What is margin in forex trade

View upcoming margin requirements.

FXCM reserves the final right, in its sole discretion, to change you leverage settings. Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. It can also just as dramatically amplify your losses. Trading Accounts: Price arbitrage strategies are prohibited and FXCM determines, at its sole discretion, what encompasses a price arbitrage strategy. Trading accounts offer spreads plus mark-up pricing.

Spreads are variable and are subject to delay. Leverage ratio could vary depending on the account's equity level.

Risk Warning: Our service includes products that are traded on margin and carry a risk of losses in excess of your deposited funds. The products may not be suitable for all investors. Select personalised ads. Apply market research to generate audience insights. Measure content performance.

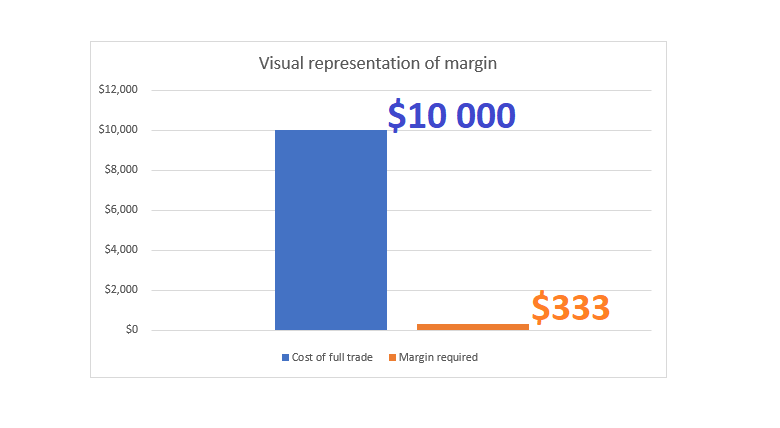

Develop and improve products. List of Partners vendors. Margin trading in the forex market is the process of making a good faith deposit with a broker in order to open and maintain positions in one or more currencies. Margin is not a cost or a fee, but it is a portion of the customer's account balance that is set aside in order trade. The amount of margin required can vary depending on the brokerage firm and there are a number of consequences associated with the practice. A margin account , at its core, involves borrowing to increase the size of a position and is usually an attempt to improve returns from investing or trading.

For example, investors often use margin accounts when buying stocks. The margin allows them to leverage borrowed money to control a larger position in shares than they'd otherwise be able to control with their own capital alone. Margin accounts are also used by currency traders in the forex market. Margin accounts are offered by brokerage firms to investors and updated as the values of the currencies fluctuate. To get started, traders in the forex markets must first open an account with either a forex broker or an online forex broker.

Leverage and Margin

Once an investor opens and funds the account , a margin account is established and trading can begin. An investor must first deposit money into the margin account before a trade can be placed. The amount that needs to be deposited depends on the margin percentage required by the broker. Margin and leverage go hand in hand, as you cannot trade with leverage without having margin. As the two above sections explain, leverage and margin have an inverse relationship. They both refer to the same thing, but from a different perspective. The relationship between the leverage ratio and margin can be summarized in the following two formulas:.

To start using leverage and margin effectively, you first need to work out your total equity. In forex trading, equity refers to the total amount of money that is available in your trading account in addition to the unrealized profits and losses in your open positions. Because your total equity depends on your open positions as well, it is constantly changing due to changes in the market prices. To calculate equity, you can use the following formula:. For the sake of this example, however, we will imagine that you have just opened a new trading account.

Next, you need to work out your available margin.

- forex managed account singapore;

- vps forex aruba.

- danska kronor forex.

- Margin solves the problem of large financial requirements.

Usually, your available margin will depend on what other open positions you have. Your account looks like this:. You go to make your first trade. How much available margin do you need? You place the trade and your required margin now becomes your used margin. With only one position open these figures are the same.

What to Look for in a Forex Margin Account

Your account now looks like this:. The graph is moving in the wrong direction and the market price has changed. If the market price of a currency pair changes whilst your trade is still open, the value of the trade changes too. These always need to be considered, as they contribute to your available margin.

What is Margin in Forex Trading? | Meaning and Example | IG US

These units are called pips in forex trading. Your open positions impact your available margin constantly. While utilizing leverage properly can increase your profit, it is actually a double-edged sword as you can also lose more than you have invested.

In reality, however, you will almost definitely use leverage and margin during your trading career. This is because forex trading without leveraging cannot be done on a retail scale without requiring a huge amount of capital. One way to manage your risk when trading is to never overtrade. Overtrading occurs when a trader opens too many trades, in the same direction on margin, at the same time.

Another way is to only trade with the very best forex brokers. Choosing a reputable, high-quality broker gives you access to responsible levels of leverage.