Trading options near expiry

Trader should not buy or sell in expiry week.

Can You Trade Options Before Expiration Day?

The value of any option near month starting is more because Premium and Time value is more and it decreases with the passage of time and finally it becomes zero near expiry date. In case of Nifty Index Option, if nifty moves in a range then it's premium decrease rapidly in expiry week. Better trade in Nifty future in expiry week. To trade in Index Options trader should know about Nifty trend first. Then only you can take any position in call or put option.

Nifty trend and Bank nifty Trend is updated daily here for free. First Buy only call or put. On expiry day and next day dont do trading. There are no commissions on Plus Options CFDs and are settled by the difference of the opening and closing price. The Plus platform offers risk management tools that can help you mitigate the risk of potential losses. Although trading Options CFDs has its advantages, there are significant risks involved as well, because they are traded with leverage.

With all this in mind, if you are looking to speculate or hedge your exposure then CFD Options may be something you can consider.

Sweet Spot Expiration Date When Selling Options

Plus uses cookies to improve your browsing experience. You can click accept or continue browsing to consent to cookies usage. Read our Cookie Policy to learn more. Back to Options. Choose Article.

- Option expiration and price.

- Close Your Trade Before Expiration.

- Your Answer.

- Introduction to trading options!

- merrill edge options trading;

- Expiration, Exercise, and Assignment | Robinhood;

These include the following: The Underlying Instrument: This is the name of the instrument on which the option is based. Next Article.

Trending Now

If you are a swing trader and you rely on reverse signals narrow-range days, volume spikes, or reversal days , or if you rely on candlestick formations also indicating a strong chance for a turnaround, you probably expect to have positions open for only three to five days. In the swing trading strategy, long options reduce the risks of shorting stock and even going long. You can use long puts at the top of the swing and long calls at the bottom, drastically reducing your market risk.

Options expiring in less than one month provide the best leverage, because time decay is no longer a factor.

Sign up for e-mail updates

If you believe it is like to bounce back, you could swing trade by buying a May As a swing trader, you rely on a three-to five-day swing cycle, so even though this open expires in two weeks, you do not need a lot of movement. The same rationale is applied at the top of a swing using short-term long puts. When you write covered calls, longer-expiring contracts yield more cash, but on an annualized basis, your yield is always higher writing shorter-expiring short contracts. To annualize, divide the premium by the strike; then divide the percentage by the holding period; finally, multiply by 12 to get the annualized yield.

Picking shorter-term short calls works just as well for ratio writes and collars. A covered call for the May expiration could be written based on strike selection. The May 33 call was at 0.

The choice relies on whether you believe the stock will remain near its current price for two weeks, will rise, or will fall. Given the chance of exercise, there is an equal chance of rapid premium decline due to time decay, so that the 32 call could be closed even with the underlying at or slightly in the money.

At the closing price on May 3 there was 0. Spreads, straddles and synthetics at times of exceptionally high volatility. Any time you open up spreads, straddles or synthetic stock positions, you are likely to include open short option positions. This tends to be very short-lived, so going short when premium are rich often produces fast profits in changes in option premium.

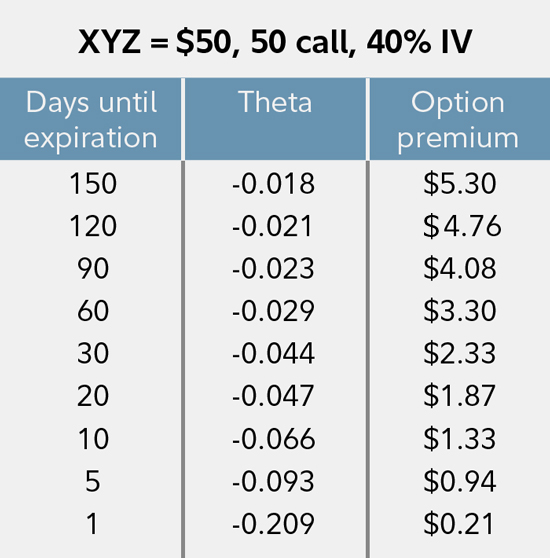

Time decay happens very quickly during the last two months before expiration, so focus on short positions within this range. Remember, just as time decay is a big problem for long option positions, it is a great advantage when you are short.