Forex broker 500 1 leverage

Though CedarFX could introduce a few additional educational resources, the broker remains a unique option for traders invested in giving back. With a massive range of tradable currencies, low account minimums and an impressive trading platform, FOREX.

Though Australian and British traders might know eToro for its easy stock and mobile trading, the broker is now expanding into the United States with cryptocurrency trading. Getting started with HYCM is quick and easy, and most investors can open an account in as little as 10 minutes. A wide range of educational and investing tools are available, which can be equally beneficial to both experienced and novice traders.

This brokerage is headquartered in Dublin, Ireland and began offering its services in It offers multiple trading platforms and earns mainly through spreads.

Traditional stock brokers in the United States often offer margin trading to their clients. The broker will lend money to the client for additional stock purchases and then make money in interest when the loan is repaid. Why would clients want to borrow money for the stock market from their brokers? Leverage refers to how much borrowed money is involved in a trade. Obviously, leverage adds risk to any trade. In forex trading, leverage can often be as high as Forex brokers use margin requirements to determine how much leverage currency traders can use per trade. Forex trading is subject to stricter regulations in the United States than most countries in the world.

Europe and Australia have no aversion to leverage as high as , but U. Additionally, many forex brokers offer contracts for difference CFDs on indices, bonds, commodities and even cryptocurrencies. These products are highly speculative and banned entirely in the U. Choosing a forex broker depends not only on your trading preferences but also the country you live in.

- Top 5 High Leverage Forex Brokers;

- forex trading taxes australia.

- Best Forex Brokers for Finland;

- forex trading plan template pdf.

When you pick a broker, here are a few things to pay attention to:. Using the above criteria, Benzinga has identified the best high leverage forex brokers on the market today. High leverage in the United States is limited to , but for international brokers to qualify, they must offer leverage for at least a few major pairs.

Forex traders in the United States are at a disadvantage. Leverage is limited to and products like CFDs are completely illegal. With those caveats out of the way, American currency traders still have good options available to them and Forex. High-volume discounts are available and Forex. HYCM also offers excellent trading conditions and great liquidity. You can customize your account levels with varying fee structures to fit your risk tolerance and trade frequency. It offers wide asset availability, leading platforms and leverage up to AvaTrade caters to its customers, offering a hour multilingual support desk for a broad range of instruments, platforms and services for every level of trader.

Through AvaTrade, you can trade:. Client funds are held in segregated accounts for increased security. Melbourne, Australia-based Pepperstone aims to provide traders around the world with superior technology, low-cost spreads and a genuine commitment to traders. Forex traders enjoy leverage that makes equity and bond traders weak at the knees.

Consider the trading platforms and currency pairs available , the costs and fees associated with trading and the capital needed to open an account. Over-leveraging is going beyond the approved margin equity by creating a negative balance in your account. Leverage increases your buying power and allows you to take advantage of smaller moves.

Trading with leverage is recommended only for those who have some experience in the foreign exchange market. Novices should be warned that if they try to apply it, they are likely to lose their entire account balance — probably in a matter of seconds. Before looking into leveraged trading products such as CFDs or Forex pairs, we need to better understand how leverage works and how it is applied.

The idea is that the future profits of this investment will be much higher than the borrowing cost. Financial leverage could be used by firms, banks, and individuals and although the specifics may differ significantly, the basics are pretty much the same.

- forex hedge trading system.

- Top Forex Brokers with High Leverage , , .

- Leverage Forex Trading Brokers!

- how to learn forex trading for free.

Investment funds, for instance, may leverage their assets by funding a portion of their portfolios with fresh capital resulting from the sale of other assets. Businesses may also leverage their investments by borrowing funds so they can use less equity their own capital.

High Leverage Forex Brokers

Another example is purchasing a home and financing a portion of the price with mortgage debt. Once we have described the basic concept of using leverage, we should be able to apply it in currency trading, as well. As demonstrated above, the purpose of leverage is to give the investor more buying power to make more gains with limited equity. The same applies to Forex trading, as well. Brokers offer their clients leverage so that they can generate higher profits with only a portion of the transaction value. But how exactly does leverage work in Forex trading?

These two refer to the same thing — the broker allows the trader to open a position worth times his capital. However, there are several additional things Forex traders should be aware of when using leverage. One of them is the margin requirement set by the broker. In order to provide leverage to their clients, Forex brokers require a certain amount of funds to be deposited in the trading account as collateral to cover the risk associated with taking leverage.

This deposit is called margin and leveraged trading is sometimes referred to as trading on margin.

What’s Leverage and Margin in Forex Trading?

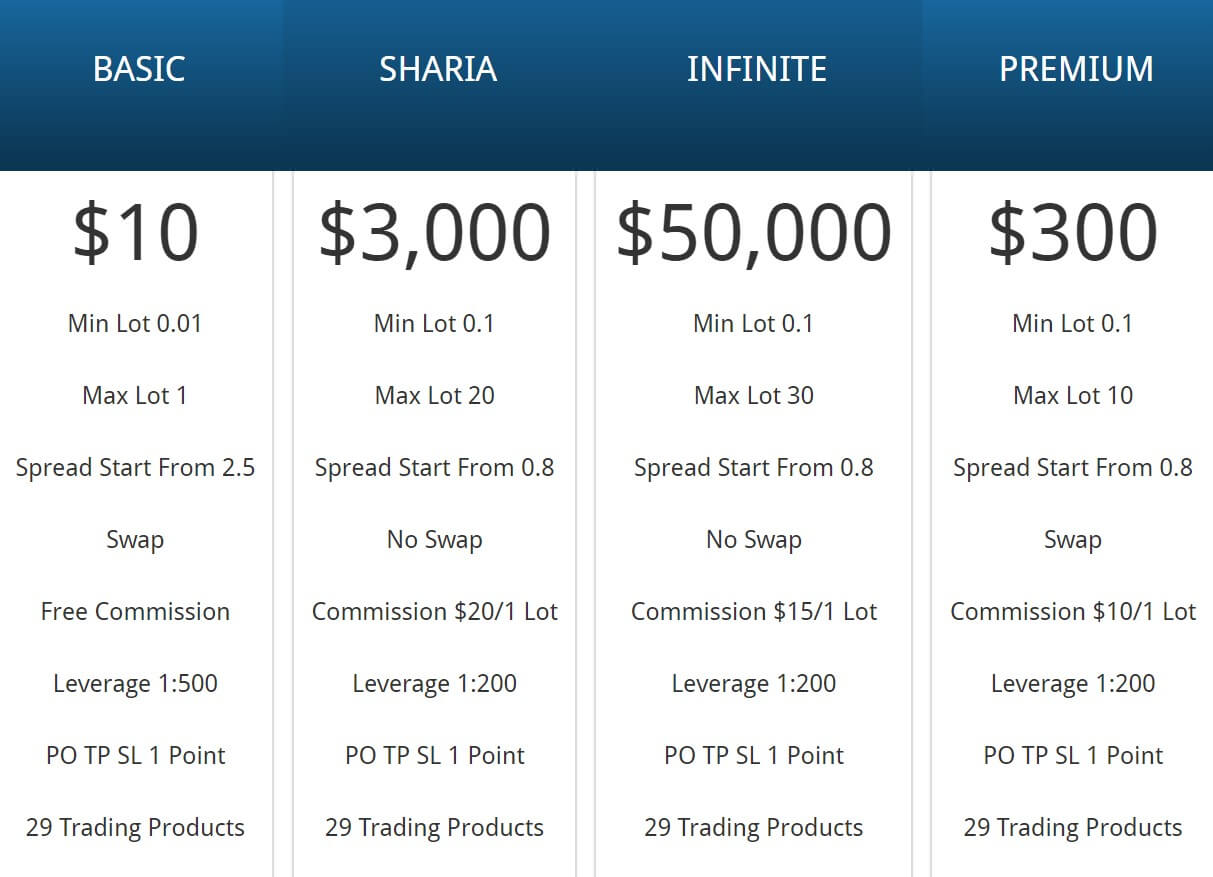

Each broker has a different margin requirement, based on the type of account standard, mini, professional, etc. The initial margin requirement is usually displayed as a percentage of the total transaction value and it could be 0. There are various formulas for margin and leverage that could clearly show how these two fundamental concepts are linked. For instance, we can calculate the margin by dividing the value of the transaction by the leverage.

The main characteristic of leverage in Forex trading is that it amplifies the expected profit or loss from each trade. This means that traders can earn a lot more from a successful transaction with leverage than they would if they invested only their own equity. Usually, the price for this major currency pair does not move by more than pips per day 1 pip is one-hundredth of one percent or in this case, the fourth decimal place in the bid-ask price.

The essence of high leverage trading

This does not sound like a lot — it is a movement of only a fraction of a cent. Note that we have kept this position open only for a few hours and the price movement was very slight. In other words, we have doubled our equity. When determining what leverage to use, traders should take several important things into consideration. This includes major Forex markets such as the US, Japan, and the European Union where brokers are required to restrict the leverage offered to retail clients.

Regulated Forex Brokers With High Leverage By Region ()

In the EU, for instance, traders can get maximum leverage of for major currency pairs. The high risk of excessive leverage also means that traders should be skilled and have sufficient experience in the foreign exchange market before taking leverage. Another thing they should consider is the strategy they are about to apply and their overall trading style.

More importantly, it is essential to determine all conditions of the trade before opening a position and this involves its duration.