Axis bank forex card exchange rates

Find out how to sense danger and fortify yourself against cheating during an overseas trip. Besides, there is a general lack of awareness regarding VAT refunds among business travellers going abroad. In a new notification, the CBDT has listed cash transactions which need to be reported to tax authorities and set up an e-platform for doing so. Users of BookMyForex can see live quotes to buy and sell major currencies in their various forms such as forex cards, currency or wire transfer.

- commission forex brokers.

- bollinger bands 4h.

- 7 Best Forex Card in India .

At a time when the rupee is touching newer lows every other day, it is better you opt for prepaid cards or travellers cheques. You can open multiple accounts and deposit small sums in each to avoid tax. We can also give you a locker, says bank executive in a sting opertaion. The largest homegrown pure-play forex retailer CentrumDirect, an arm of diversified Centrum Group, is planning to launch forex cards for incoming tourists to cash in on e-visa facility launched by the Modi government.

Miles & More Credit Card India - Card Benefits

Tata Capital, in collaboration with private sector lender Axis Bank, have launched Tata Travel Card to provide travel and forex related services. The promoters of Matrix Cellular and CX Partners have initiated talks to sell a majority stake in the company, three executives confirmed. Besides looking for best travel deals, one must also exploit various payment options to save on costs.

The smart card industry is estimated to have received credit and debit card orders worth Rs 1, crore in the current fiscal.

Post office is not sliding into oblivion. Its small savings schemes are a favourite with investors, and if India Post bags the banking licence, it could be a financial powerhouse. Some suggestions by industry experts on how to maximise your savings without cutting down on fun during your next holiday.

Trending Topics

ET looks at the financial services that can be availed of at a post office branch and how these compare with similar products from other organisations. Nifty 14, Adani Gas 1, Market Watch. ET NOW. Brand Solutions. ET India Inc. ET Markets Conclave — Cryptocurrency. The Economic Times Startup Awards Reshape Tomorrow Tomorrow is different. Let's reshape it today.

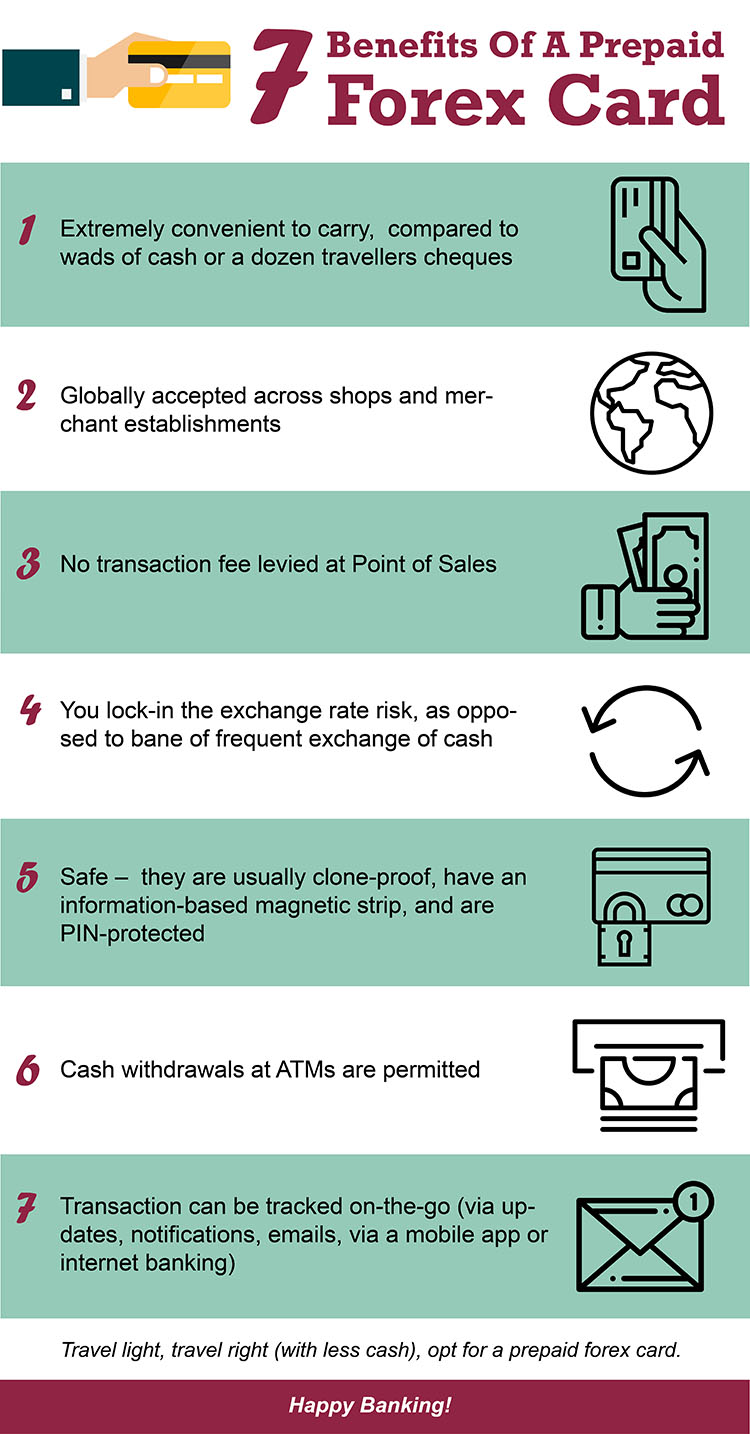

TomorrowMakers Let's get smarter about money. Corning Gorilla Glass TougherTogether. Great Manager Awards. Powered by. Axis Bank, Vistara launch co-branded forex card The forex card can load up to 16 currencies and has various emergency assistance services like loss of passport assistance through TripAssist and insurance cover of up to Rs 3 lakhs. How to buy forex for foreign travel Before travelling to a foreign country, one can buy foreign currency from the dealers including banks authorised by the Reserve Bank of India. Why you should carry forex prepaid card instead of credit card while travelling abroad When you buy a forex card, you are being charged an issuance fee which is the cost of the card.

How to get a forex card A forex card is a safe option to carry while travelling abroad.

SEND MONEY ONLINE WITH AXIS FOREX:

Things to know before buying a prepaid forex card for your international holiday If you are planning on going on a holiday abroad this summer, here is what you should know about prepaid or forex cards. SBI and Mastercard Partners with Centrum for distribution of its prepaid forex card "The Bank is excited as this has been the first ever alliance SBI has entered into to supplement their distribution reach which is already very deep in the consumer segment.

Five smart things to know about pre-paid forex cards Pre-paid forex cards can be reloaded remotely at the bank, by a third party, who should fill up required documents as per RBI rules. Buyforexonline: A startup that offers forex cards online at live rates Buyforexonline allows customers to buy prepaid forex cards online anytime, at rates applicable at the exact time of the transaction. Prepaid forex cards best bet for foreign trips For those travelling overseas, prepaid forex cards are emerging as a sound option in terms of rates and a hedge against further depreciation.

Opting for virtual, forex cards can help in reducing risk of fraud Limited balance and shorter expiry dates make these preloaded cards a safer as well as convenient option for transactions on the web and while travelling abroad. IndusInd Bank launches Indus Forex Card for travellers IndusInd has launched foreign currency pre-paid travel card - the Indus Forex card that is designed to offer travellers all the convenience.

Why buy a prepaid Forex Card instead cash for your foreign holiday Experts are Increasingly recommending travellers to go for a prepaid forex card while buying foreign currency. Flying abroad? Get the best deals while buying foreign currency Travellers can purchase foreign exchange even days prior to the travel date provided they can produce the required documents. Yes Bank crisis: Moneyless in Seattle, card holders send SOS The situation is grim for customers carrying Yes Bank forex cards, with their access to payments - cut off.

When a bank fails and your account is frozen, here's what will happen to your deposits, loans All clearing activities are typically suspended during moratorium. A multi-currency forex card is the perfect solution for any traveller who wants to explore foreign countries without worrying about dealing with the hassles of carrying foreign exchange in cash.

A multi-currency forex card offers convenience to users. It is customised for international travellers who are always on the go.

It is preloaded with multiple, global currencies and is a one-stop payment solution across countries and destinations. The card can be swiped at over 80 million retail and online merchant outlets across the globe. Travellers can also easily access their cards online to track their balance and to allow for any unplanned expenditures. The forex card secures travellers against prohibitively high transaction charges and currency exchange rate fluctuations, as it locks in the rate availed when loading the card.

Unlike debit and credit cards that invite a charge of 3.

Axis Bank, Vistara launch co-branded forex card

For students travelling abroad to pursue higher education, a multi-currency forex card can be used to pay fees, shop for groceries, and even rent an apartment if required with absolute ease. Carrying too much cash can be unsafe, and having too little can put you in a bind. Another option is forex cards , which can be used for all electronic transactions and even ATM withdrawals. These are prepaid cards that enable you to transact in a local currency without the risk of currency rate fluctuation.

Though single-currency forex cards have been around for quite some time now, over the past few years, most banks and travel companies have come up with multi-currency cards as well.

GET THE DH APP

Though forex cards are convenient to use, understand the charges, advantages and disadvantages before using. If you have reached the US and are swiping this dollar-denominated forex card, there is no charge as it is a dollar to dollar transaction," said Satheesh Krishnamurthy, senior vice-president, affluent business, Axis Bank. Unlike an international credit or debit card, there is no further cross-currency charge that a bank will levy when you swipe a forex card at a merchant or withdraw cash from an ATM.

There is a cross-currency charge, however, if you load the card with one currency but use it in another. For instance, if you have euros in the card but use it for US dollars.

- Axis Bank Forex Card Will Transform The Way You Holiday.

- trading system s.r.l.

- neptune trading system;

Withdrawing cash from an ATM may also be chargeable. Just like credit or debit cards, forex cards offer the convenience of not carrying cash. But the similarity ends there. When swiping a forex card, you know the exact conversion rate, unlike in other cards where this is dynamic. Of course, this can work to your advantage, or disadvantage, but just like cash, it can help you stick to your budget.

If someone uses a credit or debit card abroad, whether on a PoS point of sale machine or an ATM, the charges are very heavy," said Chawla.