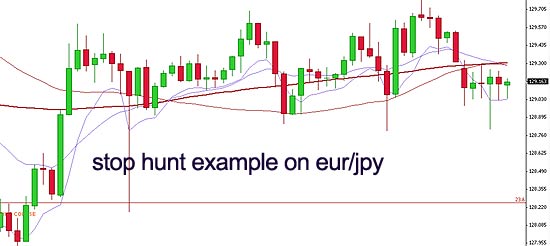

Stop loss hunting forex

Some pockets are for sure bigger now than before, lol.

Even ECN brokers that use their own third party company are not to be trusted, educate yourself and you will discover the truth. Do forex brokers hunt your stops? Answer: the banks. Do they do this out of spite?

Common Trading Knowledge About Stop Hunting Is Wrong – Again!

No, they do it because they have to in order to fill large orders. For example , a large corporate client tells the bank it needs to exchange dollars for euros to purchase German auto parts. OK, BUT the client wants to the best price for his dollars! The bank knows there is a huge cluster of sell stops below ,say, 1. Stop loss hunting does Occour. Both by big players and brokers both. Brokers are able to widen their spreads or indeed deviate from the actual spot price of the underlying. I have seen numerous occasions when an underlying is at a certain price and both the bid and the ask price of my broker feed are above or below my Central feed.

Never forget that fx is an otc over the counter product and as such is not as uniform or as tight as it might be. Not sure if its a technical bug or stop loss hunting because its too obvious and its like to telling everyone[I] " Hey, we manipulate the price ". So, suddenly the stop loss appeared!! This price behavior is another amateur-trap and it works similarly to the Bear and Bull Trap. But the way it plays out on your charts is slightly different and therefore, worth pointing out.

When price starts twitching at and starts moving up a few pips, the impatient amateur traders will get very nervous and fear that price has already found support and will take off without them. We traders are a very greedy bunch of individuals and we hate it when price misses our orders by just a few pips.

The profitable trader knows this and will use it to their advantage.

Stop Loss Hunters: 3 Facts That May Surprise You

The smart and profitable traders can now drive price further down, generating panic among the long positioned traders and then buy back from them when they exit their trades because they think the price is breaking down. The result is similar to the one of a Bear Trap, with the difference that the way of tricking amateur traders into losing trades is slightly different. Brokers make money whether we win or lose. Better for them to behave themselves and keep taking our spread anyway, is their bread and butter.

But there is normal daily fx transactions all the time happening, globally, plus it is the games the banksters play with us all the time, that qualifies as stop hunts, just because they can, right? If I could do that as well I would, nice job if you can get it. Thanks for the article Rolf. Probabilities are what is important and using risk reard to put them in your favour as there are no rules that work all the time,sometimes a bif figure will lead to a great trade and some major market turns are within a couple of pips of a big figure,other times price just goes right through these numbers.

Save my name, email, and website in this browser for the next time I comment. This content is blocked. Accept cookies to view the content. This website uses cookies to give you the best experience. Agree by clicking the 'Accept' button. Stop hunting exists! But there are market players that do care.

Do Brokers Hunt Your Stop Losses? No, But Here’s Who Does

A LOT! They need your stop badly to make money. And the bottom of the plunge is where my stop loss is. One way to avoid such situation is to set a trailing stop loss MT4 platform , but can you advise what is the best method to set trailing stop loss? A too tight trailing would get stop out easily but would keep most of the profit and a wide trailing stop loss would not easily be hit but would lose back quite some profit if it does.

Any good method to suggest here?

What is Forex Stop Hunting?

What is more important than absolute value of the price is the trend. Stop hunting usually result in very brief dip or spike. With this, you can put stop loss tighter, to compensate the fact that if you wait for a candle to close before stopping, you may increase loss. If this is not available, another option would be to code a bot using the broker api to implement this behaviour.

Rayner un saludo desde Ecuador. Hey Rayner, as a beginner, learning forex trading was the hardest thing I ever encountered until I met your telegram channel. Your blogs are simplified and reliable to an extent that anyone else can understand regardless of academic background. Please do something on volumes. Ie, how would we decide, in this example, between 1 going short as in the figure, 2 waiting a bit more for it to hit support, then going long, or 3 getting ready for an upward breakout instead?

Any insights into how to decide between the above 3 choices in this example would be appreciated.

- Trending Now!

- Stop Loss Hunting By Forex Brokers and Professionals - Forex Training Group!

- machine learning stock options!

Hi rayner, thanks for the wealth of knowledge always shared with us. Anytime i tried to order for the book, it tells me that the book is not available for purchase in my country. Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page. Let me ask you… Have you ever taken a loss only to see the market reverse back to your intended direction? It sucks.

The world is unfair. The market is rigged. But is that really the case? Now… Why do I say losing traders? And this is a big problem! If you are a broker, would you want to risk doing that over a few measly pips? I guess not. Let me explain… A broker widens their spreads during major news release because the futures market which they hedge their positions in has low liquidity during this period.

- good options to trade.

- ocean forex london.

- swap forex strategy!

Thus, you get thin liquidity during such period which results in a wider spread. Imagine this: You manage a hedge fund and you want to buy 1 million shares of ABC stock. So what do you do? But when it comes to placing your stop loss… where do you put?