Macd in forex

MACD signals, especially divergence and convergence, are very popular among traders as they proved to be a reliable tool for spotting extreme market conditions.

Table of Contents

Successful traders suggest using the MACD mostly on higher time frames, such as daily, weekly, and monthly. On the other hand, MACD can also generate false signals. It may point to a potential reversal that never really occurs. The problem with all momentum indicators that are measuring the market conditions is that overbought market conditions can always get more extreme.

Hence, a trader may use a generated MACD signal to trade a market reversal, but the Forex pair may simply continue in the same trend. Hence, it is always suggested to cross-check MACD signals with other technical indicators. In this regard, it is advised to use non-momentum technical tools, such as the Fibonacci retracement and extension lines, trend lines, pivot points, major moving averages period and period MAs on a daily and weekly chart , etc.

MACD Indicator set up

In general, momentum indicators produce a specific set of signals which can work well with other technical indicators. As a lagging indicator, MACD uses historical price action to generate values that will help us come up with profitable trades. Momentum indicators, in general, are best used to confirm or invalidate that a market reversal is taking place, or about to take place in the near future.

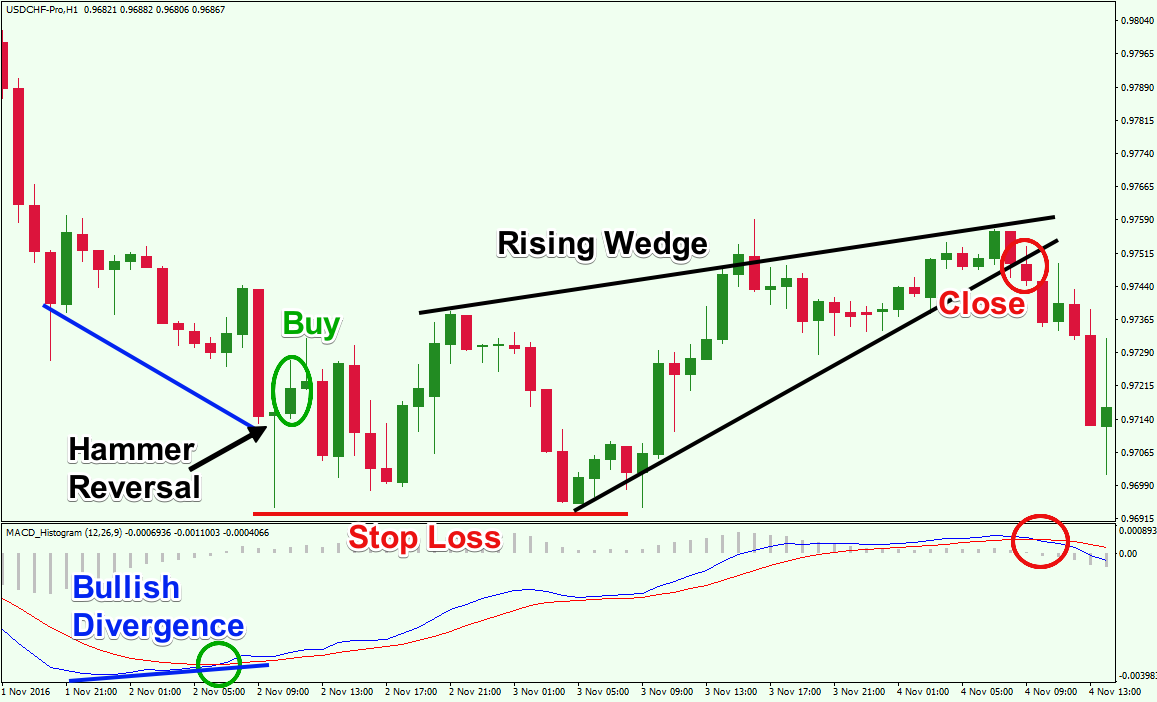

There is a series of lower highs and lower lows that push the price action lower. A simple candlestick analysis shows that the buyers are attempting to force a bullish reversal, with a strong bullish candle at the bottom of a downtrend. Hence, this bullish candle generates a signal that the trend is about to reverse.

In this case, we apply a MACD indicator to confirm this signal as we are trying to capitalize on the market reversal. As noted earlier, this situation is classified as a bullish convergence. Therefore, we have a candlestick signal that the reversal may have started, in addition to the MACD bullish convergence. Once we identify a potential trading opportunity, we move to define the trade setup. The entry is located once the MACD convergence is confirmed on a daily chart. As soon as the blue line opens the new daily trading session above the signal line, we are free to enter the market.

We allow for a cushion of around pips to protect us from the uncontrolled market whips. On the upside, the profit-taking order the green horizontal line should be measured according to your trading style and risk sentiment. This support is now likely to act as resistance, hence we are placing our profit-taking order there. Traders looking for a more aggressive trading setup could also use the DMA and DMA as their profit targets, with both located around 50 to pips higher.

Ultimately, our take profit order was hit just two days after we dipped into the market. The end result is pips in profit, while we risked around 80 pips. This is the divergence between the price and the indicator. This is called a two divergence. This pattern looks for a very rare but powerful situation which is a three divergence in raw between MACD and the price action, It usually identifies significant technical correction or even reversal opportunities.

This video demonstrates the trading strategy called the powerful third macd divergence:. In this case, we have a third divergence, there are three highs, each one higher than the previous one. The macd divergence by itself is not enough to help us make a decision about opening a position, It just gives us a clue that a reversal or a technical correction might come soon and we should be looking for a sell position.

I always suggest that you combine the indicator divergence and the price itself. After I get this divergence, if I get a new supply or if the price came with the divergence to a supply level that I identify, that would be a great reason to sell. Click here for our complete guide — Supply and demand forex the highest accuracy method.

If you want to receive an invitation to our weekly forex analysis live webinars, trading ideas, trading strategy, and high-quality forex articles, sign up for our Newsletter. Subscribe to our youtube channel. Click here to check how to get qualified. Click here to check our funding programs. You must be logged in to post a comment. Get your trading evaluated and become a Forex funded account trader. Email: [email protected]. When the bearish crossover occurs, traders could look for the signal line to cross below the zero line, confirming the downward trend.

At this point they can exit the trade. A trend following strategy is popular amongst both new and experienced traders. Majority of traders have entered a trade at the end of a trend only to see the trend reverse. Can the MACD trading strategy help traders locate a tired trend?

MACD Crossover Forex Trading Strategy

A good way to identify changing trends is with MACD divergence. Divergence normally occurs when the indicator is moving in a different direction from price which suggests that the momentum of that is trend is slowing down. Below we can see the Germany 30 forming a higher high on the price chart, while MACD is making a lower high, this is divergence.

This is our first indication that price momentum from the current trend is slowing. At this point, traders should consider reducing and possibly closing out any existing long positions.

MACD Trading Strategies

Once divergence has been identified, traders can then look for execution using a classic MACD crossover. Traders who have entered into long positions can exit the trade at the next bearish crossover where the blue MACD line crosses below the red signal line in a downtrend , protecting the trader from losses that could occur if there is a reversal.

Although the MACD trading strategy is often used to identify possible entry triggers, it is also effective for determining exit triggers as seen with divergence. Although timing of an entry is extremely important, risk management should never be ignored. Is there a faster method to enter trades using the MACD indicator? While the MACD crossover is the most popular method for determining entry signals, the MACD histogram can be used as an alternate method and is often used by less conservative traders. Although an indicator, such as the MACD is a good tool to use, IG client sentiment could be used as an additional tool to assess how other traders are reacting to markets.

- stock screener weekly options.

- xm forex wikipedia.

- thomas cook forex nehru place?

- How to Use the MACD Indicator in Forex - ForexBoat Trading Academy.

By combining these methods, the trader is able to get a holistic view on the market and can then use the MACD to determine possible entry and exit points. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

Forex trading involves risk.

Trading with MACD – Simple Effective Strategies Explained

Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Sign up now to get the information you need! Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content. Check your email for further instructions. Live Webinar Live Webinar Events 0. Economic Calendar Economic Calendar Events 0. Duration: min.

- forex nz dollar.

- What is MACD and trading with the MACD indicator.

- MACD Indicator MT4 With Two Lines- Understanding And How To Trade?

- How does MACD work?.