Stochastic indicator forex pdf

The stock moved to higher highs in early and late April, but the Stochastic Oscillator peaked in late March and formed lower highs.

The signal line crosses and moves below 80 did not provide good early signals in this case because KSS kept moving higher. The Stochastic Oscillator moved below 50 for the second signal and the stock broke support for the third signal. As KSS shows, early signals are not always clean and simple.

How Do I Read and Interpret a Stochastic Oscillator?

Signal line crosses, moves below 80, and moves above 20 are frequent and prone to whipsaw. Even after KSS broke support and the Stochastic Oscillator moved below 50, the stock bounced back above 57 and the Stochastic Oscillator bounced back above 50 before the stock continued sharply lower. The underlying security forms a lower high, but the Stochastic Oscillator forms a higher high. Even though the stock could not exceed its prior high, the higher high in the Stochastic Oscillator shows strengthening upside momentum.

The next decline is then expected to result in a tradable bottom. The stock formed a lower high as the Stochastic Oscillator forged a higher high. This higher high shows strength in upside momentum. Remember that this is a set-up, not a signal. The set-up foreshadows a tradable low in the near future. Traders could have acted when the Stochastic Oscillator moved above its signal line, above 20 or above 50, or after NTAP broke resistance with a strong move. A bear set-up occurs when the security forms a higher low, but the Stochastic Oscillator forms a lower low.

What is momentum?

Even though the stock held above its prior low, the lower low in the Stochastic Oscillator shows increasing downside momentum. The next advance is expected to result in an important peak. The stock formed a higher low in late-November and early December, but the Stochastic Oscillator formed a lower low with a move below This showed strong downside momentum.

The subsequent bounce did not last long as the stock quickly peaked. Notice that the Stochastic Oscillator did not make it back above 80 and turned down below its signal line in mid-December. While momentum oscillators are best suited for trading ranges, they can also be used with securities that trend, provided the trend takes on a zigzag format. Pullbacks are part of uptrends that zigzag higher. Bounces are part of downtrends that zigzag lower.

In this regard, the Stochastic Oscillator can be used to identify opportunities in harmony with the bigger trend.

The indicator can also be used to identify turns near support or resistance. Should a security trade near support with an oversold Stochastic Oscillator, look for a break above 20 to signal an upturn and successful support test. Conversely, should a security trade near resistance with an overbought Stochastic Oscillator, look for a break below 80 to signal a downturn and resistance failure. The settings on the Stochastic Oscillator depend on personal preferences, trading style and timeframe.

A shorter look-back period will produce a choppy oscillator with many overbought and oversold readings. A longer look-back period will provide a smoother oscillator with fewer overbought and oversold readings. Like all technical indicators, it is important to use the Stochastic Oscillator in conjunction with other technical analysis tools.

As noted above, there are three versions of the Stochastic Oscillator available as an indicator on SharpCharts. The indicator can be placed above, below or behind the actual price plot. Placing the Stochastic Oscillator behind the price allows users to easily match indicator swings with price swings.

Stochastic indicator: description, setting, how to use

Click here for a live example. This scan starts with stocks that are trading above their day moving average to focus on those that are in a bigger uptrend. Of these, the scan then looks for stocks with a Stochastic Oscillator that turned up from an oversold level below This scan starts with stocks that are trading below their day moving average to focus on those that are in a bigger downtrend.

Of these, the scan then looks for stocks with a Stochastic Oscillator that turned down after an overbought reading above For more details on the syntax to use for Stochastic Oscillator scans, please see our Scanning Indicator Reference in the Support Center. John Murphy's Technical Analysis of the Financial Markets has a chapter devoted to momentum oscillators and their various uses, covering the pros and cons as well as some examples specific to the Stochastic Oscillator.

Martin Pring's Technical Analysis Explained explains the basics of momentum indicators by covering divergences, crossovers, and other signals. Is that condition conducive to pain-free trading? This may be a time where you sit on your hands or, depending on your trading plan, look at a different time frame combination to trade.

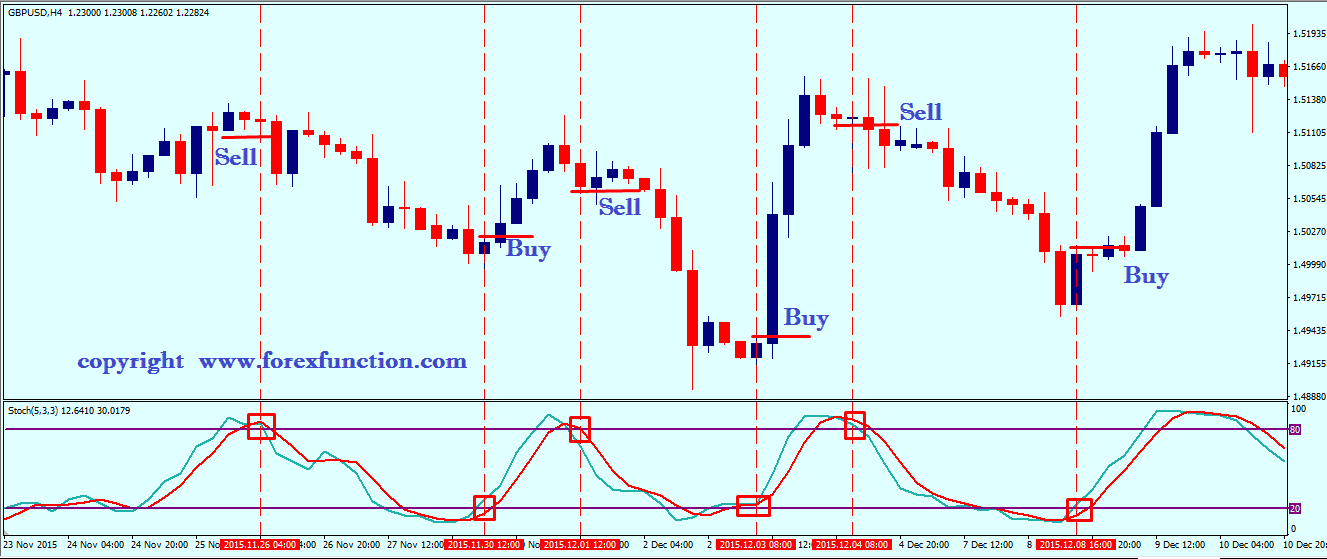

We can take some of what we have covered and add a few layers of confluence to it that may add to the probability of some price movement in our favor. To do so, we are going to add in some price structure to aid us in a trading decision. Since we can use a Stochastic crossover as a trend change signal, we can also use the crossover as a trade entry buy and sell signal. This chart has a few examples using horizontal support and resistance. We also see trend lines in action as well as reversal candlesticks. Make sure you look to the Stochastic crossover to see the buy and sell signals that were given while we also had technical confluence.

This was making a case for trading as opposed to just firing off a trade because the trading indicator gave a typical and textbook signal. When you add in a confluence of factors including price structures, you improve your odds of some movement in your favor. Nothing is perfect so having a trading plan that includes risk tolerance and trade management is extremely vital.

You can also add in the stochastic divergence that was covered early as part of the confluence you need to see before taking a trade. There are still many people who believe you can simply apply an indicator to a trading chart and take the signals when presented. Simply applying the basics such as support and resistance or trend lines will, at least, give you something to trade against.

They can also keep you out of taking trades directly into points of the chart that may offer some opposing forces that will challenge your trades. You want to ensure that any trading system you use that has trading indicators is also thoroughly tested and if based on multiple indicators, that they complement each other. Having two momentum indicators, for example, is not needed and just adds a layer of complexity to any trading strategy. Remember one of the key elements of a trading plan is how you manage your trades and the risk you will take. Those are as crucial, if not more so than what setups you use for your trades.

Whether you use the slow Stochastic as part of your trading plan or any other indicator, ensure that you critically analyze the information it presents so you can see both the pros and cons of each. Testing a trading system and each variable is hard and tedious work. Stochastic Oscillator Settings and Calculation You may find different calculations depending on the charting package that you are using however this is the proper formula for the fast Stochastic.

Best Settings For The Stochastic Oscillator Many trading indicators will give you the opportunity to adjust many of the inputs that will be used in the calculation. If 14, 3, 3 is a great setting, why not 13? What about 5, 3, 3? What about any combination you can think of? What Is The Best Stochastic Setting For Day Trading If you were set on changing the oscillator for day trading, there may be a valid reason — day trading is limited to the session.

Best technical indicators to pair with the stochastic oscillator

In this chart, I have used the slow stochastic setting of Oversold is below 20 and using a period stochastic look back, price is trading at the low end of the past day range. Overbought is above 80 and using a 14 period look back, price is trading at the high end of the past day range. Look For Confluence On Your Charts You may find opportunities when a confluence of technical factors line up when the market is oversold or overbought. Bullish Divergence Example If the price is in a downtrend, compare lows of price and Stochastic If the price is in an uptrend, compare highs of price and Stochastic If price makes lower low but Stochastic makes a higher low, consider longs as this could be a bullish divergence and look for a bullish reversal If price makes higher higher but Stochastic makes lower high, consider shorts, as this could be a bearish divergence This is a down-trending price and you can see that price puts in a low lower than the previous low.