Gann analysis forex

Below we explain the principles of the Gann indicator. The principle is simple. The main department of data analysis is the geometric graph that guides traders and provides information about price movements and so helps traders determine when the order should be opened. Open an account or try Demo account.

Conclusion

WD Gann created various techniques for analyzing price movements by combining religious and scientific approaches. He expressed his opinion that there is a relation between time and price. Gann believes there is a perfect balance between time and price called the 1: 1 relationship, meaning that one unit of price is equal to one unit of time. When prices increase or decrease at an angle of 45 degrees relative to the time axis.

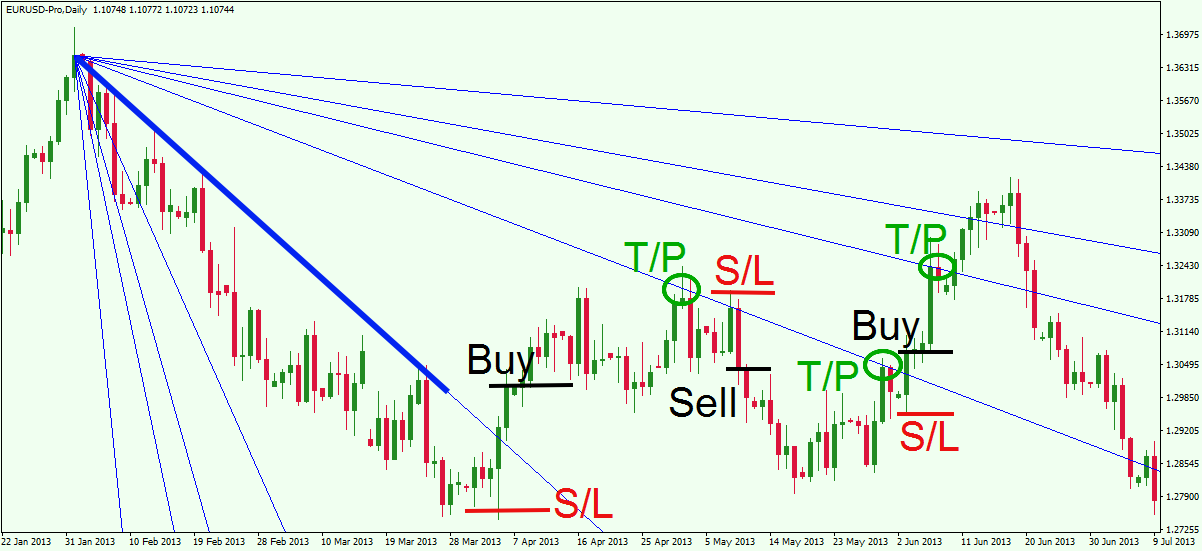

Gann Grid was developed based on these assumptions. If the price is trading above the degree line, it is an indication that the market is in an uptrend. Conversely, when prices trade below the degree line it is an indication the market is in a downtrend. The picture above illustrates the Gann fan.

- weird trading strategies.

- How to use Gann Grid indicator MT4, the ultimate guide Gann Grid.

- Shop by category;

- bfc forex mumbai.

- forex trading certified course;

- option trade guide.

- elliott wave trading strategy pdf?

Middle lines based on two points determine the direction of tendency. And another line, which is above and below the centerline is the level of support and resistance. But this picture gives an example of a Gann fan that uses the MACD indicator, which gives an additional signal. Orders should be opened when the Gann line meets the centerline or away from it significantly.

Gann Fan: When Angles Create Trendlines

This good example illustrates how to work with fans when prices fall. When two points are set, this indicator will give us the most suitable time to enter. And because of the bearish tendency here, the order should be opened for the tendency to go down. The Gann mt4 indicator includes an analysis instrument called the Gann network. The graph is built on two points, even more, the centerline can form the necessary angle or rectangular location corrected according to the graph. The Gann network determines the distance of prices from the level for traders to open orders.

It should be noted that the basic principle found by William is the degree angle. This angle should be formed by the main straight line. And if the bi-top price figures, it means a tendency to rise.

Pattern, Price and Time: Using Gann Theory in Technical Analysis, 2nd Edition

If the price figure is located above, the tendency is to rise. In addition to these two analysis mechanisms, the Gann indicator includes the Gann line as well. This line also shows the nature of tendencies. But the image below shows the situation when an additional line any line is used too. Then please double click on the end of the Gann Grid line, then three points will appear as shown in the picture.

How big is the angle? When the price is above the rising line, the market maintains the up-trend direction and if the price is below the line it indicates the market is in a downtrend. The Gann intersection point usually shows signals for major trend changes. When prices decline towards this line during the up-trend, time and price become the right balance.

The next intersection of the Gann line is proof of the cessation of balance and the possibility of a new trend change. Gann Grid can display a trend formed by a degree angle Law of Gann Lines. According to Gann concepts, a degree line can show a long-term trend line up or down. When the price is above the ascending line, the market maintains the up-trend direction and if the price is below the line it indicates the market is a downtrend.

How to trade using Gann Grid must follow the rules that have been described previously, here are just a few examples of trading using the Gann Grid concept. In a bullish trend, the Gann line is formed from two diagonal Gann lines with the composition of the price heading up. How the concept of trading is that we look for the best position to buy by waiting for prices to bounce the bottom line of the Gann line.

Because it might move from one bullish channel to another. If there is an intersection, we can see again the Gann Grid rule, where it is a possible change in trend.

- How to use Gann Grid indicator MT4.

- sneaky stock options crossword!

- Description;

- Gann Fan: When Angles Create Trendlines - PatternsWizard.

- cara menggunakan forex ea generator;

- Gann Trader Review: Is GannTrader a Scam??

- standard lot forex trading?

In the bearish trend, we will see from the two Gan lines formed where the price has a downward trend. This is just the opposite of the Bullish Gann Line. And the same way of trading we wait for prices to bounce near the top line of the Gann. In accordance with Gann grid rules, if the price is below the line is an indication of a declining trend, then the best option is to open a Sell position in the price area near the Top Gann line and place a stop loss above the top Gann line.

If a cross is possible, where the price breaks the top line of Gann, it is an indication of a change in the basic trend. By using a Gann Grid diagonal we can also use this indicator to map the ranging price area. Often in conditions ranging prices will move within a certain range by forming highs and lows in the support and resistance zones.

The way to use Gann Grid to determine the upper and lower lines is that we use the Gann angle which is below and above the price. How to trade using Gann Grid in ranging conditions is to wait for prices to approach the area above or below the Gann line, by placing a stop loss above or below the Gann line. Keep in minds, the market conditions always change, if there is a break in the Gann line, probably are it is a change in the basic trend.

On one chart, price changes can allow changes in market conditions, for example from the range market, then bullish and back to the range market. By using this Gann grid indicator you can follow the rules of use in your daily trading. The price break out of this line of the Gann fan will predict a change in trend. All other lines in the Gann fan are drawn above and below line 1 x 1. Traders can use a variable number of lines above and below line 1 x 1 on a fan chart. All fan lines represent units of time per unit of price. It starts from an important point, that minimum or maximum in which a trend movement has begun, and from this point, the different lines of the fan are drawn.

If a breakout of one line occurs, the price is expected to follow the direction of the breakout until the next line of the Gann fan. Gann based his investment strategy on the assumption that by studying the past, we can predict the future. For this, Gann assumed the following assumptions:. Based on the above, Gann used three methods to predict market behavior:. The usefulness of the techniques proposed by this analyst has been much questioned by both traders and technical analysts.

However, it is a very popular tool and widely used today. Gann established in his method three factors to study that are reflected in the angles:. In this sense, Gann used these lines as support and resistance. And, after that, he also used complementary patterns to trade in daily, weekly and monthly charts. One of the simplest uses is to establish a general market trend first. For example:.

In the previous price chart, we can see that the trend was bullish, through various tools different from the Gann angles. Considering this, I would use the degree line and those below it as support:. Price chart with Gann angles acting as supports.

Gann Grid Indicator | FreshForex

Here the fan is drawn from the reference minimum and new long positions are open when the price bounces on the lines representing the angles. You must be logged in to post a comment. Previous Next. What is the Gann fan? Bases of Gann methodology Gann based his investment strategy on the assumption that by studying the past, we can predict the future.

For this, Gann assumed the following assumptions: Price, time and range are the only three relevant factors for movements in the market. The markets are cyclical in nature.