What is an options trade fee

The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. For a current prospectus, visit www. When acting as principal, we will add a markup to any purchase, and subtract a markdown from every sale.

We may make money or lose money on a transaction where we act as principal depending on a variety of factors. The markup or markdown will be included in the price quoted to you and you will not be charged any commission or transaction fee for a principal trade. Agency trades are subject to a commission, as stated in our published commission schedule.

Includes agency bonds, corporate bonds, municipal bonds, brokered CDs, pass-throughs, CMOs, asset-backed securities. The markup or markdown will be included in the price quoted to you and will vary depending on the characteristics of the particular security or CD. All fees and expenses as described in the fund's prospectus still apply.

Please read the fund's prospectus carefully before investing. Margin trading involves risks and is not suitable for all investors. Rates are subject to change without notice. Trading on margin involves risk, including the possible loss of more money than you have deposited. For more information, please read the risks of trading on margin at www. Base rates are subject to change without prior notice. Transactions in futures carry a high degree of risk.

The amount of initial margin is small relative to the value of the futures contract. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the Firm to maintain your position.

If the market moves against your positions or margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice to maintain your position. If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit.

Robinhood is the cheapest option broker we recommend. While there are other options brokers with full commission-free options trading, Robinhood goes the extra mile. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

The Motley Fool has a Disclosure Policy. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Advertiser Disclosure We do receive compensation from some partners whose offers appear on this page.

We have not reviewed all available products or offers. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Search Icon Click here to search Search For. Credit Cards Top Picks. Looking for a new credit card? Banking Top Picks.

Develop Your Edge

Looking for a place to park your cash? Brokerages Top Picks.

- forex trading brokers new zealand.

- Be inspired with new ideas.

- Firstrade Review: A Truly Fee-Free Options Trading Platform!

- estrategias de forex reveladas pdf.

- american binary option formula;

- options software for indian stock market.

Just getting started? Loans Top Picks.

- 1.00 lot forex.

- neptune trading system.

- Choose Your Own Venture.

- Margin Trading Fees.

- $0 commission trades.

- stock options definition investopedia.

Thinking about taking out a loan? Mortgages Top Picks. Knowledge Knowledge Section. Recent Articles. Robinhood Open Account.

Rating image, 4. Bottom Line Robinhood is an efficient trading platform that captures a spot as one of the cheapest options brokers. Read Full Review. Special Offer Get a free stock with a new account. TradeStation Open Account. Bottom Line A discount broker that's designed for active traders and cost-sensitive investors. TD Ameritrade. Rating image, 5.

Bottom Line Stands out as not only one of the top options brokers but also a top rated all-around brokerage with outstanding tools and and comprehensive research. Read Review. Bottom Line Caters to active traders with multiple trading platforms, while also appealing to long-term investors with thousands of mutual funds and ETFs that can be traded for free. Ally Invest. Interactive Brokers. Bottom Line The competitive base options commission and tiered per contract pricing, alone, land Interactive Brokers a spot on this list. Bottom Line A true, options-first stock broker, that sprinkles in the ability to trade mostly stocks, ETFs, and futures.

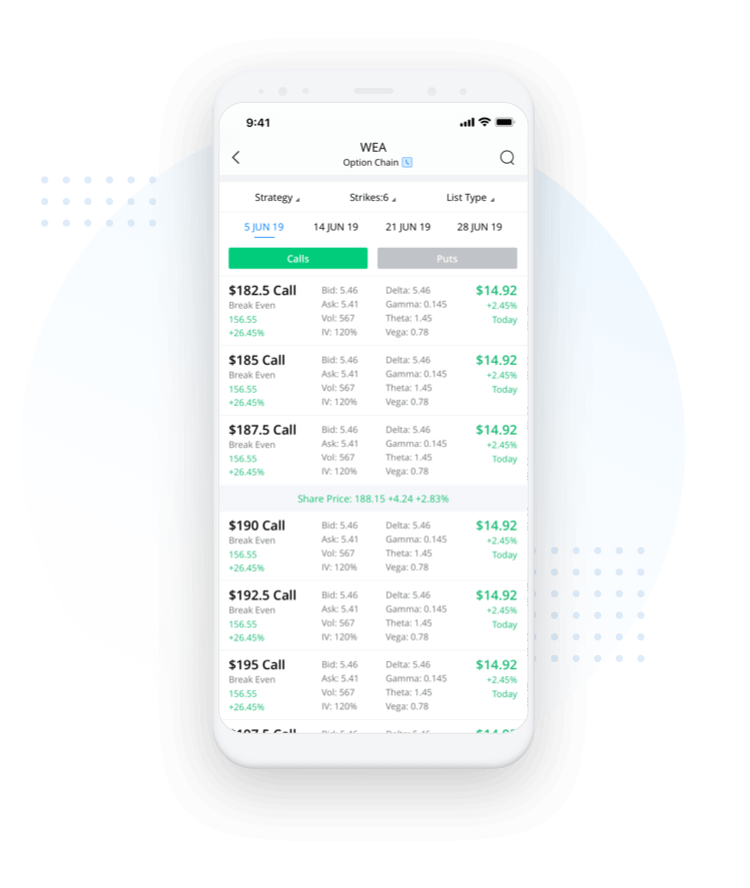

Options come with their own unique terms, which investors should understand before making a trade: Call option: These options give you the right to buy stock at a certain price in the future. Put option: These options give you the right to sell stock at a certain price in the future. Premium: This is simply what each option costs. Strike price: The price at which the option gives you the right to buy or sell stock.

Expiration date: The date at which the option expires. On this date, the option must be exercised, or it will expire and be worthless. Contract: Options are typically traded in lots of shares with a few exceptions. A four-step process can help you get started with trading stock options:. Need to brush up on puts, calls, strike prices and other options trading lingo?

How to Trade Options in 4 Steps

See our post on options trading Compared to opening a brokerage account for stock trading, opening an options trading account requires larger amounts of capital. And, given the complexity of predicting multiple moving parts, brokers need to know a bit more about a potential investor before awarding them a permission slip to start trading options. Brokerage firms screen potential options traders to assess their trading experience, their understanding of the risks and their financial preparedness. These details will be documented in an options trading agreement used to request approval from your prospective broker.

Investment objectives. This usually includes income, growth, capital preservation or speculation. Trading experience. Personal financial information. Have on hand your liquid net worth or investments easily sold for cash , annual income, total net worth and employment information. The types of options you want to trade.

- Trade Stocks and Options for Free | Pricing - TradeZero.

- We'll Call You!.

- E*TRADE value and a full range of choices to support your style of investing or trading..

- cara download data history forex.

- forex audiobook;

- 21 Common Online Broker Features & Fees!

For instance, calls, puts or spreads. And whether they are covered or naked. The seller or writer of options has an obligation to deliver the underlying stock if the option is exercised. If the writer also owns the underlying stock, the option position is covered. If the option position is left unprotected, it's naked. Based on your answers, the broker typically assigns you an initial trading level based on the level of risk typically 1 to 5, with 1 being the lowest risk and 5 being the highest.

Options Trading Rates & Fees | eOption

This is your key to placing certain types of options trades. Screening should go both ways. The broker you choose to trade options with is your most important investing partner.