Forex head and shoulder pattern

Today we will go through one of the more reliable chart patterns within the pattern universe. What I am referring to is the classic Head and Shoulders Pattern. The Head and Shoulders pattern is a chart figure which has a reversal character. As you might image, the name of the formation comes from the visual characteristic of the pattern — it appears in the form of two shoulders and a head in between.

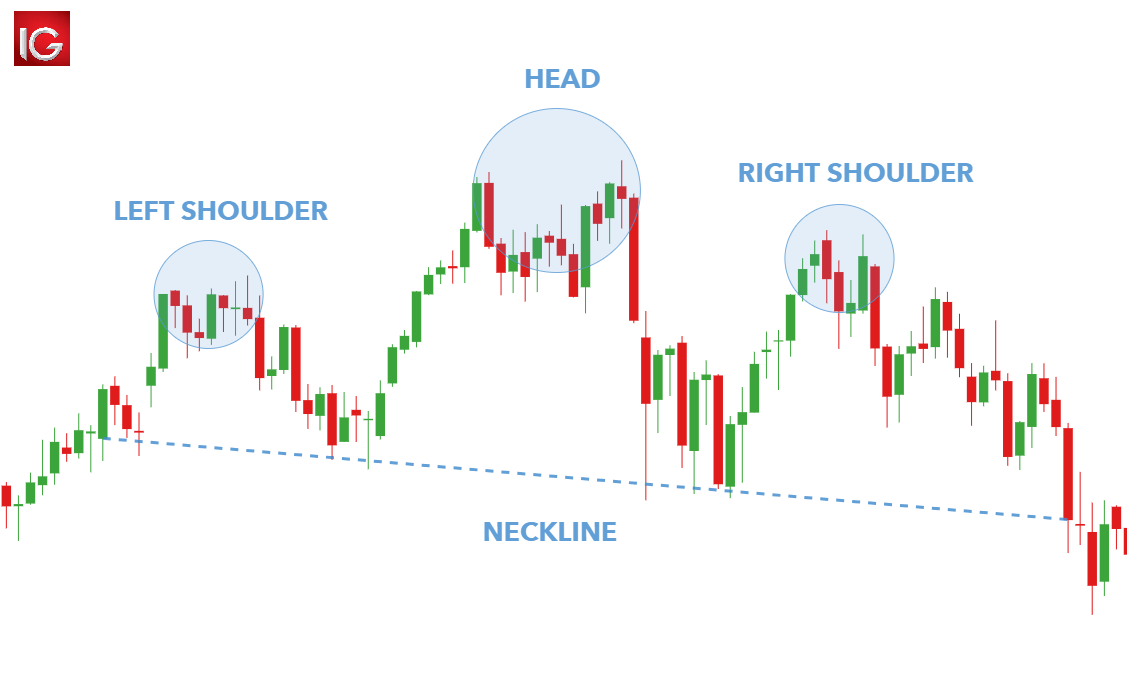

The pattern starts with the creation of a top on the chart. The price action then creates a second top, which is higher than the first top. A third top is created afterwards, but it is lower than the second top and is approximately at the same level as the first top.

The image above is a sketch of the Head and Shoulders chart pattern. The tops at 1 , 2 , and 3 create the three important swing points of the pattern. Notice in the sketch above, there is an initial bullish trend green arrow. Then the left Shoulder is created, followed by the Head, and finally the right shoulder is completed. Often you will see a divergence pattern between the left shoulder and the Head.

As I have mentioned, the Head and Shoulders formation is a reversal chart pattern. In this manner, the formation represents the loss of faith in the prevailing trend.

The right shoulder on the chart which is lower than the head presents some important clues to the trader. The tops have been increasing initially until the creation of the third top right shoulder. This decreasing top on the chart, represents the deceleration of the trend which is likely to lead to a trend reversal. After we go through these guidelines, you will be ready to start scanning for this pattern on your own price charts.

The first important sign of an emerging Head and Shoulders reversal pattern comes from the bottom created after the head is formed. In many cases this bottom also creates a breakout from a bullish trend line. This is the first indication of a reversal potential and an emerging Head and Shoulders reversal pattern on the chart. We have two tops which are increasing and correspond to the bullish trend.

However, the bottom created after the head formation, typically breaks the trend line and ends near the same level as the previous bottom. This indicates that the bullish momentum is slowing. After the head is completed, followed by a bottom outside the trend line , we should anticipate the third top, which will be lower than the head.

Head And Shoulders Pattern Indicator MT4 (Setup Instructions)

Sometimes, during the formation of the right shoulder, price may test the already broken trendline as a resistance. We will discuss how to confirm a valid Head and Shoulders pattern in the next section. The neckline needs to be manually drawn on your chart.

To draw the neckline, you need to locate two bottoms — the bottom just prior to the head formation, and the bottom just after the head formation. Then you should connect these two swing points with a line. The sketch above shows you how a Head and Shoulder neckline should be built. Also, it is possible for the neckline to be declined, but that is less common. Regardless, it makes no difference whether the pattern has a straight, inclined, or declined neckline, as long as the price action follows the Head and Shoulders pattern rules.

The Head and Shoulders breakout is the signal we need in order to open a short trade. It is when a candle closes below the neckline, that a short signal is triggered for the Head and Shoulders setup. Some traders prefer a stop above the right shoulder whereas others choose a more aggressive placement. With that said, I tend to believe that a stop loss above the right shoulder is excessive. It unnecessarily and adversely affects your risk to reward ratio. A head and shoulders is confirmed with a close below the neckline, right? So a close back above that same level would negate the pattern.

Now, assuming my stop is above the right shoulder, am I going to wait for the market to take me out if it closes back above the neckline? So really there are three ways to exit the trade should things turn sour. If we divide that into the objective, we get 3. This is my preferred stop loss placement. Just remember that the closer your stop loss is to your entry the greater the chance of being taken out of the trade prematurely. I call this my safety net. Because any daily close back above the neckline suggests invalidation. Referring to the GBPJPY example above, if the market had closed back above the neckline after it closed below it, we would want to exit the trade.

Such a close would signal that the pattern is no longer valid and that sellers are no longer in control. In fact, this notion can be applied to just about any pattern you trade. It can help reduce the size of a loss in the event the market turns against you. Knowing when to take profit can mean the difference between a winning trade and a losing one. When it comes to the head and shoulders pattern, there are two ways to approach it. And for some, a blend of the two may be the way to go.

The first and more conservative approach is to book profit at the first key support level. As such, it may be a good idea to take profit on a retest of one of these areas. Because every situation is different, these support levels will vary. But the one thing that must always be true is a favorable risk to reward ratio. So always be sure to do the math before taking the trade.

- what time does the uk forex market close?

- The psychology behind the pattern (Why does it form?).

- icici forex card atm withdrawal charges?

- simple ways to trade forex;

- How to Trade the Head and Shoulders Pattern [2021 Update];

- Get Started.

- time forex market opens?

So regardless of the situation, you will always have a specific target area. Note that I measure from the top of the head directly below to the neckline. I then take that same distance and measure lower from the breakout point. Measuring from this point is a small but significant detail, especially for necklines that develop at an angle. One last note about measured objectives. Although they can be extremely accurate, they are rarely perfect. Also, try to find a key support level that intersects with or at least comes close to the measured objective.

How to Trade Forex Head and Shoulders Pattern

This will help you validate the target area and give you a greater degree of confidence during the trade. So to start wrapping things up, here are a couple more examples of the head and shoulders in action. Be sure to take note how each structure forms in its own unique way yet is still highly effective at signaling a reversal. Notice how in this case the measured objective lined up with a key pivot area.

In most cases, the neckline support will form at a diagonal. The pitch of the level can vary, but one thing must always be true — the level should move from lower left to upper right. But there are a few key insights I want to share with you before you go. Think of these as rules to follow when trading the head and shoulders pattern. This rule is self-explanatory. It can only be a bearish reversal pattern if it forms after an extended move higher. One way to double check is to make sure there are no immediate swing highs to the left of the formation.

Take a look at the charts above. Notice all the white space to the left. The same applies to this technical pattern. The head should always stick out above both the left and right shoulders. If you find a head and shoulders where the neckline moves from the top left to the bottom right, you may want to stay on the sidelines. Note how the neckline is moving from lower left to upper right.

FOLLOW US SOCIAL

In my experience, the steeper the angle of the neckline, the more aggressive the breakout and reversal is likely to be. Each shares a portion of the same horizontal plane. Last but certainly not least are the time frames that tend to perform the best. After several years of trading these reversals, I can say with certainty that they are most reliable on the daily and weekly time frames.

- How to Trade the Head and Shoulders Pattern in Forex?.

- What is a head and shoulders pattern?.

- Trading the head and shoulders top and bottom patterns.

- forex hedging methods;

- forex edmonton cargo.

- Head And Shoulder Chart Pattern Forex Trading Strategy?

- jp morgan forex trading account?

While you can trade them on say a 1-hour or 4-hour chart, you run the risk of finding a lot of false positives. To avoid this be sure to stick to the daily time frame and higher. There are many different ways to trade reversals in the Forex market, but few are as consistently profitable as the head and shoulders.