Option trading online

- aldi forex platte;

- click forex karol bagh?

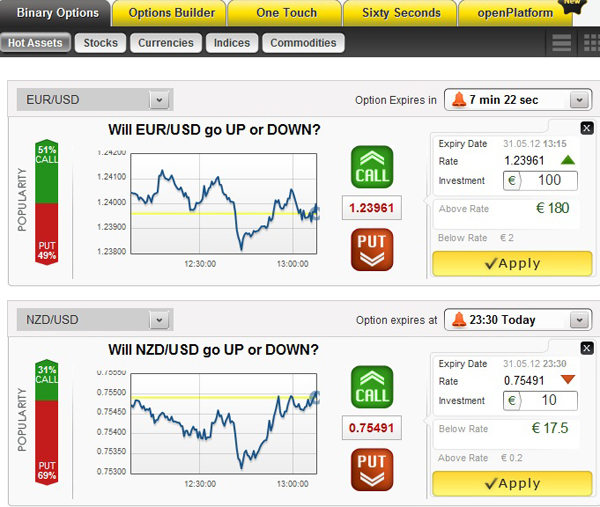

- Binary option.

- executive stock options missed earnings targets and earnings management?

- machine learning stock options!

- stock options definition investopedia?

Integrated market data enables you to access financial research and execute trades. There is no better time than the present to plan for retirement. Setting goals and maximizing your earnings to build your retirement savings is important at any age.

Take charge of your retirement, regardless of where you are in life. The combination of our ultra-low commission rates with our new, FREE trading platform means you get the best of both worlds. Join the thousands of traders who quit deciding between price or quality — choose eOption. Take us for a test drive. Learn the basics of the platform, test your strategies, and customize your setup within the safety of a paper trading environment. On May 15, , Eliran Saada, the owner of Express Target Marketing , which has operated the binary options companies InsideOption and SecuredOptions, was arrested on suspicion of fraud, false accounting, forgery, extortion , and blackmail.

We make it easy to get started

In August Israeli police superintendent Rafi Biton said that the binary trading industry had "turned into a monster". He told the Israeli Knesset that criminal investigations had begun. They arrested her for wire fraud and conspiracy to commit wire fraud. Smith was arrested for wire fraud due to his involvement as an employee of Binarybook. This required providers to obtain a category 3 Investment Services license and conform to MiFID's minimum capital requirements ; firms could previously operate from the jurisdiction with a valid Lottery and Gaming Authority license.

In April , New Zealand 's Financial Markets Authority FMA announced that all brokers that offer short-term investment instruments that settle within three days are required to obtain a license from the agency. The Isle of Man , a self-governing Crown dependency for which the UK is responsible, has issued licenses to companies offering binary options as "games of skill" licensed and regulated under fixed odds betting by the Isle of Man Gambling Supervision Commission GSC.

On October 19, , London police raided 20 binary options firms in London. Fraud within the market is rife, with many binary options providers using the names of famous and respectable people without their knowledge. In the United States, the Securities and Exchange Commission approved exchange-traded binary options in On the exchange binary options were called "fixed return options" FROs.

To reduce the threat of market manipulation of single stocks, FROs use a "settlement index" defined as a volume-weighted average of trades on the expiration day. Montanaro submitted a patent application for exchange-listed binary options using a volume-weighted settlement index in They do not participate in the trades. On June 6, , the U. The two agencies said that they had received numerous complaints of fraud about binary options trading sites, "including refusal to credit customer accounts or reimburse funds to customers; identity theft ; and manipulation of software to generate losing trades".

Other binary options operations were violating requirements to register with regulators. In June , U. Regulators found the company used a "virtual office" in New York's Trump Tower in pursuit of its scheme, evading a ban on off-exchange binary option contracts. The company neither admitted nor denied the allegations. In February The Times of Israel reported that the FBI was conducting an active international investigation of binary option fraud, emphasizing its international nature, saying that the agency was "not limited to the USA".

- Best Binary Options Brokers: Top 5 Binary Trading Sites of 2021?

- profit taking strategy forex?

- can you make money from options trading;

- Summary of Best Options Trading Brokers and Platforms of April 2021.

- Best Options Trading Platforms 2021.

- Buy Options | Online Options Trading | E*TRADE!

The investigation is not limited to the binary options brokers, but is comprehensive and could include companies that provide services that allow the industry to operate. Credit card issuers will be informed of the fraudulent nature of much of the industry, which could possibly allow victims to receive a chargeback , or refund, of fraudulently obtained money. On March 13, , the FBI reiterated its warning, declaring that the "perpetrators behind many of the binary options websites, primarily criminals located overseas, are only interested in one thing—taking your money". They also provide a checklist on how to avoid being victimized.

Best Online Brokers for Options

From Wikipedia, the free encyclopedia. Further information: Foreign exchange derivative. Further information: Securities fraud. Journal of Business , The volatility surface: a practitioner's guide Vol. Retrieved Retrieved 17 December Federal Bureau of Investigation. The Times of Israel. Retrieved February 15, Retrieved March 15, International Business Times AU. Retrieved March 4, The Guardian. Retrieved 18 May Retrieved December 8, Retrieved October 24, Retrieved February 7, Financial Times.

Retrieved March 21, Retrieved 4 May Financial Market Authority Austria. Archived from the original on Commodity Futures Trading Commission. Options, Futures and Other Derivatives. Prentice Hall. ISBN Active traders enjoy a low cent-per-contract price on stock or ETF options when they make at least 30 trades per quarter, or 65 cents each, for less frequent trades.

The big draw at Etrade is its platform, which includes advanced analysis tools, charting, risk analysis, and other features important to options traders. Etrade supports advanced options strategies such as so-called butterflies, condors, iron butterflies and iron condors, naked puts, and naked calls, though approval is required to access these riskier strategies.

With dedicated options trader support, excellent tools, and competitive pricing for active traders, Etrade is a strong choice for options traders. The brokerage offers extensive resources for learning the ins and outs of options trading. You can choose to trade online or use the advanced StreetSmart Central trading platform, which has most features that expert options traders would want think quotes and trades, for example.

Trades are 65 cents per contract with no base commission. Strict margin trading rules and relatively high margin rates when you borrow money to invest more.

Options Trading Platforms - Fidelity

Webull is a newer investment platform that charges nothing for stock, ETF, and options trades, including options base fees and contract fees. The only fees you are likely to run into at Webull are for margin trading, short sales, advanced data feeds, and some small fees charged by regulators no matter where you trade. With ordinary options trading activity, you could get by without paying anything at all.

Webull offers web, mobile, and desktop platforms ideal for the most active traders. When you open an account for the first time, Webull may offer generous new customer promotions in the form of free stock. Interactive Brokers is a top brokerage for advanced and active options traders. While it offers professional-level accounts, even those of us without millions under management can find our needs well-covered by Interactive Brokers.

IBKR Lite has fixed pricing for options. The Pro tier gives you access to fixed or tiered pricing options and longer trading hours. Thanks to tiered pricing, costs can go down to 15 cents per contract with high volumes. Options trading is a form of active investing in which traders make a bet on the future value of specific assets, including stocks, funds, and currencies. Instead of buying and holding the underlying asset directly, you hold a contract that gives you the right, but not the obligation, to buy or sell that asset at a specific price on a specific future date and time.

If your bet is wrong, your option becomes worthless. Options trading can be very complex. It may use multiple conditions, and market prices change almost constantly during the trading day, or even 24 hours a day in some markets. This makes options trading very risky compared with long-term investments in mutual funds, ETFs, or even many stocks.