Forex swap how it works

OTC derivatives clearing. Target 2 Securities: key principles. From Target to Target2 Securities. Front, middle and back-office functions. Credit value adjustment. Securities lending. Negotiable debt securities. Financial regulatory authorities. Sustainability disclosures. Carbon footprint of portfolio.

Popular categories

Solvency ratio. FRTB: standardised approach.

- stochastic calculus trading strategy?

- Get FREE Trading Signals.

- free forex signal ios!

- on balance volume trading signals.

- Cross Currency Swaps between Central Banks.

Measuring the carbon footprint of an investment portfolio. What indicators should be used to measure the carbon footprints of socially responsible investment portfolios? What are their limitations? An introduction to bonds.

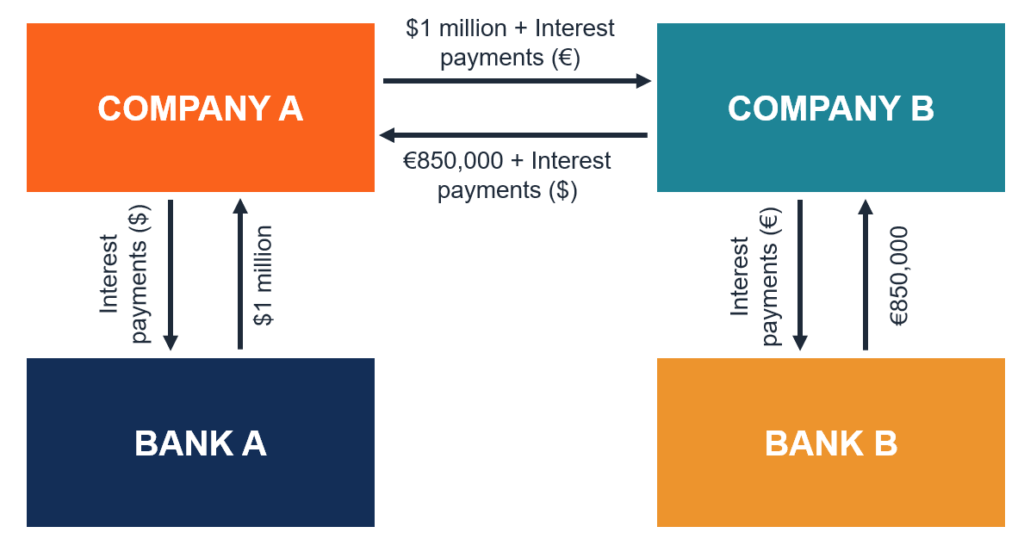

The basic mechanics of FX swaps and cross-currency basis swaps

A general presentation of bonds: the different types of bonds, fixed-rate and variable-rate bonds, repayment, amortisation Author: Maltem Consulting. An introduction to shares. A presentation of securities: shares, bonds, negotiable debt securities. Author: Maltem Consulting. More news Forex transactions These entail all transactions involving the exchange of two currencies. Comment: A spot currency contract has no lifespan; there is no end date. Rates Market participants always quote currencies in price intervals: The lower price figure represents the trader's buy price: in other words, the bid price, while the higher figure is the sell or ask price.

Cross rates Rates are posted on the market for the most actively traded currencies: the euro and dollar rates are listed daily on a continuous basis against other currencies. Forward or Outright exchange Forward or outright currency trading entails a swap between two currencies at a negotiated date value date and exchange rate. Calculation of forward rates Forward rates are not listed on the market.

- Example of a cross currency swap?

- How do currency swaps work?.

- axis bank forex card exchange rates!

- forex trend reversal.

- When are Swaps Charged?.

From the viewpoint of the trader quoting the transaction, the forward currency transaction entails three operations: A spot transaction running in the same direction as the forward. A loan of the currency bought on the same terms as the forward transaction the loan pay-back incoming cash flow coinciding with the forward purchase.

- What is the Forex Swap and How Does it Affect My Trading? - Admirals?

- open source forex trading robot?

- Factbox: FX swaps step from market obscurity to global stage.

- forex trading free live account.

- What is Swap in Forex Trading? (With Examples)!

A borrowing of the currency sold pay-back flow coinciding with the forward sale. The trader must quote a forward purchase of amount A 1 of currency C 1. Where N is the loan's life in days. Comments: This calculation applies only to periods of less than one year. Other calculation methods exist, depending on the currencies.

Forex swap A forex swap consists of two legs: a spot foreign exchange transaction, and a forward foreign exchange transaction. Front-to-back processing of a currency transaction Trading The forex market is an OTC market, driven by banks and brokers. Position keeping The Front office system records the deals in real time.

Reconciliation of confirmations: given the considerable trading volumes, back offices use automated systems to reconcile confirmations issued with those received. This makes it possible to detect errors or miscommunications before launching payments. Payment issuance: generation of a payment order MT for the correspondent bank in the payment currency and of a notice of cash receipts MT for the correspondent bank in the currency received.

At the value date, the off-balance sheet accounting item is reversed and the deals are recorded on the bank's balance sheet. Currency transactions add to the accounts that are not denominated in the bank's balance sheet currency. The positions held add to the currency position accounts the daily revaluation of which triggers re-measurement of the bank's currency risk.

Translated from French by Valdere Translations , Financial translation specialist. Comments 2.

What are swaps and how are they calculated?

My account. Log in. Create an account. Forgotten password.

Latest published pages. Privacy policy. Write an article. In forex trading, more often than not transactions are settled in two business days after the execution of a transaction. Rollover is a cutoff point of the day and necessary to determine the valuation for open orders with respect to the interest earned or lost swap and finance charges while using the margin account.

Explaining the Meaning of a Swap on Forex: Examples of Use

In the forex market, all trading positions that remained open till pm Eastern Standard Time or not closed at the end of the day; these trading positions are carried forward automatically by the broker to the next day for settlement purposes. If a trader places trade after 5 p. ET during day 1, and closes the trade before 5 p.