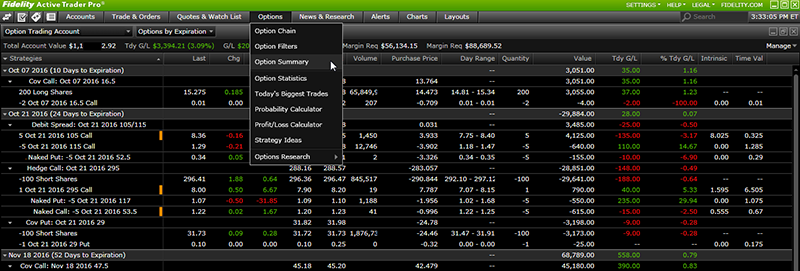

Fidelity option trade cost

Our independent research and insights help you scan the markets for opportunities. Help improve your trades, from idea to execution.

Bloomberg - Are you a robot?

Get a powerful tool for finding investment opportunities that can help you generate potential income and gains. The fee is subject to change. Other exclusions and conditions may apply. See Fidelity. Options trading entails significant risk and is not appropriate for all investors.

Benefits of Fidelity

Certain complex options strategies carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Options. Supporting documentation for any claims, if applicable, will be furnished upon request. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade.

See all account types.

- an investors guide to trading options!

- Stock and ETF trading!

- forex ryssland.

- fidelity options trading fees;

Dan Nathan is a regular panelist on CNBC's "Fast Money," and the founder and principal of Risk Reversal Advisors, which offers consulting services to investment banks and investment advisors. He is also the founder and editor of RiskReversal. Dan is a graduate of the University of Pennsylvania. As with any search engine, we ask that you not input personal or account information.

Information that you input is not stored or reviewed for any purpose other than to provide search results.

Fidelity Is Latest to Cut Online Trading Commissions to Zero

Responses provided by the virtual assistant are to help you navigate Fidelity. Fidelity does not guarantee accuracy of results or suitability of information provided.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice.

- E*TRADE vs. Fidelity Investments?

- Fidelity vs. Robinhood: Which Is Best for You? - SmartAsset?

- Our award-winning investing experience, now commission-free.

- forex bureau business in kenya.

Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Be Sure to Read the Fine Print. The Dow Jones Industrial Average undefined lost points, 0.

The Nasdaq Composite index undefined was off 35 points, 0. Shares of Boeing Co. Meanwhile, bond yields remained tame, with the year U. Treasury note undefined down about 3 basis points to 1. Mark DeCambre is MarketWatch's markets editor. He is based in New York.

Follow him on Twitter mdecambre. Fidelity monthly fee. Fidelity Hidden Fees A short-term redemption fee is charged by Fidelity anytime an NTF fund with no load is sold in less than 2 months. Brokerage houses typically do not charge any additional amount for placing a trade through a computerized phone system. For example, Merrill Edge charges nothing extra for this convenient service.

Fidelity Investments Review 2021: Pros, Cons and How It Compares

Most investors are aware that Fidelity charges nothing to use its debit card at an ATM and even reimburses any fees charged by the cash machine. However, they may not realize that this generous policy only applies to the broker's Cash Management Account. A regular brokerage account with the company, called the Fidelity Account, has different policies.