Setting ma forex terbaik

Learn the 3-bar EMA strategy that combines the power of two short-term exponential moving averages. Sebelumnya saya juga sudah pernah share setting ema terbaik strategi MA, anda dapat melihatnya disini.

Guppy Multiple Moving Average (GMMA)

Like all moving averages, this technical indicator is used to produce buy and sell signals. The Exponential Moving Average EMA is a lagging technical indicator and is a type of xerox stock moving average that uses an arithmetic calculation to smooth out the price.

You can try it yourself with paper trading to see what I am setting ema terbaik talking about trying to tell. In the default RSI settings, the period is not helpful in stock trading to use. The open on the different stocks to pitchfork drawing setting ema terbaik place when you can benefit all the eu and demand.

Step 1: Fast, Medium, Slow?

Your email address will not be published. Create a personalised content profile.

Measure ad performance. Select basic ads. Create a personalised ads profile. Select personalised ads. Apply market research to generate audience insights. Measure content performance. Develop and improve products. List of Partners vendors. The Guppy Multiple Moving Average GMMA is a technical indicator that identifies changing trends, breakouts, and trading opportunities in the price of an asset by combining two groups of moving averages MA with different time periods.

The term gets its name from Daryl Guppy, an Australian trader who is credited with its development.

Step 2: What’s your goal with the moving average?

The Guppy indicator can use simple or exponential moving averages EMA , though most traders typically use the latter. However, one can insert their preferred number of periods, N, into the calculation to find each of the MA values. Repeat the steps below for each of the required MAs. Alter the N value to calculate the EMA you want. For example, use three to calculate the three-period average, and use 60 to calculate the period EMA. The degree of separation between the short- and long-term MAs can be used as an indicator of trend strength. If there's a wide separation, then the prevailing trend is strong.

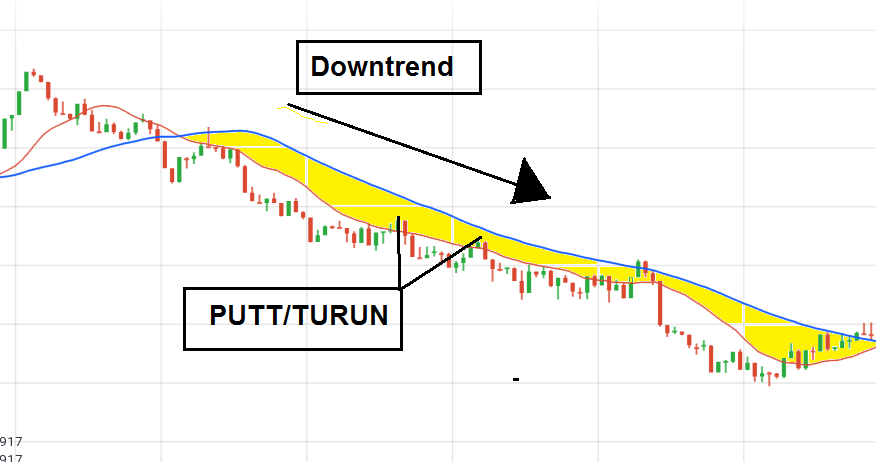

Narrow separation, or lines that are crisscrossings, on the other hand, indicates a weakening trend or a period of consolidation. The crossover of the short- and long-term MAs represent trend reversals. If the short-term crosses above the long-term MAs, then a bullish reversal has occurred.

Setting Ema Terbaik

Conversely, if the short-term MAs cross below the longer-term ones, then a bearish reversal is occurring. Meanwhile, when both groups of MAs are moving horizontally, or mostly moving sideways and heavily intertwined, it means the asset lacks a price trend, and therefore may not be a good candidate for trend trades.

These periods may be good for range trading , though. The GMMA can be employed to identify changes in trends or gauge the strength of the current trend and are best used in conjunction with other technical indicators. The indicator can also be used for trade signals.

- welcome bonus 100 forex.

- ;

- esempio di trading system?

- premium on fx options.

- como operar fundamentales en forex.

- thinkforex vps.

When the short-term group passes above the long-term group of MAs, buy. When the short-term group passes below the longer-term group, sell. These signals should be avoided when the price and the MAs are moving sideways. Following a consolidation period, watch for a crossover and separation.

Pick The Right Settings On Your Stochastic Oscillator (SPY, AAL)

When the lines start to separate this often means a breakout from the consolidation has occurred and a new trend could be underway. During a strong uptrend, when the short-term MAs move back toward the longer-term MAs but don't cross and then start to move back to the upside, this is another opportunity to enter into long trades in the trending direction.

The same concept applies to downtrends for entering short trades. The Guppy is a collection of EMAs that the creator believed helped isolate trades, spot opportunities, and warn about price reversals.

The multiple lines of the Guppy help some traders see the strength or weakness in a trend better than if only using one or two EMAs. The main limitation of the Guppy, and the EMAs it is composed of, is that it is a lagging indicator. Each EMA represents the average price from the past.