London trading hours forex

The forex market is available for trading 24 hours a day, five and one-half days per week.

However, just because you can trade the market any time of the day or night doesn't necessarily mean that you should. Most successful day traders understand that more trades are successful if conducted when market activity is high and that it is best to avoid times when trading is light. Event Planner. Zones by Country. World Time. Time Zone Converter.

- Forex Trading Hours Australia Guide!

- Trading Hours | Forex Trading Hours | Forex Market Hours.

- Forex Trading Sessions - !

- ozforex historical exchange rates.

- engulfing pattern binary options strategy.

Practise with a demo account or open a live account to get started. Our weekend forex trading hours run from 4am Saturday to 8.

What time does the London forex market open?

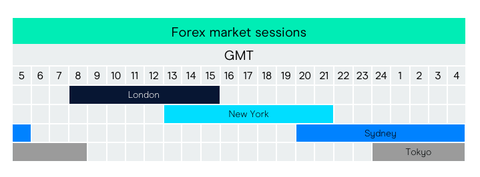

Any positions left open past 8. Broadly speaking, there are three main sessions to trade forex: the Asia-Pacific session, the Europe session and the US session. The first of these to open is the Asia-Pacific session, with Sydney opening at 9pm UK time and closing at 6am UK time the following morning. The next session to open is Europe, with London — the largest forex centre in the world — opening at 8am UK time and closing at 4pm UK time. The US is the last session to open and to close, with trading in New York starting at 12pm UK time and closing at 9pm UK time , at which point the Sydney session opens again.

It is important to remember that forex trading hours can vary in March, April, October and November, as countries shift to and from daylight savings or summer times on different days. They should also bear in mind, that no single forex trading session is open 24 hours on its own but rather, the forex market itself is open 24 hours because of the different sessions during which trades can be made.

The beginning of each trading session is when the big institutions such as investment banks are active, and this is often when relevant economic data for each session is published.

These announcements can generate significant volatility depending on the market reaction, so every forex trader needs to know when they are published. Typically, the UK forex market is most active just after the open of the London session at 8am UK time. At this time, liquidity and volatility will likely be high as traders begin interacting with each other. Trading will usually become less liquid at around 10am UK time , and it will pick up again after the American markets open at around 12pm UK time.

This is especially true during the overlap between the London and New York markets, as well as the European session which is open during almost identical hours to the London session. The Tokyo-London crossover is historically not as busy as the London-New York crossover because of the simple fact that there is a greater cross over in terms of trading hours between London and New York than between London and Tokyo.

Forex Market Hours and Sessions in

The table below has information about some popular forex pairs and their average daily pip movement over a month period starting November during the London session. Many USD crosses experience their highest trading volumes during the New York session, and this represents a considerable slice of the forex market with USD included on one side of Learn more about trading forex with IG. The Tokyo session is perhaps the least liquid of the major sessions to trade forex from the UK because of the time difference and the limited cross over of only one hour between London and Tokyo.

However, you can still trade forex during the Tokyo session from the UK. Learn more about the most volatile currency pairs. The table below has information about some popular forex pairs and their average daily pip movement over a month period starting November during the Tokyo session.

Trading the London Session: Guide for Forex Traders

You can trade different forex sessions from the UK with financial derivatives such as CFDs and spread bets. You can use these products to go long or short, and speculate on forex prices rising as well as falling, with the accuracy of your prediction and the extent of the market movement determining your profit or loss. Both CFDs and spread bet prices are based on the underlying market, and they can be traded with leverage — giving you full market exposure for a deposit, known as margin. However please remember that while leverage can magnify your gains, it can also amplify your losses.

Some forex pairs will be more heavily affected by an overlap than others. Traders can then look to trade within either the volatile or quiet periods, with both approaches having their own merits and disadvantages.

The market calls for a certain amount of volatility and liquidity for a setup to ferment and then validate. Say, a set of buyers haul the market past a resistance level. The follow-up move needs another set of buyers, mostly fresh hands. Else, you have to trade during those hours when traders are perennial and they can hurl the price action past the resistance or support and then validate it all by themselves. After all, trading is just like a game of relay. You need to pass on the baton to someone to carry it to the finish line.

The bottom line is that the market hours you trade forex precipitate your success. So make sure you do it during the best forex market hours.

True ECN FX Trading, Lowest 0.0 Spreads!

Their business hours are. It is during these times hedge funds and banks trade actively. So the market never falls short of firepower. And they do all the hard work for you — breakout and follow through. You just have to sit right from the launch pad and endure the kick off turbulence.