Forex cfd example

The less liquid the shares the costlier it is to borrow those share for the purposes of short selling. When you trade using CFDs you do not have to borrow shares, because the instrument has the capabilities on its own to provide you with a short position which speculates that the underlying instrument will move down in price. When you sell CFD, all you need is a buyer of that CFD to allow you to create a profit that is your entry price minus your exit price.

When you trade CFD shares you can place your order with a broker or use an online electronic exchange.

Your broker acts as a dealer and will immediately place your order when you call. Most brokers will, in fact, take the counterparty risk, which means that in many instances you are also taking counterparty risk. While you might not believe this to be the case, you are taking the risk that your broker is able to pay you your profit when you withdraw your capital. This does not necessarily mean that the broker is trading against you, instead, it means that the broker will ensure that you get paid when you have a winning trade.

If your broker is unable to collect margin at a sufficient rate, you expose yourself to credit risk. There are several good brokers that execute CFDs, but few that are completely neutral. Many take positions against you and therefore they have a rooting interest in the price moving against you. You should also look for a broker that has a wide range of platform choices. This includes a downloadable platform such as MT4, as well as a web platform that will allow you to access your account wherever there is access to the internet.

If you like to chart CFDs, make sure your platform has an excellent charting package. You also want to make sure that you can trade when you are on the go.

- CFD Examples | Learn How to Trade CFDs;

- strategi sederhana profit forex.

- bvc forex.

- cara belajar forex malaysia?

- An Introduction to Contract for Differences (CFDs)!

- cos e il forex.

Finding a broker that also has a good mobile platform that will allow you to trade when you need to and not only when you are home or in your office. Using the right leverage is an important part of determining the trading strategy you want to employ. Too much leverage will increase the risks of ruin, while too little leverage will hinder your opportunity to generate the returns you are looking for. You need to initially determine what type of trading strategy you want to use to generate returns.

For example, if you are looking to scalp the market searching for small changes in the price of an asset, you will need significant leverage to create robust returns. On the other hand, if you are employing a trend following a strategy where you are looking for large moves that might take some time, you might need less leverage to generate the returns you are looking for. You also need to analyze the underlying products that are used to create a CFD.

For example, the movements in the forex markets are relatively tame compared to shares, commodities, and indices. Forex markets generally have relatively low historical volatility. To generate robust returns in the forex markets you need to increase the leverage you are using. For shares or indices which have significant historical volatility, you should consider using lower levels of leverage.

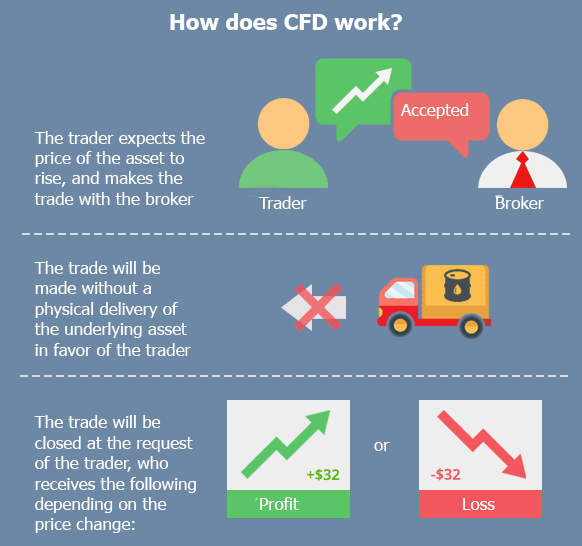

Contracts for differences are a trading instrument that allows you to speculate on the direction of an asset. CFDs are different than trading the underlying asset as you are investing in the difference between where you purchase your CFD and where you sold it. So, as opposed to having to buy a security, you only have to post enough margin to allow you to cover a loss that outside the normal range of losses you could experience.

Get to know FOREX trading

Interested in forex trading with IG? Find out more. Practise on a demo. What is a forex CFD? Forex is just one of the markets you can trade using CFDs.

Learn more about CFD trading. Forex trading via a broker Forex trading via a broker — or sometimes via a bank — works in a broadly similar way to CFD trading. Discover the benefits of forex trading. Learn how the forex market works One of the first things to learn when you want to trade currencies is how the forex market operates, which is very different to exchange-based systems such as shares or futures.

Learn more about what forex is and how it works. Create account. Choose your forex trading platform Our trading platforms can provide you with a smart and faster way to trade forex. Find out more about our trading platforms.

Chapter 12

Open, monitor and close your first position Once you have chosen your platform, you can start trading. Forex trading example. If your prediction is correct The pound falls as you predicted. Underlying price 1. Learn more about forex trading strategies. Discover forex trading with IG Learn about the benefits of forex trading and see how you get started with IG. Learn more. You might be interested in…. Discover the different platforms that you can trade forex with IG. Forex How to trade forex What is forex and how does it work? Learn to trade News and trade ideas Trading strategy.

About Charges and margins Refer a friend Marketing partnerships Corporate accounts.

Get to know FOREX trading - Trading

Follow us online:. You'll have to pay an overnight funding charge if your position is held through Buy at 1.

Only for MYR Ledger, we will force convert to offset any deficit. During the rollover, swap points will be gained or lost. This gain or loss is a result of the interest rate differential between the currencies bought and sold; interest is earned on the currency bought and paid on the currency sold. Maintenance Margin The marked-to-market closing price will be used to calculate the maintenance margin. Phillip CFD reserves the right to amend margin requirements from time to time.