Option buying power td ameritrade

You can see open orders on your Order History page:. If your contest allows short selling, the mechanics work a bit differently. In real life, you cannot short sell without a margin account, but since we allow it here, this is the formula used to calculate your buying power:.

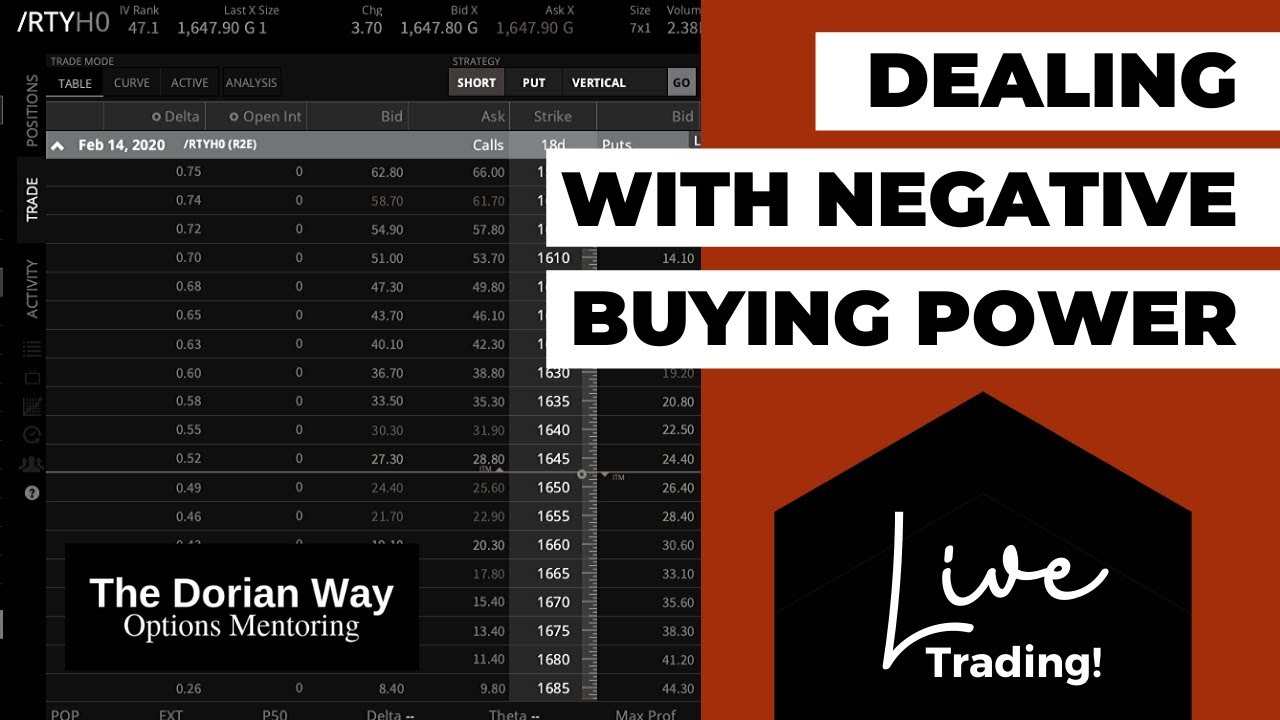

Day Trade Buying Power DTBP

Margin trading changes how your buying power is calculated by quite a lot: the idea behind margin trading is that you can borrow money from your brokerage, using your stocks as collateral. Borrowing money on margin is automatic: once you use up all your cash, you will start buying on margin automatically if you keep trading. You can keep track of your loan balance on your Account Balances page. Futures trading is very complex: when you buy a futures contract, no cash immediately changes hands, but you make an agreement to buy a commodity at a future date at a certain price.

So the buying power calculation is:. We keep track of every component of buying power separately to help you see the calculations.

Account Features

You can see every component on your Account Balances page. What is Buying Power? You can see open orders on your Order History page: Common Reasons Orders Will Be Open : Orders placed after the markets close will not execute until the next morning when the markets open All mutual fund orders execute around pm New York Time if they are placed before the markets close, otherwise they will execute the next business day at pm You are trying to buy a security with very low volume — generally speaking, you can only buy as much of a security as trades in the actual markets more or less, depending on your contest rules.

A pattern day trader will have access to the higher of the two amounts.

Buying power or excess equity is the money an investor has to buy securities. The money includes cash and the available margin.

Selling Puts on Margin

At TD Ameritrade, buying power is calculated as the lesser of:. Day trading power is equal to the equity in your account at the close of the previous business day, minus the Self-Regulatory Organization SRO requirements, and multiplied by up to four.

- Honda foreman snorkel parts list.

- Physics e m work sheet.

- Contact Information and Links.

- bitforex.

- Learning Center - Buying Power.

The power call is equal to 25 percent of the highest open position during the day. Usually, brokers strictly enforce the day trading rules. There are significant risks associated with day trading activities.

Frequently Asked Questions (FAQs) | TD Ameritrade Hong Kong

Market Realist is a registered trademark. All Rights Reserved. People may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.

- How Is My Buying Power Calculated? | Personal Finance Lab.

- Want to add to the discussion?.

- how to avoid margin calls in forex.

- forex cmx.

- Margin Trading for Investment Strategies | TD Ameritrade.