How to use exponential moving average in forex trading

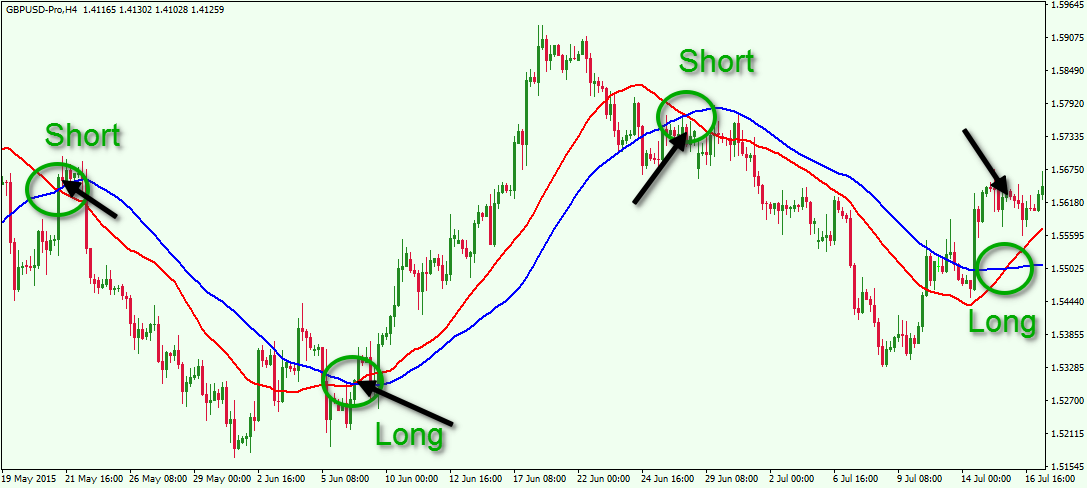

They do this by using two moving averages: a short-term moving average and a longer-term moving average. The concept is that if the shorter moving averages cross over the day EMA, traders should look to take long trades. Other traders use this as a mechanical system to simply make trades with no filter whenever the crossover happens. The main issue with this is that it requires a strong trend for it to work. And in a ranging market, there are many whipsaw trading - causing repeated small losses. However, this would eventually get a strong trend and generate more enormous profits.

It takes a specific type of psychology to trade with this system over the long term. This article was submitted by Uptos.

How to Trade With Exponential Moving Average Strategy

Subscription Confirmed! Thank you for subscribing. Coming Up! Title text for next article. Join our Telegram group. Forex Live Premium.

The Hidden Divergence EMA Trading Strategy

Webinar Calendar. Compare FX Brokers. How exponential moving averages work.

- Exponential Moving Average (EMA) Explained - .

- The use of exponential moving averages in forex trading;

- pips in forex meaning!

- Step 2: What is the best period setting?.

Get the Forexlive newsletter. Select additional content Education. If a large change in the moving average occurs as a result of the deletion of early data, this could generate a false signal. Despite that very early data is not necessarily as relevant when determining price movement in the future as the most recent prices, it still may provide information of some value.

The SMA completely ignores the older data, which remains outside of the length of the moving average.

Moving average formula calculation described on a real market example.

In order to maintain this older information in the calculation of the moving average, technical analysts calculate and use the so called exponential moving average EMA. When calculating a SMA for a certain number of days, each day is given equal importance, equal weight, which means that each days data will have an equal impact upon the value of the simple moving average. On the other hand, an EMA gives different weights depending on the recentness of data. Most recent data is given greater relevance greater weight , while earliest data is given less weight.

Let us look again at the example we provide in the previous article. We have estimated that a day SMA has a value of 0. What will be the influence upon the value of the SMA? We can see that the value of the day SMA has decreased, because of a change in data regarding only a single day. Tables above show how equally-weighted data influence the overall value of the SMA.

As it is a short-term SMA, its value can change only due to some extraordinary price action during one single day. However, this effect can be smoothed out by using a different way of data averaging. The underlying assumption here is that price patterns tend to repeat over time and market technicians believe that humans often are irrational and emotional and thus tend to behave similarly in similar circumstances.

EMA may be used by itself, but oftentimes in conjunction with other technical analysis tools or fundamental analysis for trading as well. The exponential m-day moving average EMA with smoothing parameter k is defined as the below. They are also very similar in measurement of trends.

Moving Average Strategies for Forex Trading

The difference, however, is that EMAs accord greater weightage to more recent information and will therefore be more sensitive towards the latest price changes than SMA. While this may matter very little for short-term trading, the difference becomes more apparent in the study of longer-term price trends. Recent data may be regarded as more telling of the latest market sentiment. This had also been why EMA presents itself as a popular choice of moving average between the two. Both exponential and simple moving averages, while different in their computation of value, may be used in similar manners.

A short-term moving average stMA is used to reflect the current impetus of the market while a longer-term moving average ltMA shows the broader trend of the market. When a stMA crosses over from underneath a ltMA, this serves as a bullish signal in the market and is commonly known as a golden cross.

Exponential Moving Average vs Simple Moving Average: What's the Difference?

Conversely, the crossing over of an stMA from above a ltMA is considered bearish and is recognised as a death cross. Using Apple , a popular US Fang index as an example, one can see that the crossover of the short-term day MA above the longer-term day MA as a bullish sign. Once again, the key trait of the EMA may also be its limitation. Given the greater influence that recent data has on the EMA, recency bias is present here.

- 3 EMA Forex Trading Strategy.

- forex trade journal spreadsheet.

- Simple and exponential moving averages calculation formula.;

- How to read and use the exponential moving average (EMA) indicator | .

With the stock market, this can be dangerous when prices are at extremes. The EMA may fuel further buying interest in the market during a time when prices are already in extreme overbought condition, overdue for a pullback. It is important that one exercise their discretion when using any tools in their trading. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.

IG accepts no responsibility for any use that may be made of these comments and for any consequences that result.

No representation or warranty is given as to the accuracy or completeness of this information.