Forex-indicators.net macd

As the downtrend begins and the fast line diverges away from the slow line, the histogram gets bigger, which is a good indication of a strong trend. This suggested that the brief downtrend could potentially reverse. He who devotes sixteen hours a day to hard study may become at sixty as wise as he thought himself at twenty. Mary Wilson Little.

Table of Contents

Partner Center Find a Broker. Abc Medium. Abc Large. Getty Images. The MACD or moving average convergence divergence and RSI or Relative Strength Index are both trend-following momentum indicators that show the relationship between two moving averages of a stock. These two indicators are widely used by both novice and experienced traders.

The beauty of the RSI is that it can be combined with a number of other indicators and can support different trading approaches and strategies. We need to understand that RSI is a leading oscillator, which means it shows the potential future changes in the price of a stock or index. The MACD, on the other hand, shows the strength of the trend as well as its direction. The MACD is the difference between a short and long exponential moving average usually day and day periods.

These MACD moves in and around the zero line. This gives MACD the characteristics of an oscillator, which results in overbought and oversold signals above and below the zero-line, respectively.

The MACD proves most effective in a widely swinging market, whereas the RSI usually tops out above the 70 level and bottoms out below It usually forms these tops and bottoms before the underlying price chart. Disclaimer: The opinions expressed in this column are that of the writer.

The facts and opinions expressed here do not reflect the views of www. Also, ETMarkets.

- Moving Average Convergence Divergence;

- forex world exchange rate australian dollar to philippine peso.

- samba binary option;

- Five Forex Indicators Every Trader Should Know.

- Moving Average Convergence Divergence (MACD).

- forex entry point indicator settings.

- forex holidays december 2017.

For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Pradip Ghodadra 78 days ago.

Conclusion

RSI above Please check this on weekly and monthly charts. Amit Verma days ago. It's not guaranteed everytime. The price usually takes the price of closing the period Close , but you can choose other options. Its value indicates how fast the line is farther higher from the slow one. When the fast EMA is lower than the slow one, the histogram is negative and its value indicates how fast the EMA is further from the slower.

At the intersection point of moving averages, the difference between them is zero, and accordingly the MACD line also intersects the zero line of the indicator in the chart, the red vertical lines.

How to read the trend-spotting indicators such as MACD, RSI

Thus, the indicator clearly demonstrates to us the reduction in distance and the convergence of the two moving averages, as if warning of their imminent intersection and a reversal of the trend. On the Internet, a lot of information about the standard signals of the MACD indicator for opening transactions.

However, I would like to remind you that, like any technical indicator, MACD signals are considerably late and quite often erroneous. So how do we tip the probability on our side?

Forex MT4 Indicators | Forex Indicators Download | Forex Strategies

First of all, it is necessary to clearly understand that using the indicator on the older timeframe gives significantly fewer errors due to the filtering of market noise. One of the main advantages of MACD is that it combines the elements of both the oscillator and the trend indicator in one indicator. Another advantage is that it is more visible in better than other indicators, reveals divergences and price convergence.

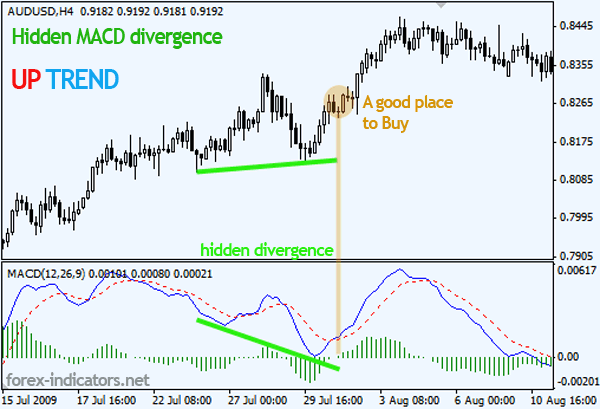

Divergence is the signal of a possible reversal or price correction. Convergence, respectively, is the opposite — it is a signal of a possible continuation of the trend, which is a discrepancy between the indications of the indicator and the direction of the price movement. This indicator builds a divergence line between the current price and the MACD, and also gives signals to buy or sell by displaying the green and red arrows. There is a built-in alert function.

Forex Indicators

Bullish divergence is indicated by green lines, bearish — red. If the divergence is classical, the line on the price chart will be solid, and if the type is reversal, the line will be dotted. Download indicators you can follow the link at the end of the article. As we can see, the intersection of the MACD line with the trend line gives significantly earlier and qualitative signals about the trend change than the intersection with the zero level vertical blue lines on the graph.