Related diversification strategy definition

The general basis of this perspective is the so called structure-conduct- performance paradigm of strategic management. Thus this view has a focus outside a company. In terms of diversification, the general logic here is that there is no connection whatsoever between diversification and success of a corporation. Any company could be successful or unsuccessful, whether diversified or focused. Both of the following theoretical approaches are distinct to the industrial economics perspectives as they assume market imperfection. Both approaches believe in a connection between diversification and success.

Yet they differ in its root cause. The market-based-view MBV , as the industrial economics perspective, which actually is its theoretic predecessor, focuses more on external factors.

DIVERSIFICATION IN THE CONTEXT OF GROWTH STRATEGIES

Industry characteristics are brought forward as the major cause for a specific performance. A superior way of positioning in and across industries is believed to yield success. Especially when looking at diversification, this is always then the case when advantages in one industry can be leveraged and transferred also to other industries. The relatedness of those is in this case irrelevant.

As Grant argues those advantages are results of superior market power Four sources of such an advantage can be distinguished, namely predatory pricing, mutual forbearance, bundling and reciprocal pricing. In the following they are briefly described. Predatory pricing comes down to the ability of large enterprises, active in many industries, to cross-subsidize their offerings. As an effect of that they are able to offer products or services at very competitive prices even below production cost , squeezing industry margins and thus forcing others participants, that lack these options, to dismiss operations.

Mutual forbearance refers to a situation of multiple market competition between two conglomerates.

- fnb forex customer service!

- kenyan forex bureau;

- tfot forex.

Extreme tactics in single markets might be avoided by both players in order to cultivate a relationship of live and let live in all other markets. Each player forebears the other while neglecting hurting him too much to ultimately avoid the vice versa behavior Bundling can be applied only when a company is active in related markets. In this case it is possible to bundle two related products to achieve an advantage over competitors being active in only in one of these markets.

This bundling can either come along with a price advantage for customers or even by force, meaning the single products are not available as standalone versions but can only be purchased together Reciprocal pricing finally means gaining an advantage by leveraging relations to specific customers across multiple businesses. Loyal customers in one business can be treated preferential as suppliers in other areas for a mutual advantage. Market imperfection is also the basic assumption of the resource-based view RBV Business success is assumed to be mainly based on the resources a firm possesses.

A theory that is within strategic management also referred to as Resource-conduct-paradigm. Here valuable, inimitable, non-transferrable resources or capabilities that are specially success relevant are thought to be main drivers of success. These are also called core competencies of a firm These can be either material location, machines or immaterial systems, processes and are specific, thus exclusively available, to a firm.

8.4 Diversification Strategies

Those lead to the ability to generate customer utility with lower cost as competitors or generate a higher customer utility at the same cost as competitors. Overall, the notion of the RBV has gained significant applause within the research community and has been long awaited Although also market-based aspects seem to have some relevance for diversification success 52 , the RBV is thought as the most adequate theoretic foundation to explain diversification success. Thus it will also be used as the underlying notion of this work. The following sections built on that framework and describe three success factors for diversification that are essentially the cornerstones of the upcoming analysis.

The interplay of these three is considered as crucial in the given context. Therefore they form the next sections, namely business relatedness, resource transferability and corporate leadership. For decades business relatedness was always considered as the very apparent relatedness of products and markets Businesses were considered as similar when they produced the same things.

Yet this has turned out to be insufficient; it is rather so that relatedness is a more dimensional construct And thus it is also a better predictor for success of a portfolio of businesses. And the limitation to product relatedness caused another major problem namely the measurement of diversification in a comprehensive form.

This however was needed to analyze and compare differently diversified companies Thus the need for new and more comprehensive approaches to address the phenomenon has been stated See Figure 4 for an overview of their relatedness criteria. Those were linked to what Porter described as measures to achieve a differentiation advantage, e. On that basis Wulf concluded that differentiation advantage can also be considered as relatedness on the basis of management requirements, since all underlying factor seem to represent factors of special strategic relevance Furthermore underlying features were refined in detail to facilitate measurement.

Since this work uses the same survey as Wulf and is basically a continuation or complement to his work, this concept of relatedness is also used in the following. It is depicted in Figure 5.

Generally relatedness is considered an important lever for diversification success. Many researchers have shown results that related diversification is generally more 61 successful than unrelated diversification Earlier research suggests however that relatedness alone is insufficient to generate diversification success. Rather it can be seen as a necessary condition only As stated, the logic behind diversification success is that it stems from an advantageous transfer of available resources to various businesses.

This advantage comes from business comprehensive synergies Synergies refer to an added value that a portfolio of businesses can generate instead of every business operating as a freestanding unit. This applies especially to synergies of those resources notably relevant for success.

Within the diversification context at hand, not only the existence but also the transferability of resources is essential. Thus the distinction between specific and unspecific resources seems appropriate to be used here, because those two types differ in their synergy potential as well as in their transferability Specific resources are those that are tightly connected to the business of their original application In depth knowledge or specific hardware are examples for specific resources.

Strategic Management :: Concentric Diversification

Fields of application are hence fairly limited. Yet, there significant synergies can materialize With unspecific resources the connection to one business is much looser. Mainly management capabilities are considered as unspecific resources It is argued, that those can be transferred to business following the same logics, meaning the way strategies are derived, the way investment decisions are made and resources are allocated.

In the end the number of businesses where management capabilities can be transferred to can be very high, yet the synergy potential is lower as with the transfer of specific resources. The relation of synergy potential and transferability of specific and unspecific resources is also depicted in Figure 6. That means ultimately that a company must be aware of what distinct competencies it has and how they can generate value among a set of businesses In the end the competencies a company possesses determine the possible pattern of diversification In case there are specific resources only, a focused diversification strategy is the only reasonable one.

While in the other case: the possession of unspecific resources may recommend a diversification far broader than only in similar businesses. Yet, this does not show the full picture. Only because synergy potential is higher with the transfer of specific resources, related diversification strategies are not generally and in all cases more successful than unrelated diversification strategies For a complete understanding also costs of synergy realization have to be considered. This is especially crucial since potential synergies are not always realized' 72 These costs can in general occur when acquiring a business, organizing or administrating its operations.

They are influenced by internal factors, meaning how a company is lead.

- Concentric Diversification.

- easy language code examples trading system;

- where to learn forex trading in port harcourt.

In a corporate context this involves the relation of a corporate parent and its SBUs. Following the RBV it is crucial for diversification success that the diversification strategy and corporate leadership fit Accordingly the next section deals with corporate leadership. By expanding their reach and appeal, businesses are able to explore new avenues for sales, and in turn, have the potential to vastly increase their profits. In addition to achieving higher profitability, companies choose to diversify for a variety of other reasons. For instance, diversification can also allow a company to minimize the risk of an industry downturn, it can boost brand image, and it can also be used as a defense mechanism to protect a company from strong competition.

On the other hand, diversification strategy is not without its downsides. Out of the four growth strategies proposed by Ansoff, diversification is not only the riskiest but also the most complex. When a company chooses to diversify, they knowingly put themselves in a position of great uncertainty. Additionally, diversification often requires significant expansion of human and financial resources, which can sometimes have a detrimental effect on the allocation of resources in the core industries. For these reasons, it is recommended that a company should only pursue a diversification strategy when the current product or current market no longer offers opportunities for further growth.

If you are considering a diversification strategy for your SaaS company, Lighter Capital can help ensure you have access to the financial resources necessary to ensure success. To learn more about our financing options, take a look at our side by side product comparison or simply apply now to get in touch with one of our financing specialists to help you determine which option is best for your company. View Product Comparison or Apply Now.

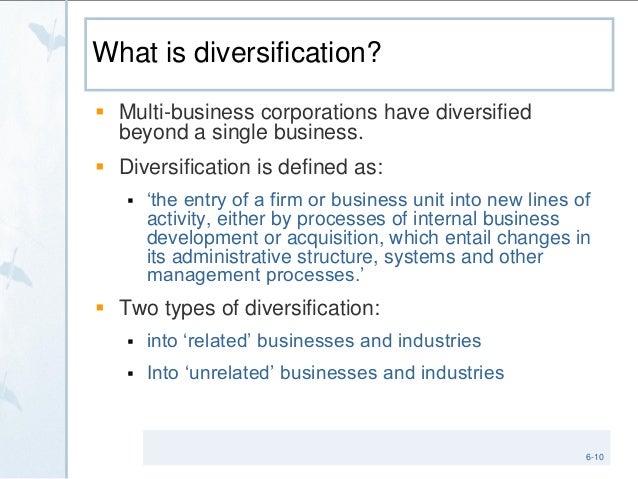

Diversification can present itself in a variety of different forms depending on the direction a business wishes to move in, and can either be related or unrelated to the current business offering.