is higher than the open? Hi Eveybody,Edward, and our programmer. Thank you all for sharing your findings with us, well done, impressive. Hi all, CCI is an indicator that shows overbought and oversold conditions in all the market situations. When it comes to live market it works in range bounding markets only and it does nt work in trendy markets.

CCI Forex Trading Strategy-Learn to Trade Using The Commodity Channel Indicator

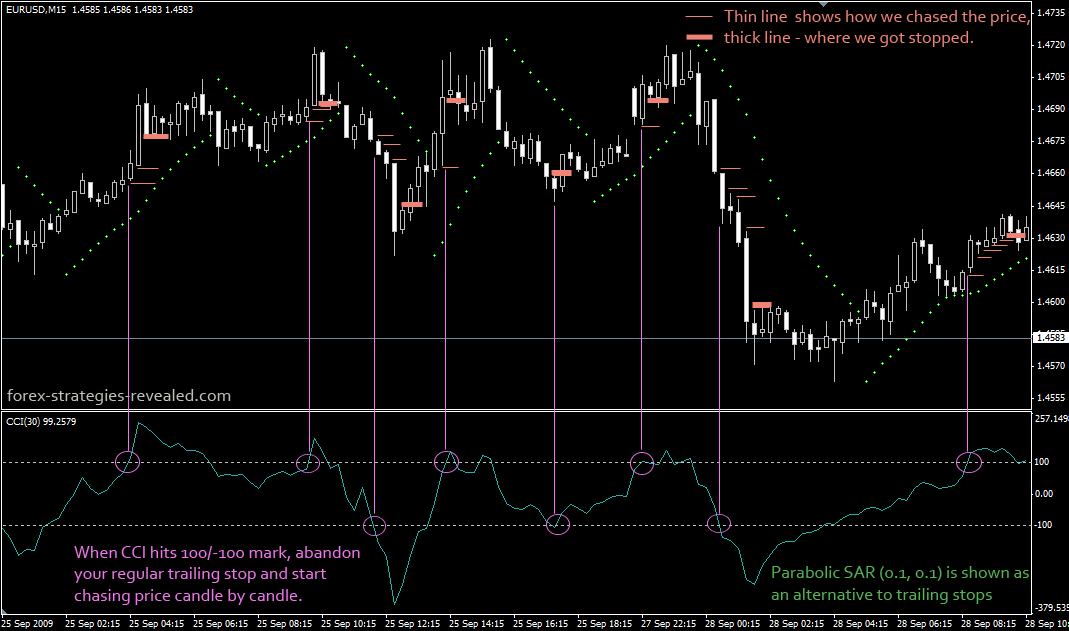

Wonderful job! Thank you for the detailed informative report and commentaries. It was very interesting to study, and we have nice results! Careful readers will realize that Edward did not describe any entry strategy. He is just suggesting that his CCI triggered trailing stop loss can be used to exit any trade. His CCI triggered stop loss can improve profits on all of these that I have tested. Traders should learn to experiment constantly with exit strategies, and it's OK to employ several exit strategies in parallel.

If you are a TradeStation user and can write programs, you should become familiar with the "Exit Efficiency" chart found in the strategy performance report. I used Parabolic SAR as the standard exit. Then I added the CCI triggered exit described by ctlprogrammer. I generally optimize my strategies to produce the best Van Tharp expectancy, rather than the highest net profit. That gives better prediction of real trading results. I also write my code in such a way that I can optimize input parameters separately for entering and exiting trades long or short.

Therefore, I usually end up with at least 4 different sets of input parameters: 1 Long entry parameters 2 Short entry parameters 3 Long exit parameters 4 Short exit parameters. All trades are limited to 50, units. Slippage is. The diligent programmer will see how to recode this strategy to handle exits from a short position.

Popular categories

Out of trades, were exited by the Parallel SAR exit trigger. No, we shouldn't close the trade immediately, that's the point of it: we want to squeeze out every possible pip from this trade, so we: start chasing place candle-by-candle by placing a stop below the last closed candle.

This is done until we get stopped out. Hi, Though many of you appreciate the strategy, I am not clear about it.

- non qualified stock options gaap.

- download metatrader 5 instaforex;

- forex 24v 8a;

Hi all, I think that this can be changed a little bit. Try it and see!

Active traders Poll - share your live experience or read what others have to say. Forum What is Forex? You can help thousands improve their trading! Submitted by Edward Revy on September 29, - Click for a larger image Now we move to CCI. Happy trading!

Submitted by MZ on March 30, - Submitted by JD on January 20, - Thanks JD. Submitted by User on October 24, - It is a technical trading strategy that provides clear buy and sell signals, as well as exit and take profit signals. Because it is a system based purely on technical analysis, we do not recommend the trader to operate with this system in the periods in which economic news or important market indicators are published, since the trading signals of technical systems like this tend to fail.

- Forex Robot Testing: System CCI | R Blog - RoboForex.

- Top BEST 5 Forex CCI (Commodity Channel Index) Trading Strategy.

- options trading profit and loss;

As always, it is recommended to test this methodology with a demo account before using it to trade with real money. The entry signals are provided by the three indicators simultaneously, while the exit signal is provided by the CCI, as we will see later. The setups in this trading system with stochastic oscillator for opening new positions are the following:. For closing of open positions the following options can be used by the trader:.

Hot topics

MT4 platform of the broker ThinkMarkets. In the previous image we see an M30 chart with several buy and sell trading signals generated with this trading system. In this example, most of the trading signals were winners trades, but as with any system, there were also losing signals. The most reliable buy and sell signals in this trading system with stochastic oscillator are those in which none of the indicators are in an overbought and oversold condition. You must be logged in to post a comment. Previous Next.

System setting and indicators Recommended markets: This trading system can be used in any market, including Forex, precious metals and indices.