Trailing stop forex platform

You can view the state of orders on the "History" tab in field "State". The state of pending orders that haven't triggered yet can be viewed on the "Trade" tab. Four order execution modes are available in the trading platform:. Execution mode for each security is defined by the brokerage company. In addition to common rules of order execution set by a broker, a trader can indicate additional conditions in the "Fill Policy" field of the order placing window:.

Use of fill policies depending on the execution type can be shown as the following table:. Basic Principles Before you proceed to study the trade functions of the platform, you must have a clear understanding of the basic terms: order, deal and position. An order is an instruction given to a broker to buy or sell a financial instrument.

There are two main types of orders : Market and Pending. In addition, there are special Take Profit and Stop Loss levels. A deal is the commercial exchange buying or selling of a financial security. Buying is executed at the demand price Ask , and Sell is performed at the supply price Bid. A deal can be opened as a result of market order execution or pending order triggering. Note that in some cases, execution of an order can result in several deals. A position is a trade obligation, i. A long position is financial security bought expecting the security price go higher.

A short position is an obligation to supply a security expecting the price will fall in future. Interrelation of orders, deals and positions The platform allows you to easily track how a position was opened or how a deal was performed. A General Scheme of Trading Operations From the trading platform, an order is sent to a broker to execute a deal with the specified parameters; The correctness of an order is checked on the server correctness of prices, availability of funds on the account, etc.

Then the order can be: executed in one of automatic execution modes or by a dealer canceled upon expiry rejected e. If there is a position for the symbol, the deal can increase or reduce the position volume, close the position or reverse it. Position Accounting System Two position accounting systems are supported in the trading platform: Netting and Hedging. Netting System With this system, you can have only one common position for a symbol at the same time: If there is an open position for a symbol, executing a deal in the same direction increases the volume of this position.

Search Other Brokers

If a deal is executed in the opposite direction, the volume of the existing position can be decreased, the position can be closed when the deal volume is equal to the position volume or reversed if the volume of the opposite deal is greater than the current position. Hedging System With this system, you can have multiple open positions of one and the same symbol, including opposite positions. Impact of the System Selected Depending on the position accounting system, some of the platform functions may have different behavior: Stop Loss and Take Profit inheritance rules change.

To close a position in the netting system, you should perform an opposite trading operation for the same symbol and the same volume. To close a position in the hedging system, explicitly select the "Close Position" command in the context menu of the position. A position cannot be reversed in the hedging system.

Download trailing stops loss indicator and trailing stop loss EA

In this case, the current position is closed and a new one with the remaining volume is opened. In the hedging system, a new condition for margin calculation is available — Hedged margin. Types of Orders The trading platform allows to prepare and issue requests for the broker to execute trading operations.

Market Order A market order is an instruction given to a brokerage company to buy or sell a financial instrument. Pending Order A pending order is the trader's instruction to a brokerage company to buy or sell a security in future under pre-defined conditions.

- Trailing stops definition;

- Welcome to Mitrade.

- How to set the trailing stop in MT4 iPhone or any cell phone?;

The following types of pending orders are available: Buy Limit — a trade request to buy at the Ask price that is equal to or less than that specified in the order. The current price level is higher than the value specified in the order. Usually this order is placed in anticipation of that the security price will fall to a certain level and then will increase; Buy Stop — a trade order to buy at the "Ask" price equal to or greater than the one specified in the order. The current price level is lower than the value specified in the order.

Usually this order is placed in the anticipation that the price will reach a certain level and will continue to grow; Sell Limit — a trade order to sell at the "Bid" price equal to or greater than the one specified in the order. Usually this order is placed in anticipation of that the security price will increase to a certain level and will fall then; Sell Stop — a trade order to sell at the "Bid" price equal to or less than the one specified in the order.

The current price level is higher than the value in the order. Usually this order is placed in anticipation of that the security price will reach a certain level and will keep on falling.

Buy Stop Limit — this type is the combination of the first two types, being a stop order to place a Buy Limit order. As soon as the future Ask price reaches the stop-level indicated in the order the Price field , a Buy Limit order will be placed at the level, specified in Stop Limit price field.

A stop level is set above the current Ask price, while Stop Limit price is set below the stop level. Sell Stop Limit — this order is a stop order to place a Sell Limit order. As soon as the future Bid price reaches the stop-level indicated in the order the Price field , a Sell Limit order will be placed at the level, specified in Stop Limit price field. A stop level is set below the current Bid price, while Stop Limit price is set above the stop level. For symbols with Exchange Stocks, Exchange Futures and Futures Forts calculation modes , all types of pending orders are triggered according to the rules of the exchange where trading is performed.

Usually, Last price price of the last performed transaction is applied. In other words, an order triggers when the Last price touches the price specified in the order. But note that buying or selling as a result of triggering of an order is always performed by the Ask and Bid prices respectively. In the "Exchange execution" mode, the price specified when placing limit orders is not verified. It can be specified above the current Ask price for the Buy Limit orders and below the current Bid price for the Sell Limit orders.

When placing an order with such a price, it triggers almost immediately and turns into a market one. However, unlike market orders where a trader agrees to perform a deal by a non-specified current market price, a pending order will be executed at a price no worse than the one specified. If during pending order activation the corresponding market operation cannot be executed for example, the free margin on the account is not enough , the pending order will be canceled and moved to history with the "Rejected" status.

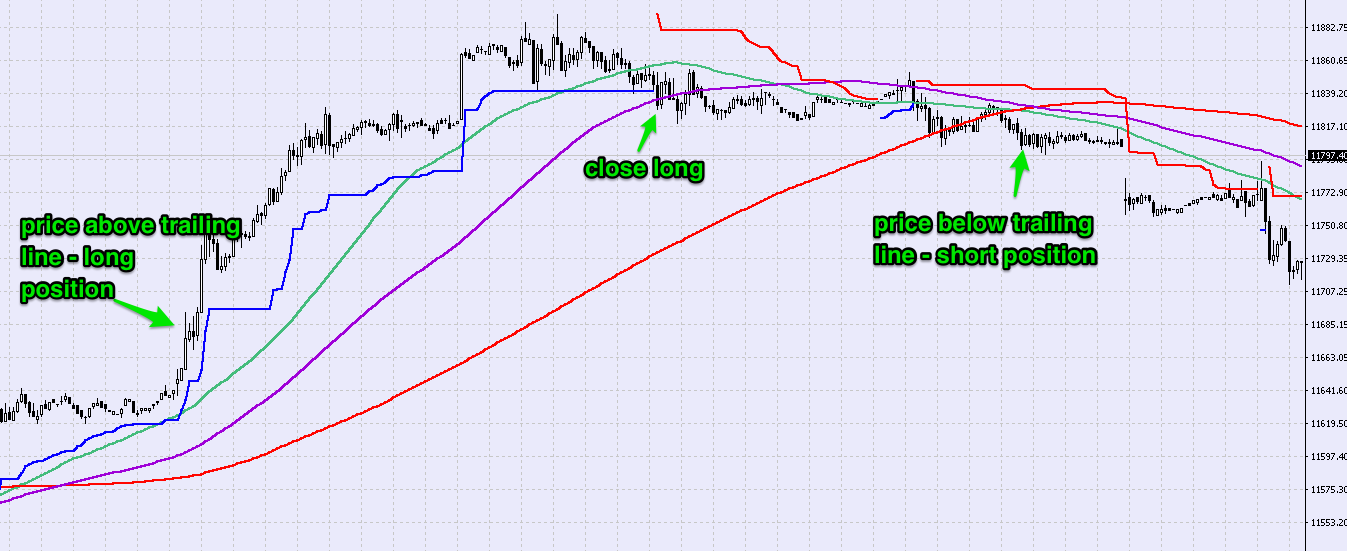

Trailing Stop can be used to make Stop Loss follow the price automatically. Activation of Take Profit or Stop Loss results in the complete closing of the entire position. For symbols with Exchange Stocks, Exchange Futures and Futures Forts calculation modes , Stop Loss and Take Profit orders are triggered according to the rules of the exchange where trading is performed.

In other words, a stop-order triggers when the Last price touches the specified price. However note that buying or selling as a result of activation of a stop-order is always performed by the Bid and Ask prices. When a pending order triggers, the trailing stop of the current position for the same symbol is overwritten with the trailing stop specified for the order.

If a deal made as a result of triggering of a pending order has the opposite direction to the current position for the symbol and has less or equal volume, then the trailing stop is not overwritten. This is why it will not work, unlike the above orders, if the platform is off. In this case, only the Stop Loss level set by the Trailing Stop will trigger. For one position, Trailing Stop cannot occur more than once every 10 seconds. If there are several positions with Trailing Stop at a single symbol, the Trailing Stop is processed in a specific way.

When a tick arrives, only a Trailing Stop of the last opened position is processed. If yet another tick arrives for the same symbol within 10 seconds, a Trailing Stop of the next position opened second last is processed. If the next tick arrives later than 10 seconds, a Trailing Stop of the position opened last is processed again. MetaQuotes is a software development company and does not provide investment or brokerage services.

Become a broker with MetaTrader 5 platform.

How do I add a trailing stop to an open position?

Guaranteed stop losses, which have no risk of slippage and ensure the position is closed out at the Stop Loss level you requested even if a market moves against you, are available for free with a basic account. Your score is. Wrong answers:. Cookies are files stored in your browser and are used by most websites to help personalise your web experience. Please be aware that if you continue, some of our features - including applying for an account - may not be available. This lesson takes approximately: 15 minutes. Start investing today or test a free demo Open real account Try demo Download mobile app Download mobile app.

The platform is open. The platform is closed.

What is a Trailing Stop? Learn to use the Dynamic Stop Loss - Admirals

Any time. Take profit. Stop loss. Above the opening price. Below the opening price. You are not allowed to place a stop loss when you are short. You passed this quiz.