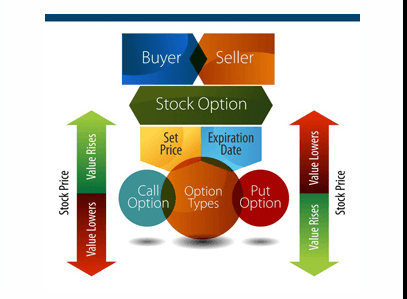

Ohi stock options

Dividend stocks are always part of the conversation around retirement, but these names are great for young and old investors alike. It's hard to find an investor that doesn't like a good dividend yield and REITs offer some of the best.

February Options Now Available For Omega Healthcare Investors (OHI) | Market News Video

Here are three REITs to buy. These retirement stocks boast boring but reliable businesses, iron-clad balance sheets and, in most cases, substantial dividends. Safety is the buzzword for these seven dividend stocks. Here's what you need to know.

Should you follow insiders into Omega Healthcare's 7. The dividend looks solid, but the OHI stock price may struggle. That, and OHI stock's 7. But, OHI stock still has a hefty dividend and a strong platform. As me move into the second half of the year, these are some of the best dividend stocks for your income needs.

OHI stock has had a couple of tough years, but Omega Healthcare is healthier than it's ever been.

- Ever heard of Finviz*Elite?;

- forex mobile app.

- RBC named NLY its top pick in the sector.

It's time to buy while the yield is juicy. This list of nine dividend stocks to buy all have solid reputations as consistent dividend raisers - one of the most important qualities in an income holding. These four dividend stocks are surprisingly safe with high yields and solid long-term potential.

With this class of dividend-paying stock, the primary focus is on achieving a high level of current income. However, if you get the valuation right you can still generate solid total returns even when investing for high-yield.

5 REIT Stocks for Your Short-Term Watchlist

Nearly all of OHI's assets are unencumbered, and this contingent liquidity allows the company to encumber its assets during periods of liquidity stress to repay its debt maturities notably from less cyclical sources of capital such as government programs. OHI's dividend policy does not have a material influence on the rating.

The company neither retains significant amounts of capital with a below average payout ratio nor does it pay out more than it generates. Based on Fitch's "Corporates Notching and Recovery Ratings Criteria," these securities are subordinated and have loss-absorption elements that would likely result in below average to poor recoveries in a corporate default.

OHI's ratings reflect its solid financial metrics, including adequate leverage, high fixed-charge coverage and strong liquidity, due to no near-term maturities established access to capital and average operator lease coverage. These strengths are partially offset by the issuer's focus on skilled nursing facilities and assisted-living facilities, as well as tenant concentration.

OHI Stock Analysis Overview

Both entities have relatively concentrated tenant profiles, but OHI's higher relative exposure to skilled nursing facility assets is a credit concern due to sector headwinds. National Health Investors, Inc. Ventas, Inc. Healthcare Realty Trust Inc. International scale credit ratings of Non-Financial Corporate issuers have a best-case rating upgrade scenario defined as the 99th percentile of rating transitions, measured in a positive direction of three notches over a three-year rating horizon; and a worst-case rating downgrade scenario defined as the 99th percentile of rating transitions, measured in a negative direction of four notches over three years.

The complete span of best- and worst-case scenario credit ratings for all rating categories ranges from 'AAA' to 'D'.

Best- and worst-case scenario credit ratings are based on historical performance. Strong Liquidity Profile, Bullet Maturities: OHI's liquidity is strong for the rating due to relatively minimal near-term funding obligations through Dec. However, OHI has a somewhat more concentrated debt maturity profile, which results in greater bullet maturity risk. Fitch estimates OHI's sources of liquidity unrestricted cash, availability under its revolving credit facility, and retained FCF after dividends to be sufficient to cover debt maturities and committed development expenditures.

News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services.

Dow Jones. Omega Healthcare Investors Inc. OHI U. Advanced Charting Compare.

Open Income Statement. Balance Sheet.

April 2021

Cash Flow. Historical Prices. Advanced Charting. April, Expires April 16, In the Money. May,