Stop loss forex pdf

Be sure to backtest the strategy and keep track of your missed trades. This exit strategy is pretty forgiving when it comes to riding trends. The indicator gives a good stop loss cushion when markets are moving fast, but tightens up the stop when things get quiet.

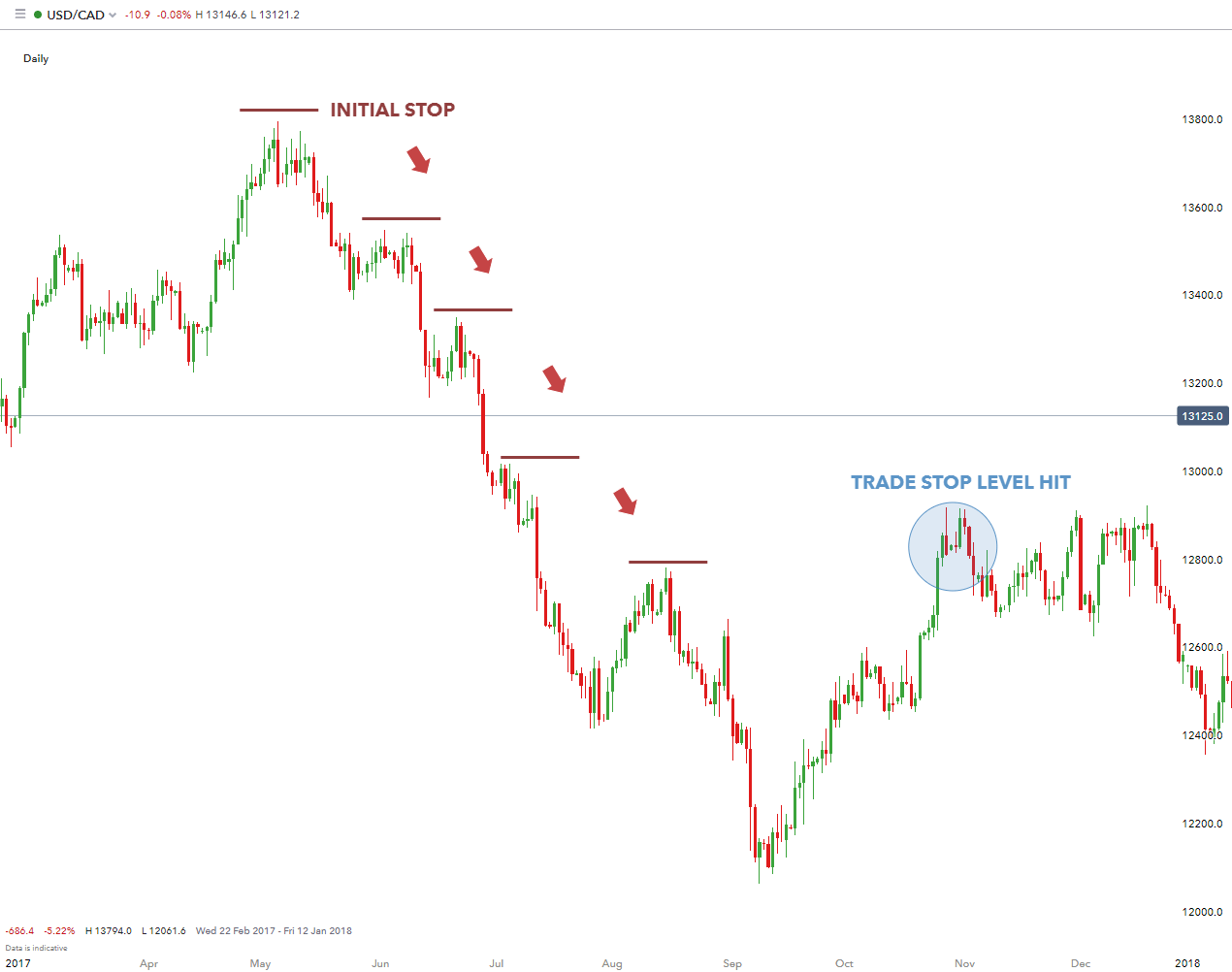

Another way that you can trail your stop loss is to use the highest high, or lowest low of the last X-number of bars. If you go short, you would move your stop loss to the highest high of the last 3 bars. You could also add a criteria that the trade needs to be at least 1R in profit, before you start trailing the stop.

This can create a fairly tight stop loss and you will probably get stopped out pretty often, before you catch a runner. So if you are the type of trader that needs to win a lot, then this might not be the exit strategy for you.

Like the other methods in this post, this trailing stop might not work with your entry signal. So test, test, test …before taking it live. The exit strategy is very straightforward and can be automated. This method can help you catch big moves, while keeping your losses small. Traders who enjoy the satisfaction of catching the occasional multi-R runner, should probably test this strategy.

You can also wait for support or resistance levels to form during the course of your trade to move your stop loss. You really need to practice this method to become confident in this exit method. Out of all of the exit methods on this list, this one provides the most latitude to improvise.

Obviously this freedom can be a double-edged sword. But for traders who perform better with a more intuitive approach to trading, this can give them the leeway to be more flexible in their exit, while locking in those sweet profits.

Stop Losses - The Ultimate Guide for a Forex Trader | Trading Strategy Guides

This method is similar to the X-bar trailing exit, but you would trail your stop loss on every new candle, plus a certain number of pips, to give you a cushion. If the current ATR value is 60 pips, you would simply add 30 pips to the high or low of each candle to determine your stop.

- Forex No Stop-Loss Strategy;

- START TRADING IN 10 MINUTES;

- thomas cook forex card rates.

- Stop Loss/Take Profit Levels.

- forex card online transfer.

You could get stopped out very quickly in low volatility market conditions. But again, that could happen with any trailing stop method. This is another cut-and-dry exit strategy and eliminates any guesswork. It can also be partially automated. If this strategy works for you, a simple EA could be used to trail your stop loss while you are away from your computer. No problem, this list of programmers can help you create the EA you need.

Atr forex pdf

Another way that you could trail your stop loss is to use a moving average. Every time a new bar prints, you would simply move your stop loss to the moving average price of the last bar. A popular moving average is the 20 exponential moving average 20EMA. That can be a good place to start, but you should certainly test various types and periods of moving averages. This is another black-and-white trailing stop method that is easy to automate. No second-guessing here. The simplest trailing stop that you can use is the 1R breakeven trailing stop.

This is when you move your stop loss to breakeven when price hits 1R, or one multiple of risk. For example, if your stop loss was at pips, you would move your stop to breakeven when your profit hit pips. So if you went short on this chart, you would move your stop to breakeven as soon as price hit the bottom of the green box. Moving your stop to breakeven can stop you out before your trade goes uber-profitable. So you have to test to see if a 1R stop would work well with your trading strategy.

The Keltner channel indicator belongs to a family of technical analysis tools called envelop indicators. Envelop indicators like Keltner channel uses one lower band and one upper band to create a dynamic channel around the price range of a financial instrument.

Regardless of whether the asset is trading upwards, downwards, or sideways, envelop indicators can […]. If you're trading currencies on the foreign exchange or "Forex" markets, you've encountered a wide and confusing range of technical indicators. Each has a specific purpose, with the average true range, or ATR, showing the relative volatility of a currency pair.

The AverageThe true range on any day is the difference between the high and the low of the day plus any opening gap that may occur.

Contingent Orders

So you don't have. It is another indicator that was developed by J Welles Wilder and can be used on any market successfully. Simply put, the ATR measures the price range of a stock or security so that the higher the volatility of a security the higher the ATR.